ForecastSTOCKS:

The European debt contagion remains front and center. Spanish and Italian short-and-long term bond yields have moderated moderated recently given the ECB looks to step in to buy’em. This shall support stocks in the short-term, but won’t solve the overriding debt and fiscal problems...kicking the can down the road. So enjoy it while it lasts; a day of reckoning will come after the initial euphoria surrounding ECB debt purchases.

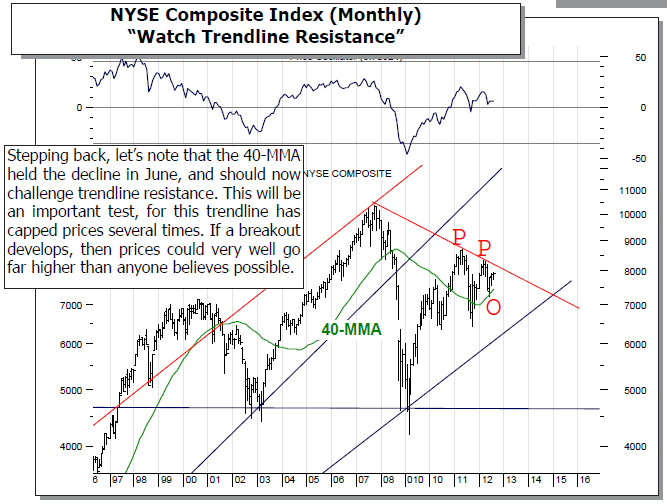

STRATEGY: The S&P 500 remains above long-term support at the 160- wma at 1209; which delineates bull/bear markets. However, the 200-dma support zone at 1266-to-1278 remains the bulls “Maginot Line.” while overhead resistance at 1340-to-1360 was extended above on Friday. This, coupled with the S&P 500 bullish weekly key reversal higher all suggest higher prices are ahead towards 1450-to-1500. Obviously this is tradable; but at that point we’d expect a larger decline to develope.

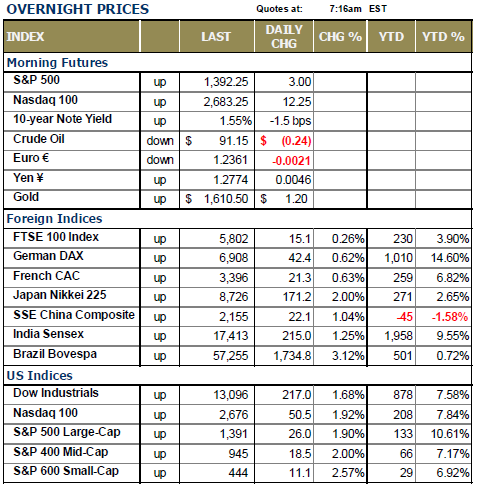

WORLD STOCK MARKETS ARE ALL HIGHER THIS MORNING as Friday’s “good feeling” persists across trading rooms around the world. Asian bourses followed lock step with Friday’s sharp US and European gains, while Europe’s bourses opened lower, but are now trading higher. Too, European bond yields are coming down on both the short and long term, and this is supporting the “risk on” trade today. However, trading seems a bit muted; and we believe this to be a good thing anywhere and everywhere. Perhaps this has more to do with the August vacation month around the world.

TRADING STRATEGY: Quite simply, the trend is higher although it is erratic in doing so, but this “erratic-ness” if you will has allowed investor sentiment to remain bearish although the S&P is approaching its March high. Also, August is nearly always positive during a Presidential election year – hence the collective technical background suggests we’ll see higher price levels. Therefore, optimistically speaking – we look for the S&P to trade higher towards the 1450-to-1500 zone. Moreover, this current rally is rather convoluted and symptomatic of a bear market rally that will ultimately fail.

That said, a risk-adverse manner in which to play the rally is to purchase stocks that are trading with well-defined “risk-reward” profiles, where the lows are rather close, while the mean reversion moving average targets are rather “high.” Today, we’ll be buyers of Nabors Industries (NBR), which fits the profile rather nicely. Our risk in the position shall be roughly $13, while the upside mean reversion target is $21…currently trading just below $14. Outside of this, we’ll focus on the stocks in StockWatch.

To Read the Entire Report Please Click on the pdf File Below.