The holiday shortened week for most of our eight featured world indexes was dominated by one theme: The East rose and the West fell. Japan's Nikkei 225 continued its surge, up 4.58% (aided by the yen's slide, down 10% in seven weeks). China's Shanghai Composite rose 3.71% for a gain of 13.95% for the month of December with one day of trading left. India's SENSEX and Hong Kong's Hang Seng both posted respectable gains. The four markets from the West all declined for the week, with the S&P 500 faring worst with a loss of 1.94%, an unsurprising decline as the US teeters at the edge of the Fiscal Cliff.

The Shanghai remains the only index on the watch list in bear territory -- the traditional designation for a 20% decline from an interim high. See the table inset (lower right) in the chart below. Despite its huge rally in recent weeks, the index is still down 35.67% from its interim high of August 2009. At the other end of the inset, despite its fractional loss for the week, the UK's FTSE 100 has regained the top spot from the S&P 500, thanks to the nearly two percent loss for the latter.

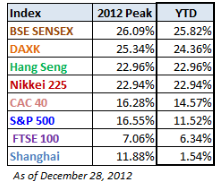

As for the 2012 performances, with one day of trading left, here is a table highlighting the year-to-date gains, sorted in that order, and the 2012 interim highs for the eight indexes. Four indexes have gains above 20%, and the Hang Seng and Nikkei are both at their 2012 highs. The stellar December performance of the Shanghai Composite has finally moved it into positive territory for the year.

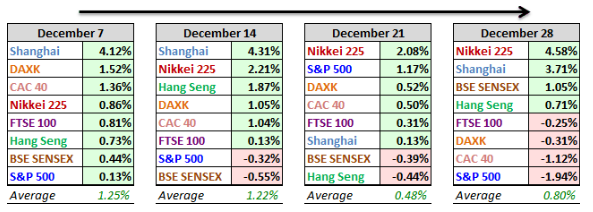

A Closer Look at the Last Four Weeks

The tables below provide a concise overview of performance comparisons over the past four weeks for these eight major indexes. I've also included the average for each week so that we can evaluate the performance of a specific index relative to the overall mean and better understand weekly volatility. The colors for each index name help us visualize the comparative performance over time.

The chart below illustrates the comparative performance of World Markets since March 9, 2009. The start date is arbitrary: The S&P 500, CAC 40 and BSE SENSEX hit their lows on March 9th, the Nikkei 225 on March 10th, the DAX on March 6th, the FTSE on March 3rd, the Shanghai Composite on November 4, 2008, and the Hang Seng even earlier on October 27, 2008. However, by aligning on the same day and measuring the percent change, we get a better sense of the relative performance than if we align the lows.

A Longer Look Back

Here is the same chart starting from the turn of 21st century. The relative over-performance of the emerging markets (Shanghai, Mumbai SENSEX, Hang Seng) is readily apparent, especially the SENSEX, but the trend over the past two years has not been their friend (make that three years for the Shanghai).

Check back next week for a look at the early days of 2013.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

World Markets Review: The East-West Divide

Published 12/31/2012, 12:16 AM

Updated 07/09/2023, 06:31 AM

World Markets Review: The East-West Divide

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.