FORECAST

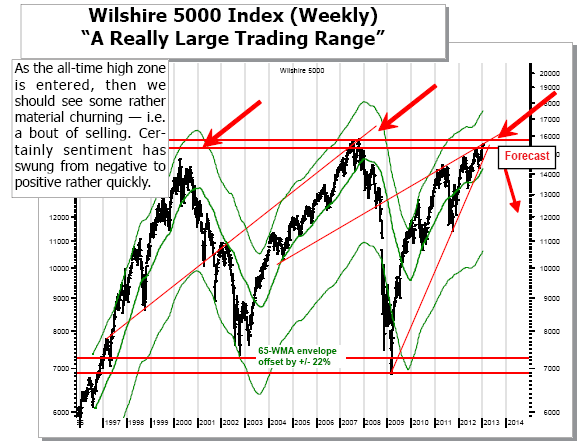

STOCKS: The European debt contagion has been “kicked down the road” as Spanish and Italian short-and-long term bond yields have moderated recently given the ECB “plan” to buy bonds of up to 3-years in maturity...but only if asked and only if conditionality is imposed upon those asking. The Fed has also changed its game from “inflation-fighting” to “unemployment fighting” with the new move to QE-4; and with any war — they will go further and farther than anyone believes in printing money to achieve their ends...regardless of their balance sheet concerns.

STRATEGY: The S&P 500 remains above the 160-wma long-term support level at 1263. The much followed 200-dma support level stands at 1393, and was regained in weekly key bullish reversal fashion. Collectively, this stands bullish for a test and likely breakout above the recent September highs at 1475. We are long of gold and transports at this juncture; but need to consider pullbacks for a potential rally extension.

WORLD MARKETS are all lower this morning as a plethora of concerns are starting to overtake the markets. First, in Europe, there are concerns regarding the high level of the euro and its impact upon growth. This view as expressed in comments yesterday by Mr. Juncker of the Eurogroup – the eurozone’s top financial committee.However, this morning, those comments are being downplayed by ECB policymaker Nowotny – who said there are no concerns. We find this all rather interesting; but the fact of the matter is that Germany’s poor 4Q-GDP figures – the worst in 3-years – suggest that recession in Europe isn’t going to be easy to exit from regardless of whether or not Spanish or Italian bond yields have moved lower in the past 7-months.

In adition, we’ve seen various earnings reports out of Goldman Sachs (GS) and JPMorgan (JPM) that were received differently. GS is moving higher in the pre-market; JPM Is moving lower. Each has benefited tremendously by the Fed’s move to QE, for each have had a bond/mortgage refinancing/issuance market handed to them on a silver platter. This is part and parcel of the bank recapitalization program that has been in place for a number of years. At some point, the music stops, but that isn’t likely today – although if the banks start to perform badly, then it would certainly not be good.

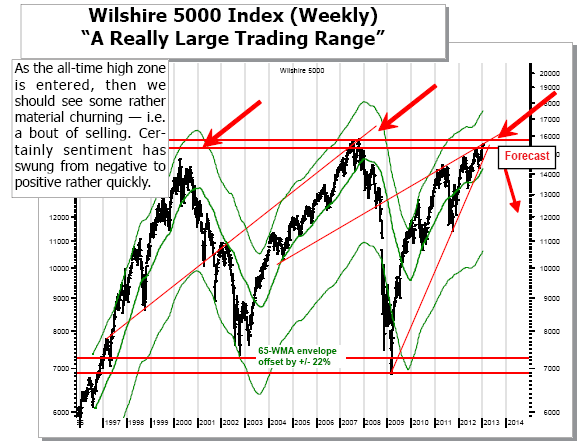

STOCKS: The European debt contagion has been “kicked down the road” as Spanish and Italian short-and-long term bond yields have moderated recently given the ECB “plan” to buy bonds of up to 3-years in maturity...but only if asked and only if conditionality is imposed upon those asking. The Fed has also changed its game from “inflation-fighting” to “unemployment fighting” with the new move to QE-4; and with any war — they will go further and farther than anyone believes in printing money to achieve their ends...regardless of their balance sheet concerns.

STRATEGY: The S&P 500 remains above the 160-wma long-term support level at 1263. The much followed 200-dma support level stands at 1393, and was regained in weekly key bullish reversal fashion. Collectively, this stands bullish for a test and likely breakout above the recent September highs at 1475. We are long of gold and transports at this juncture; but need to consider pullbacks for a potential rally extension.

WORLD MARKETS are all lower this morning as a plethora of concerns are starting to overtake the markets. First, in Europe, there are concerns regarding the high level of the euro and its impact upon growth. This view as expressed in comments yesterday by Mr. Juncker of the Eurogroup – the eurozone’s top financial committee.However, this morning, those comments are being downplayed by ECB policymaker Nowotny – who said there are no concerns. We find this all rather interesting; but the fact of the matter is that Germany’s poor 4Q-GDP figures – the worst in 3-years – suggest that recession in Europe isn’t going to be easy to exit from regardless of whether or not Spanish or Italian bond yields have moved lower in the past 7-months.

In adition, we’ve seen various earnings reports out of Goldman Sachs (GS) and JPMorgan (JPM) that were received differently. GS is moving higher in the pre-market; JPM Is moving lower. Each has benefited tremendously by the Fed’s move to QE, for each have had a bond/mortgage refinancing/issuance market handed to them on a silver platter. This is part and parcel of the bank recapitalization program that has been in place for a number of years. At some point, the music stops, but that isn’t likely today – although if the banks start to perform badly, then it would certainly not be good.