STOCKS:

The European debt contagion has been “kicked down the road” as Spanish and Italian short-and-long term bond yields have moderated recently given the ECB “plan” to buy bonds of up to 3-years in maturity...but only if asked; and only if conditionality is imposed upon those asking. The Fed has also changed its game from “inflation-fighting” to “unemployment fighting”; and with any war — they will go further and farther than anyone believes in printing money to achieve their ends. This will support all asset prices ultimately.

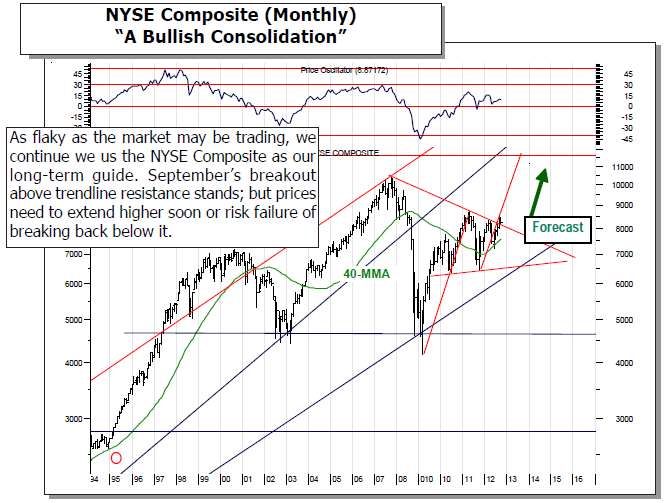

STRATEGY: The S&P 500 remains above the 160-wma long-term support level at 1236. The much followed 200-dma support level stands at 1370, and remains the bulls “Maginot Line.” We’ve noted this is perhaps one of the “weirdest rallies” we’ve ever been witness to, and it causes us a great deal of consternation. But the new Fed policydirectly targets stocks; expect a near S&P all-time high test at 1515-to-1530.

WORLD MARKETS ARE HIGHER THIS MORNING as there are a number of news points worth pointing out. First, let us note that Chinese inflation moderated to +1.9% y/y; while PPI fell -3.6% y/y. This is assumed to take pressure off the PBOC and Chinese authorities to loosen the monetary and fiscal spigots – to which we can take no exception. Second, there are reports out of the EU that Spain will indeed ask for a bailout – nothing new there – but the time frame has been extended to doing so in November.

This is reasonable given PM Ranjoy’s Galicia region votes on October 21st; and it may – just may – have something to do with the US election on November 7th. Lastly, New York Fed President Dudley has indicated that previous Fed policy “wasn’t aggressive enough;” and need to be recalibrated with QE-3. This admission of “not enough” would suggest that when the Fed errs in the future, such at year-end when Operation Twist ends – then they shall be perhaps more aggressive than the market believes in buying outright US treasuries. Certainly that would be out thought.

All of the above have pushed both Asian and European bourses higher on their sessions, with China closing down very modestly. The S&P futures are higher by +7 points; but there is little follow-through higher in the commodity markets to deem this a “risk-on” day; hence we’ll call it “risk ambivalent.” We’ve been surprised in the past several weeks when we’ve opened with a clear “risk-on” day, only to finish with something far worse…losses, but uneven losses. This type of trading is rather confounding, and today we won’t read anything.

To Read the Entire Report Please Click on the pdf File Below.