The recent disappointing performance of the world economy has been labelled as the "new mediocre" by Christine Lagarde, the "new reality" by Olivier Blanchard and the "new normal" by many others.

How mediocre is global growth? The answer to this question heavily depends on the way we measure world GDP. Aggregating national GDPs can be done in two ways: using market exchange rates or using PPP (purchasing power parity). Because PPP puts larger weights on emerging markets and because these countries have shown faster growth rates in recent decades, the two measures have been diverging over time and they now provide a very different picture of the state of the world economy.

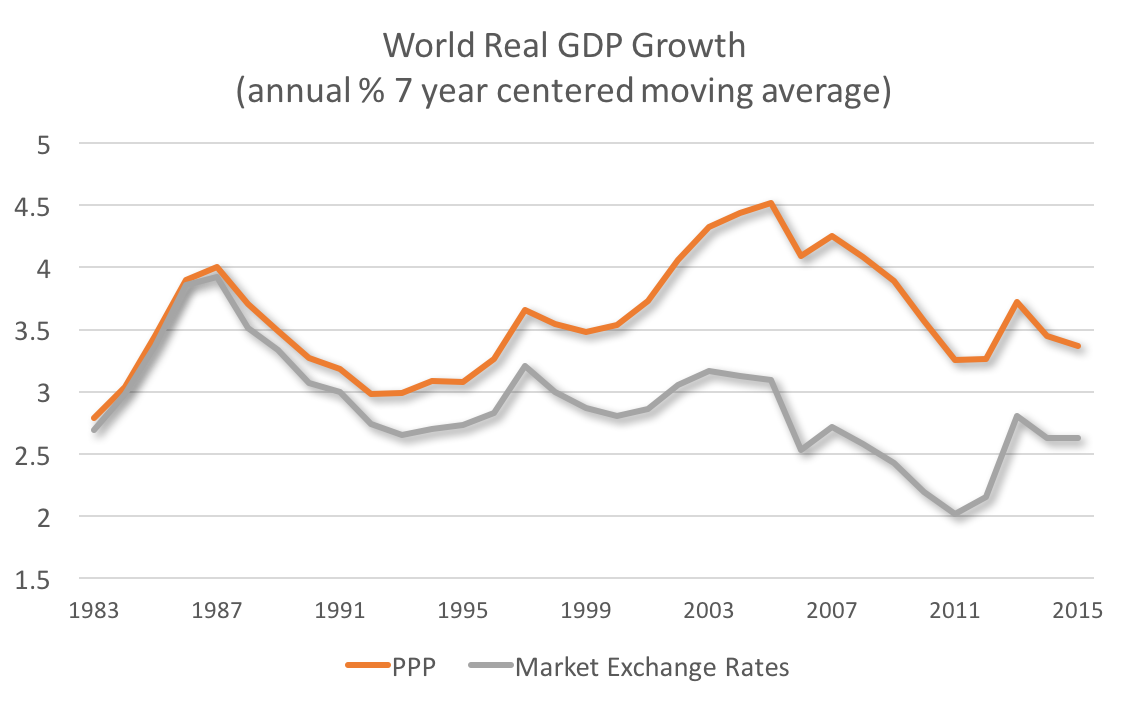

Below I plot world real GDP growth rates (smoothed by taking a 7-year centered average) measured at market exchange rates and PPP (both data are produced by the IMF).

During the early 80s, both measures were identical because emerging markets did not grow faster than advanced economies (plus their relative size was smaller). Since the 90s the gap opens and reaches a maximum of about 1.5% a year during the mid 2000s, the time when emerging markets were growing at their fastest rate.

What do we make of the last decade? Using the PPP yardstick it simply looks like a return to the rates of early decades. The exceptional years where the 2003-2008 period when the world grew above 4%. Rates of 3-3.5% look normal.

But using market exchange rates. recent data paints a picture of mediocrity (or worse). Rates in the 2-2.5% range are very low by historical standards. The last years feel like the worst years we have seen in terms of growth.

Which of the two numbers is the right one? The use of PPP is justified when measuring improvements in living standards. The larger weight given to emerging markets makes sense given that the volume of goods and services they produce is larger than what a market exchange rate conversion suggests.

But from many other perspectives market exchange rates make more sense: financial flows are aggregated using market exchange rates, so from the perspective of financial markets the market exchange rate GDP measure might be more precise. Also, from the perspective of a multinational company looking at the world economy as a source of demand market exchange, rates are likely to provide a better picture of the state of the world.

It is therefore not surprising that when we look at the state of the world economy what looks like returning to earlier growth rates for some might look like mediocre (or even pathetic) growth for others. Make sure you read the footnote below before the next time you check out a chart on the state of the world economy.

Footnote: And talking about footnotes here are two: First, the data above includes forecasts for the years 2016-2018 to calculate the last years in the chart. Second, an interesting question is what happens to world growth rates as PPP rates change—one day prices in emerging markets might be as high as those in advanced economies.

This is not captured in the chart above. The IMF and others use the latest PPP estimates (2011) as a base for international prices when calculating PPP adjusted data for all years in the sample.