So this is the new year and markets look to be starting 2012 with a renewed sense of vigour. I don’t blame anyone if they didn’t pay much attention to the economic news over the festive break as there wasn’t much. What was about mainly focused on politicians talking about how 2011 was a tough year and that we shouldn’t expect 2012 to be any different. Merkel, Cameron and Sarkozy were all fairly downcast in their end of year appraisals but the political mood is not influencing risk so far.

Equities were open in Europe yesterday and the DAX led the way as it moved higher by 3%. Most of this we expect to be as a result of traders buying their “Trades of 2012” but a broad rally in risky assets through the opening sessions of the year is entirely possible if yesterday’s moves are amplified through other markets.

Europe will remain the main focus of the markets through Q1 and Q2, save some black swan event happening elsewhere, and the panacea that everyone has been hoping for has yet to appear. Italian and other peripheral yields have remained elevated through the end of the year and Spain’s will not have been helped by a warning from the new government that the country’s budget deficit may continue to rise past the 8% level. This would put it as the third largest deficit in the Eurozone after Greece and Ireland but 8% is still a better figure than either the US or UK can claim. The difference is, both us and the Americans can print our currency and attempt to inflate the problem; Spain is tied to everyone else in the Eurozone.

While a near term rally in risk may be on the cards, the fundamentals of the Eurozone still remain very poor. The situation was made evident by the poor manufacturing data from Europe yesterday. The manufacturing PMI survey for the area was 46.9 for the month of December; the fifth consecutive month of it being below 50.0 and therefore, the fifth consecutive month of contraction. This is not expected to turn around and forms the basis of the expected recession that should fall across the Eurozone from last quarter onwards. Similar data is due from the UK today and while a contraction is expected, the depth is set to be less severe than the European measure. We do however expect that Q4’s GDP number will show almost now growth (GDP expectation is 0.1% QOQ).

Rates are roughly where we left them pre-Christmas and, save a large sell-off in EURUSD on Dec 30th, there has not been much volatility to speak of. We doubt that will last however and urge people to look at GBPEUR near the 1.20 with a hedging eye.

Apart from UK manufacturing (09.30) we have German unemployment (08.55) which is expected to show a further decrease in December, although how much of this is seasonal will be a key number. The US manufacturing ISM is due at 3pm.

Welcome back.

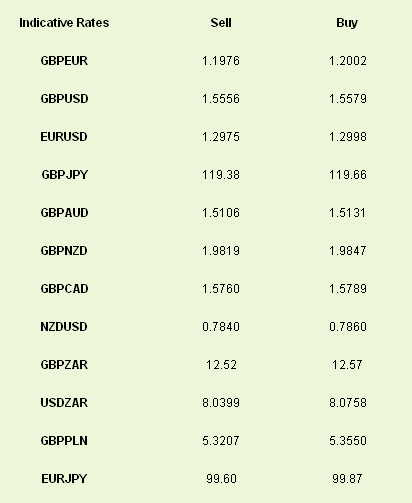

Latest exchange rates at time of writing

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

World First Morning Update: Meet the New Year, Same as the Old

Published 01/03/2012, 05:38 AM

Updated 07/09/2023, 06:31 AM

World First Morning Update: Meet the New Year, Same as the Old

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.