It was a second day of losses for risky assets yesterday with this year’s largest declines seen on European and US stock markets. The drivers of this fear remain the same as we have had for the past couple of sessions, even years, now: Greece and the global economic outlook in general.

On Greece, the closer we get to tomorrow night’s deadline on private sector involvement, the more panicky the markets are getting that those investors who hold out may derail the entire process. Overnight Greece and the IMF have threatened those holding out with a default, saying they do “not contemplate the availability of funds”. Translated it means, you’ll get what you’re given and that will be nothing if you don’t play along. You have to expect there will be more of these sort of noises as we get closer to the deadline and the only thing that will change is the volume of the arguments.

Fears over growth were ratcheted up overnight as Australian growth fell way short of consensus. Expectations had been of a Q4 GDP number of around 0.8% however 0.4% was all Australia could manage. A housing slump has long been a deterrent to discretionary consumer spending but output will also have been nailed by fears over the European debt crisis and the effect that it had, and is still having, on China and commodity markets. AUD has slipped by 3% over the past few days and will continue to as long as the story is faltering global growth.

The increase in oil prices has also been closely watched from a growth perspective but we have seen them pare over the past few sessions. Negotiations between Iran and the wider world over the former’s nuclear ambitions were agreed yesterday although a date for the talks has not been set. Speculation is that should these talks fail then some form of military action by the US or Israel would be only just around the corner. Brent crude was down over a per cent on the day but remains near record highs in sterling and euro pricing.

As we get closer to the end of the week we also get closer to releases that have helped risky assets onward; US jobs numbers. The latest ADP employment report for February is due at 13.15 with expectations sitting at an increase of 210,000 jobs from January’s 170,000. Some use this release as a precursor to Friday’s Non Farms Report but we find this hopeful only in trend and not in magnitude.

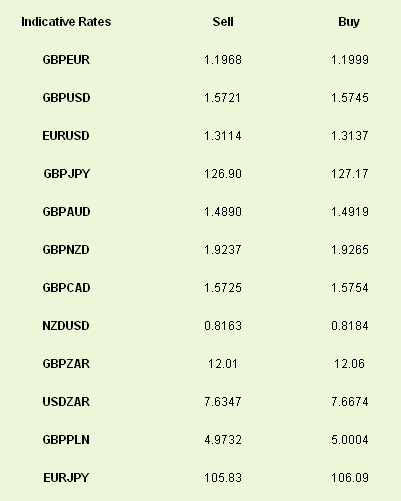

Action in currency markets were by no means as volatile as in equities yesterday although dollar strength was the order of the day. GBPEUR has managed to remain range bound between 1.1930 and 1.2030 although GBPUSD has broken lower as we expected. Support comes in at 1.5660.

Latest exchange rates at time of writing

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

World First Morning Update 7th March: Hopes that US Jobs Can Rescue Risk as Markets Slip

Published 03/07/2012, 08:07 AM

Updated 07/09/2023, 06:31 AM

World First Morning Update 7th March: Hopes that US Jobs Can Rescue Risk as Markets Slip

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.