Pressure remained on the European single currency yesterday as borrowing costs for Italy and France both rose, fuelling fears about Europe and its banking sector. This was despite good data in both the US and the UK helping some risky assets. Strong data came in particular from the US jobs market ahead of today’s non-farm payroll number. GBP/EUR moved to a fresh 15 month high while EUR/USD fell in to the 1.27s and a fresh 15 month low. While we do not expect the euro to weaken too much more in the coming weeks this has set up EUR to be the worst performing of the year currency of the year in the G10 space.

Focusing on the French bond auction, initial thoughts upon publication of the numbers was that the auction went OK. Yields were roughly the same as the previous auction and the bid to cover component was lower. It is now 8 consecutive days that French yields have risen in the secondary market and we are still of the opinion that the French credit rating remains at considerable risk given the likely contraction in output through Q4 and onwards.

The European banking system was also the subject of rumour and fear yesterday and the Italian bank Unicredit remained on the rack and has lost 30% of its market value in the past 48hrs. Euro was taken lower by a report that Deutsche Bank was looking to raise additional funding from its shareholders but this was swiftly denied by a spokesperson. It is not unlikely that a fair few European banks will have to ask investors to pony up some more cash given their funding position and so further talk about banks is certain through the rest of the year.

But now some good news and it came, once again, from the UK. The PMI for the UK services sector showed an increase to 54.0 from an expected figure of 51.5. As we highlighted yesterday, recent earnings releases from the High Street have shown that demand was not spectacular into Christmas and we are worried that the pop higher may be as a result of price discounting and would therefore be difficult to maintain into Q1. It would also make the potential fall-off in the first 3 months of 2012 that much more sharp and increase the risk that Q1 GDP is negative. That being said this means that all 3 PMIs (services, manufacturing and construction) have been better than expected and this allows us to maintain our initial estimate of Q4 GDP at 0.1%, meaning that the UK should avoid a double-dip in the short term.

It was US jobs numbers that took the biscuit for the most impressive data release yesterday with the ADP private measure of how many jobs were added in the US in December rocketing to 325k against a predicted number of 175k. The correlation between that and today’s non-farm payrolls number is up for discussion i.e. there isn’t much, but it has led some analysts to revise their predictions higher for today’s number. The market expects the Bureau of Labor Statistics to announce that 155k jobs were added in December. A big beat may be enough to turn the fall in risky assets around but we wouldn’t bet on it; the euro has few friends at the moment.

As is typical for “Jobs Friday” we expect the morning session to be quiet as traders sit on their hands and wait for the number.

Have a good weekend.

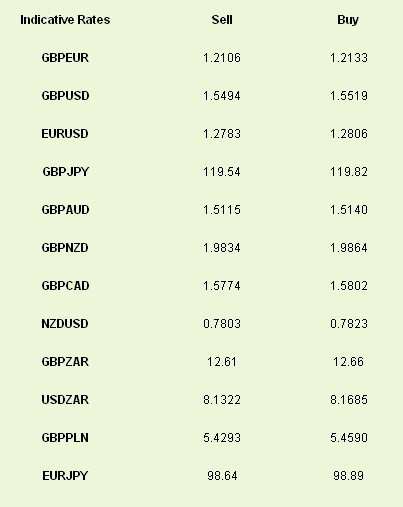

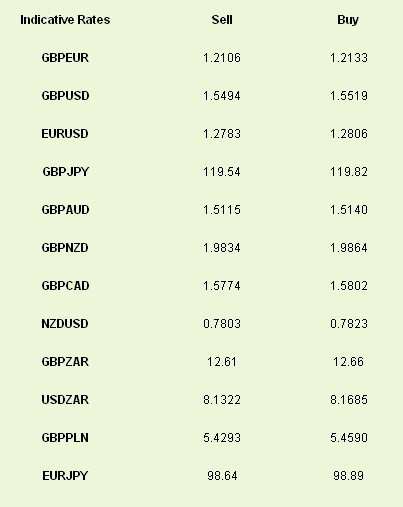

Latest exchange rates at time of writing

Focusing on the French bond auction, initial thoughts upon publication of the numbers was that the auction went OK. Yields were roughly the same as the previous auction and the bid to cover component was lower. It is now 8 consecutive days that French yields have risen in the secondary market and we are still of the opinion that the French credit rating remains at considerable risk given the likely contraction in output through Q4 and onwards.

The European banking system was also the subject of rumour and fear yesterday and the Italian bank Unicredit remained on the rack and has lost 30% of its market value in the past 48hrs. Euro was taken lower by a report that Deutsche Bank was looking to raise additional funding from its shareholders but this was swiftly denied by a spokesperson. It is not unlikely that a fair few European banks will have to ask investors to pony up some more cash given their funding position and so further talk about banks is certain through the rest of the year.

But now some good news and it came, once again, from the UK. The PMI for the UK services sector showed an increase to 54.0 from an expected figure of 51.5. As we highlighted yesterday, recent earnings releases from the High Street have shown that demand was not spectacular into Christmas and we are worried that the pop higher may be as a result of price discounting and would therefore be difficult to maintain into Q1. It would also make the potential fall-off in the first 3 months of 2012 that much more sharp and increase the risk that Q1 GDP is negative. That being said this means that all 3 PMIs (services, manufacturing and construction) have been better than expected and this allows us to maintain our initial estimate of Q4 GDP at 0.1%, meaning that the UK should avoid a double-dip in the short term.

It was US jobs numbers that took the biscuit for the most impressive data release yesterday with the ADP private measure of how many jobs were added in the US in December rocketing to 325k against a predicted number of 175k. The correlation between that and today’s non-farm payrolls number is up for discussion i.e. there isn’t much, but it has led some analysts to revise their predictions higher for today’s number. The market expects the Bureau of Labor Statistics to announce that 155k jobs were added in December. A big beat may be enough to turn the fall in risky assets around but we wouldn’t bet on it; the euro has few friends at the moment.

As is typical for “Jobs Friday” we expect the morning session to be quiet as traders sit on their hands and wait for the number.

Have a good weekend.

Latest exchange rates at time of writing