Investing.com’s stocks of the week

The lack of recent ratings agency news was ended last night following Standard & Poors’ decision to downgrade Spain’s credit rating to BBB+ from A, a two notch move. This hasn’t really come as a shock to anyone given that we have known that budget deficit targets were going to be missed for months now, the economic fundamentals (unemployment confirmed this morning at 24.4%) remain at dangerously weak levels and that the resulting contraction on the economy would only exacerbate problems for the already wobbling banking sector.

While the decision is not really news to anyone it will keep Spanish yields at current levels, especially given the remaining negative outlook, signifying that further ratings action is more than likely to be on the way.

We also have to look at the contagion element of the decision. Will Italy see its credit rating cut soon? With bond auctions today of 4,5,7 and 10yr debt from Italy the market is almost certain to ask for increased yields on the latest issuances, adding to pressure on yet another European economy.

Needless to say EUR/USD has slipped, but not collapsed, on the news and GBP/EUR is pushing towards the 1.23 level. 1.2395 is the high that traders will be targeting soon enough but further pull backs in risk may keep rallies capped for now.

Overnight we have seen equities remain underpinned by another central bank’s decision to increase monetary easing. The Bank of Japan said it would expand its asset purchase fund to 40trn yen from 30trn. The BOJ also kept rates at 0.1%; a level that they have sat at since late 2008. Lower industrial production in the Japanese Q1 had soured the mood in the hours before the Bank’s decision; a direct result of the on-going strength of the yen and the pain it has caused local exporters.

Away from the Italian auctions, the focus will shift to the state of things in the US with their preliminary estimate of Q1 GDP. If the UK’s is anything to go by making a prediction is a worthless exercise but the market is looking for 2.5% on an annualised basis i.e 0.625% per quarter. A better figure will obviously once again see traders price out the belief that further QE is coming down the chute and therefore is likely to see USD strengthen this afternoon.

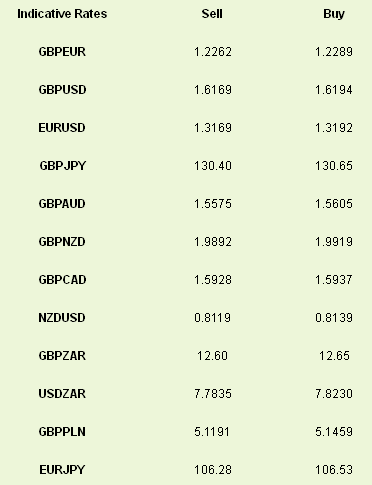

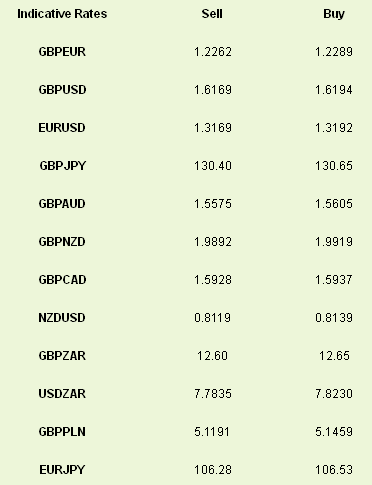

Latest exchange rates at time of writing:

While the decision is not really news to anyone it will keep Spanish yields at current levels, especially given the remaining negative outlook, signifying that further ratings action is more than likely to be on the way.

We also have to look at the contagion element of the decision. Will Italy see its credit rating cut soon? With bond auctions today of 4,5,7 and 10yr debt from Italy the market is almost certain to ask for increased yields on the latest issuances, adding to pressure on yet another European economy.

Needless to say EUR/USD has slipped, but not collapsed, on the news and GBP/EUR is pushing towards the 1.23 level. 1.2395 is the high that traders will be targeting soon enough but further pull backs in risk may keep rallies capped for now.

Overnight we have seen equities remain underpinned by another central bank’s decision to increase monetary easing. The Bank of Japan said it would expand its asset purchase fund to 40trn yen from 30trn. The BOJ also kept rates at 0.1%; a level that they have sat at since late 2008. Lower industrial production in the Japanese Q1 had soured the mood in the hours before the Bank’s decision; a direct result of the on-going strength of the yen and the pain it has caused local exporters.

Away from the Italian auctions, the focus will shift to the state of things in the US with their preliminary estimate of Q1 GDP. If the UK’s is anything to go by making a prediction is a worthless exercise but the market is looking for 2.5% on an annualised basis i.e 0.625% per quarter. A better figure will obviously once again see traders price out the belief that further QE is coming down the chute and therefore is likely to see USD strengthen this afternoon.

Latest exchange rates at time of writing: