Political events in Europe have once again plunged investors into uncertainty. Instead of advancing toward a lasting solution, the situation has deteriorated. The Greek election results show the extent to which hard times have undermined popular support for austerity. The same phenomenon is illustrated by French voters’ replacement of their government, even though its austerity had been less drastic. As if this were not enough, the global economy, while still in expansion, has recently disappointed.

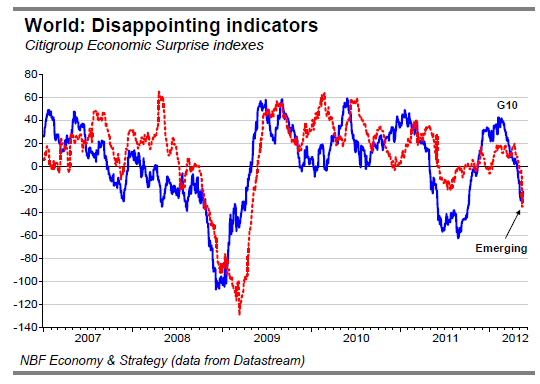

The downside surprise of recent global indicators is visible in the path of the Citigroup economic surprise indexes. For the G10, modest expectations have not been met. And in contrast to a year ago, emerging economies have also disappointed. Brazil, for example, has hit a soft patch. Its production declined 0.35% in March, leaving first-quarter output up only 1.1% from a year earlier, well below trend. Chinese indicators also show weakness. Exports, industrial production, retail sales and credit expansion all fell short of expectations in April.

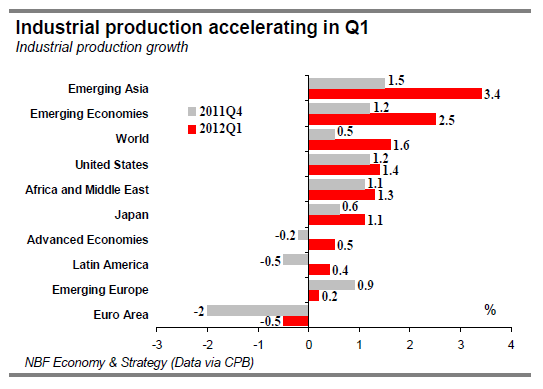

Although disappointing, the global economy is still growing as evidenced by the latest data from the CPB on industrial production and global trade. Industrial production was up 0.2% in March, a 6th consecutive monthly increase. For the quarter as a whole, it was up 1.6%, an acceleration compared to the 0.5% observed in 2011T4.

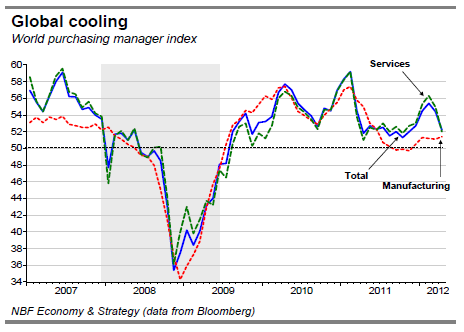

The acceleration is generalized since only emerging Europe is decelerating. During the quarter, global trade increased also 1.6% indicating that what’s produced is being shipped and not piling in inventories. Global growth extended into 2012T2 based on the global PMI index which remained above the threshold of 50 in April. But among the disappointments is a sharp April slowdown in services, whose index fell to a five-month low. The manufacturing index, on the other hand, is at a 10-month high. The U.S. PMI was among the most buoyant in April, and Brazil, China, India, Japan and the U.K. all showed expansion. Apart from Australia, the sharpest drag on the global economy comes from the eurozone.

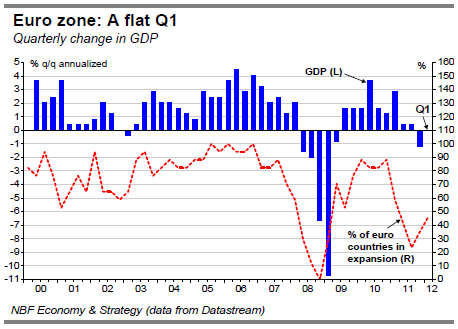

GDP for the eurozone as a whole, after contracting in Q4, beat the consensus expectation in Q1 by coming in flat. However, the resulting avoidance of two straight quarters of contraction – the technical definition of recession – gives little comfort. As is the case for public debt and fiscal deficits, which may seem manageable for the zone as a whole, the devil is in the details. Q1 beat expectations because of the standout 2.0%- annualized expansion of the German economy. The absence of fiscal integration in the monetary union means that Germany’s strong showing will not resolve the crisis. One upshot is that the German economy has been made much more competitive by the euro weakness. On the whole, the Q1 GDP numbers depict a fourth straight quarter in which most euro economies show no growth. The third and fourth largest of them in fact show sharp contractions – Italy (-3.8%), Spain (- 1.2%). France came in no better than flat in Q1.

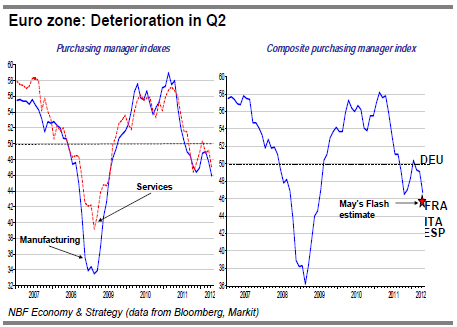

More worrisome for the zone’s second-largest economy is that its purchasing manager index fell to 45.6 in April, signalling deterioration in Q2. Italy (42.7) and Spain (42.0) also showed sharp deterioration in April. The reading for Germany, 50.5, signals output no better than flat. Furthermore, the flash estimate for May indicate the worst downturn for the euro area since mid-2009. The new business index is at a similar depressed level, extending the gloom in the months ahead.

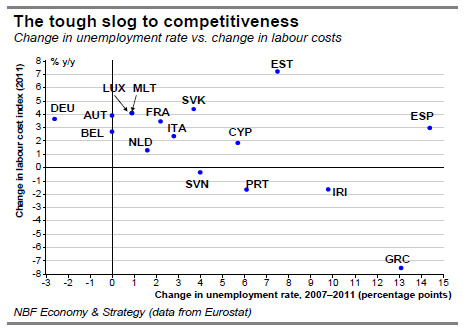

Until now, the path chosen by the peripheral countries of the zone has been to reduce their deficits as fast as possible, Greece, Portugal and Ireland are required to do so by their respective bailout plans. For Italy and Spain, accelerated debt reduction is aimed at avoiding the need for a bailout. The fiscal contraction has thrown these economies into recession and many workers out of jobs. The unemployment rate of the euro countries as a whole rose to 10.9% in March, the highest since the single currency was adopted. In Spain the jobless rate is a catastrophic 24.1%, in Greece it is 21.7%. Ultimately, a surplus of workers should deflate wages, solving the other problem of these economies – their lack of competitiveness.

Before monetary union, a country facing a crisis in its public finances could regain its competitive position by drastically devaluing its currency. Since a euro country cannot devalue its currency, a restoration of competitive position requires a decline of wages – a course for which political acceptance is much harder to come by. Among the 16 euro countries for which labour cost indexes are available, four are down from a year earlier – those of Slovenia, Portugal, Ireland and Greece. For Greece entering its fifth straight year of recession, the 12-month decline is a drastic 7.5% and it follows a 6.4% drop in the previous 12 months. The political unacceptability of austerity in such conditions is not hard to imagine. The recent elections have only increased Greece’s political disarray, leaving no party or group of parties able to form a government.

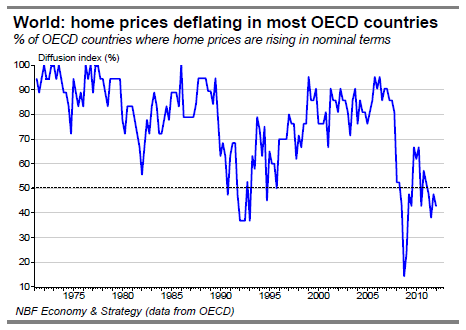

Apart from wage deflation, a much broader deflation is currently under way in the OECD countries. According to the latest data, home prices remained depressed in most countries on a sequential basis in Q1 2012. This marked the fourth consecutive quarter during which our diffusion index for nominal home prices was below 50%. No less than four of the G7 economies reported price declines during the quarter (U.S., Japan, France and Italy). The current economic backdrop in the matured economies of the OECD is therefore characterized by a deleveraging process of governments and financial institutions while household net worth is negatively impacted by falling home prices. These conditions are hardly auspicious for strong economic growth in the medium-term. The recent waning in economic momentum suggests that further stimulus by central banks may yet be required.

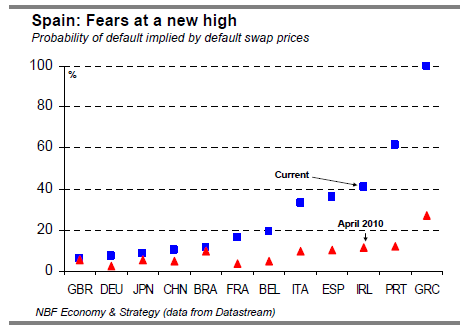

So while we still expect the developed countries as a whole to continue growing over the coming quarters, albeit weakly, the political developments of recent weeks have revived fears of a financial crisis that could send the global economy back into recession. In particular, a Greek exit from the monetary union could send shock waves through the euro countries. The prices of five-year credit default swaps show the market giving odds of default by four other countries higher than they were for Greece in April 2010. The odds given for Spain are at an all-time high of 40%. For France, a core country of the monetary union, they are almost 20%. In short, restoring confidence in the European project remains a great challenge for the governments of the continent.

U.S.: A Soft Patch

Recoveries tend to be uneven and the first half of 2012 seems to be a case in point. There are indications that the US economy has hit a soft patch with a deceleration in growth and employment creation. We see this as temporary and anticipate a pickup, helped by industrial production buoyed by domestic demand and exports, and a slow recovery in housing. The necessary condition, of course, is that financial markets remain functional in the face of the ongoing European crisis.

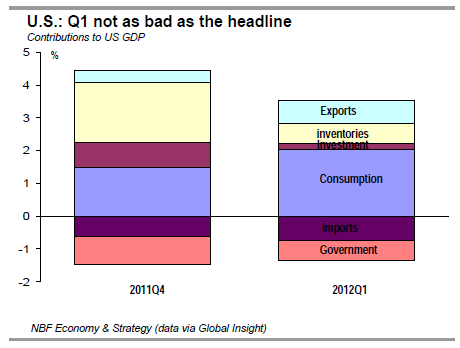

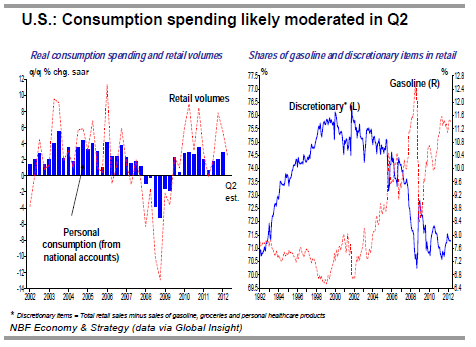

The world’s largest economy continued to expand in the first quarter of 2012, albeit at a more modest pace of about 2.0% annualized. That said the composition of growth in Q1 was better than in the prior quarter, with more vigour in consumption spending. The 2.9% increase in personal consumption, which accounted for over 90% of the GDP increase in Q1, was the best quarterly performance by consumers since 2010. Preliminary indicators, however, suggest that consumers are taking a breather in the current quarter. April’s marginal gains leave real retail spending tracking growth of roughly 2% annualized in Q2, compared to 5.5% in Q1. The deceleration isn’t entirely unexpected, given the Q1 drop in the savings rate and the apparent softening of the labour market.

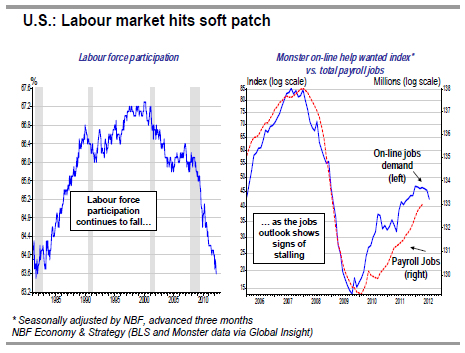

Both employment reports – nonfarm payrolls and the household survey – were disappointing in April. Payrolls showed a gain of only 115,000 jobs, the lowest since last October. The private-sector gain was 130,000, also a multi-month low. The household survey showed a second consecutive drop in employment, although that didn’t stop the unemployment rate from dropping to 8.1% in April. That’s because there were fewer people looking for work, with the participation rate falling to 63.6%, the lowest in 31 years. The outlook for the next few months isn’t particularly bullish given that the online help wanted index (seasonally adjusted), which leads job creation by roughly three months, showed its biggest decline in April since 2010.

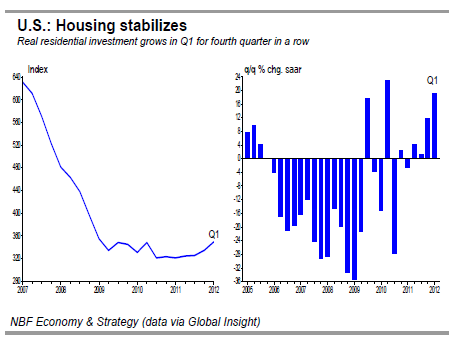

But there is good news too for the U.S. economy. The housing market seems to have stabilized, with residential construction up in Q1 for a fourth consecutive quarter. That trend seems to have continued in Q2, judging by a further ramp-up in housing starts in April and a rise of the homebuilder confidence index to a five-year high in May.

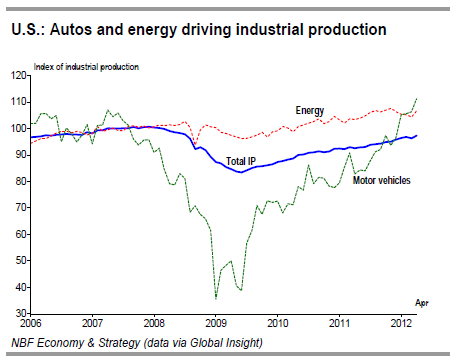

Another piece of good news was a 10-month high in both the April manufacturing ISM and its new orders subindex. The ramp-up at U.S. factories was confirmed by the month’s industrial production report, which showed a sharp increase in manufacturing output in addition to strong gains in energy production.

Industrial capacity utilization rose to 79.2%, the highest in 4 years. That suggests potential for bottlenecks in production further ahead. As a result, forward-looking corporations are likely to deploy their record cash positions and make the most of government incentives to boost investment. Though uncertainty seems to be delaying these necessary outlays, the potential for an investment boom is real.

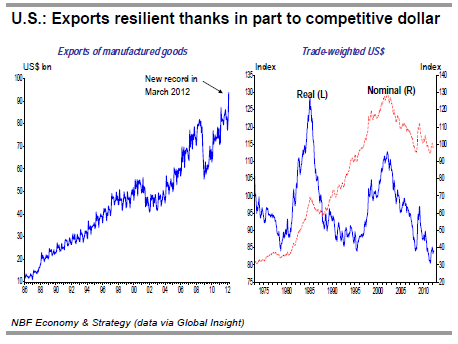

While new technology such as “fracking” has spurred energy output, the manufacturing renaissance has been driven by auto production and exports. The latest trade data show record exports of manufactured goods despite curtailment of demand by eurozone recession. Productivity enhancements have helped US exporters but so has a highly competitive dollar which remains near historic lows in real terms.

Despite the Fed’s loose monetary policy, inflation hasn’t spiralled out of control. The annual CPI inflation rate fell to 2.3% in April, the lowest in more than a year. So the real dollar exchange rate is set to remain highly competitive for now. That’s crucial for US growth, given that exports now account for roughly 14% of GDP, the highest on record.

Canada: Condo Boom

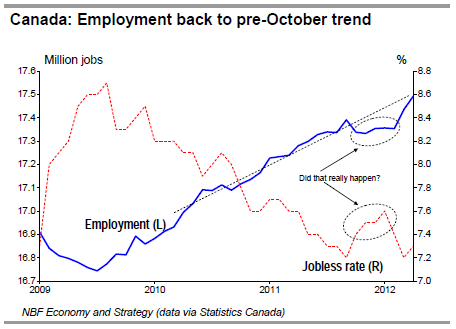

Just like that, Canada’s employment is back to trend after an inexplicable slump in Q4 last year and the start of this year. That would normally have raised odds of a rate hike by a hawkish-sounding Bank of Canada, particularly given the ongoing boom in the condo market. But caution has been urged on the BoC by other developments: a hugely disappointing February GDP report and deterioration of the eurozone economy and financial position.

We had been quite skeptical of the soft Labour Force Survey results of the October-February period, given the coinciding strength of other economic indicators. We questioned the Quebec employment slump in particular, which contrasted with healthy consumption-related data such as auto sales and housing. The LFS now seems to have self-corrected, with a stunning 140,000 net job gains over the past two months putting employment back on its pre-October trend. Quebec has recovered all of its reported job losses of recent months.

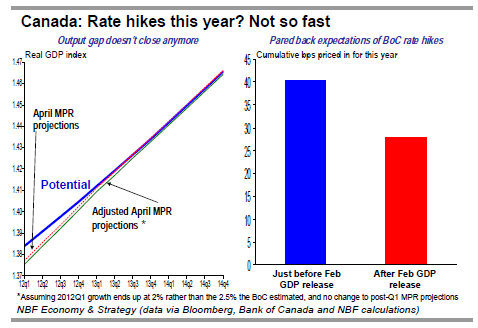

Economic growth, meanwhile, has been weaker than the employment rebound would suggest. First-quarter GDP growth wasn’t available at this writing, but various monthly indicators suggest a print of around 2% annualized. February’s surprising GDP contraction did much of the damage in restraining Q1 growth, so much so that the output gap is now unlikely to close over the Bank of Canada’s forecast horizon, assuming no change to post-Q1 Monetary Policy Report projections. Little wonder that markets have pared down expectations of rate hikes this year.

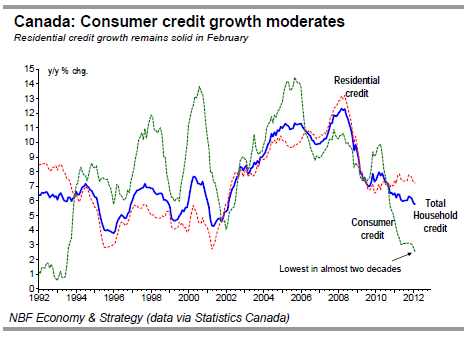

While that doesn’t mean there won’t be any, odds are the Bank of Canada will stand pat until next year. The annual inflation rate remains close to its 2% target. In addition to softer-than-expected domestic demand, external factors such as the possibility of a European implosion remain a clear and present danger for the Canadian economy. Moreover, the household debt accumulation that the BoC sees as the “biggest domestic risk” is now being addressed by households themselves.

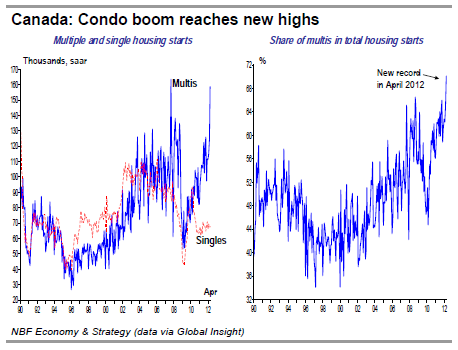

Year-on-year growth in consumer credit is now at its lowest in almost two decades. That said, Canada’s love affair with real estate continues unabated thanks to record low mortgage rates which have kept residential credit growth elevated. So much so that some segments of our real estate are showing clear signs of overheating. The Toronto condo market is a case in point. As a share of total housing starts, multiple units (which include condos) hit a record high in April. The increased activity in Toronto might be a reflection of a high level of pre-sales in large multi-unit projects. As potential buyers are priced out, activity will eventually be curtailed in those currently hot markets.

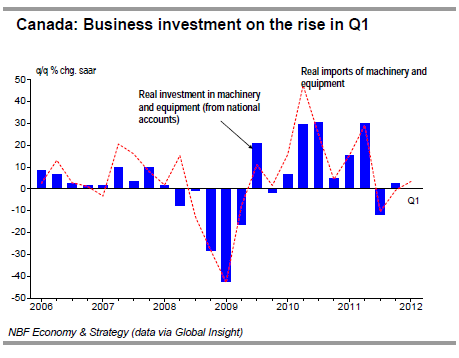

It’s not just residential construction that contributed to Q1 GDP. Machinery and equipment import volumes suggest that business investment picked up in the first quarter. However, we’re not expecting a stellar result here. Post Q1, the investment outlook is unclear. True, investment intentions were strong in the Bank of Canada’s Business Outlook Survey, but corporations may remain on the sidelines until uncertainty dissipates somewhat. That’s one channel through which a prolonged European drama could weigh on domestic demand. Financial contagion is another channel through which European woes could affect our domestic economy. But at this point, Canadian financial markets seem well shielded by a relatively solid banking sector and orderly public finances.

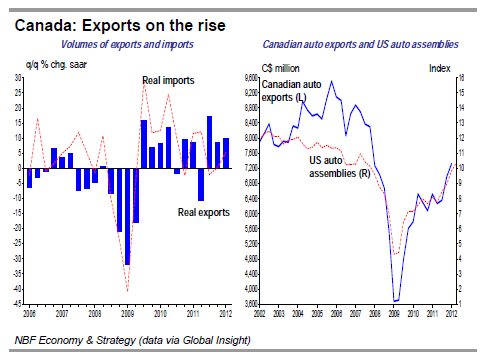

Fortunately for Canadian trade, it’s the U.S. that matters, not Europe. The continued expansion stateside allowed our export volumes to grow at a solid annualized pace of 10% in the first quarter despite the challenges brought by a strong Canadian dollar. Strong U.S. demand for autos in particular is boosting Canadian exports of autos and parts. US auto assemblies were up a stunning 46% annualized in Q1, and the ramp up in auto production extended into Q2 based on April data.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

World Concerns Are Back

Published 05/29/2012, 06:33 AM

Updated 05/14/2017, 06:45 AM

World Concerns Are Back

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.