The stock markets strengthened their ascent on Friday. Asian markets opened a new week near the two-year peaks in the MSCI Asia Pacific Index, thanks to a 2% jump in the Chinese indices after a week of local holidays.

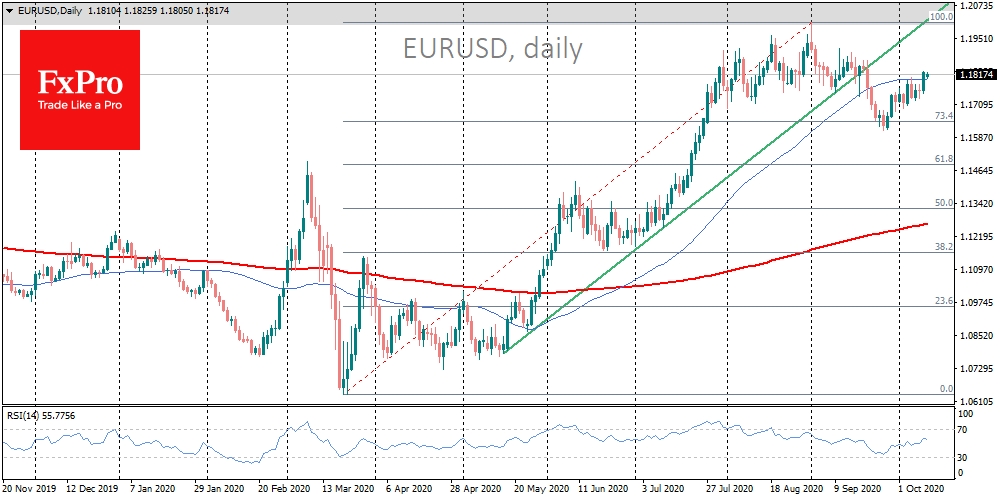

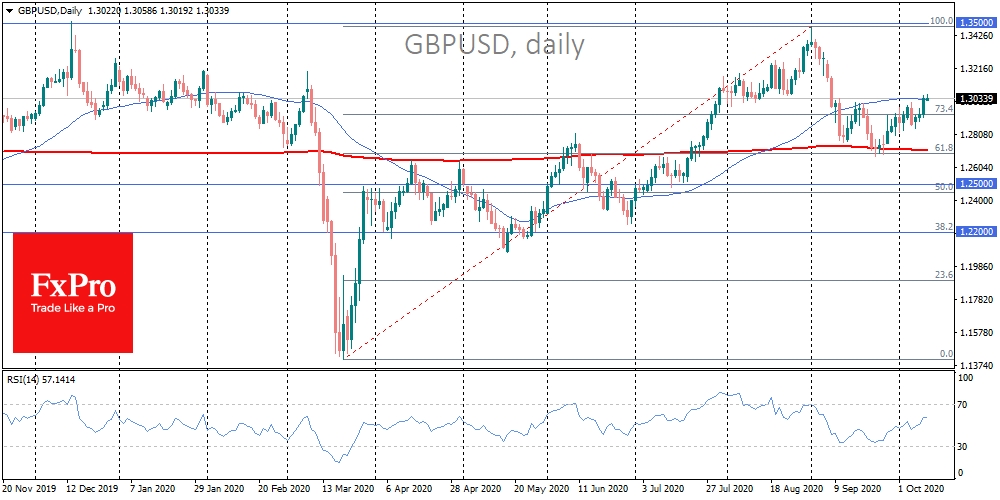

Demand for risk assets dragged the dollar down. On Friday, EUR/USD went up above 1.1800 while GBP/USD surpassed 1.3000 and USDCHF sank to 0.9100. The dollar index came back to 93.00, from where it made a jump in September on the strengthening of corrective sentiment in the markets.

The dollar may not experience any critical obstacles if it remains above its early September levels. A return of EUR/USD, GBP/USD to recent local highs may raise the question of whether other countries' authorities will be comfortable with their currencies strengthening.

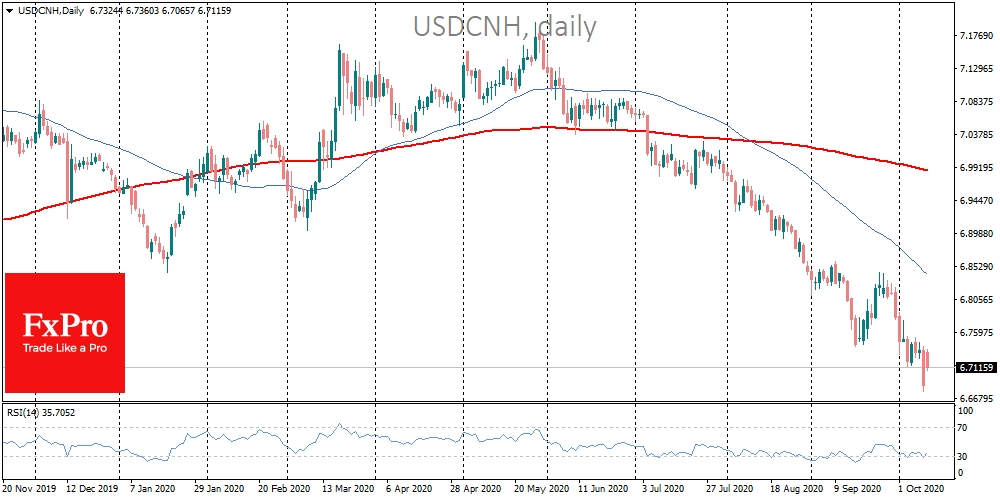

China, for example, has begun taking measures to curb the growth of its currency since returning from the holidays. The People's Bank of China made it easier to short the Chinese currency, which caused an impulse drop at the start of trading. Before that, between late May and last Friday, USD/CNH fell by 7.2%, plunging from multi-year highs to lows not seen since early 2019.

Over the last two years, the People's Bank of China kept the currency from falling uncontrollably by asking financial institutions to set aside cash when purchasing foreign exchange. However, it has now made a complete policy reversal and wants to keep the yuan from growing. For China, exports are an important driver of the economy, so keeping competitive prices for Chinese goods is a matter of survival for the world’s second-largest economy.

To a lesser extent, this rule also applies to European currencies—the euro, the swiss franc, and the pound—where central banks also keep exchange rate movements under control to keep their economies competitive.

This means that it is now worth keeping a close eye on how the European authorities will react to the weakening of the dollar against their currencies above 1.2000 per euro and 1.3500 per pound. If it is sustained, we should expect even more easing in monetary policy.

The Bank of England and the ECB have already indicated that they are ready for new measures. The UK is studying the possibility of introducing negative rates as BoE has asked commercial banks if they are technically prepared for this step. In the Eurozone, there is a discussion for the expansion of support programmes and QE that may weaken the national currency.

It may well turn out that in Europe there is no hesitation to fundamentally change policy, knowing that half measures will only mitigate growth but will not reverse the euro and pound.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Central Banks Are Strengthening Measures To Keep The Dollar From Falling

Published 10/12/2020, 05:20 AM

Updated 03/21/2024, 07:45 AM

Central Banks Are Strengthening Measures To Keep The Dollar From Falling

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.