WTI crude is flat on Friday, trading at $36.65 per barrel early in the European session. Taking a look at economic news, it’s a busy day in the US, with a host of key releases, led by Retail Sales and CPI.

Oil prices continue sag on world markets. Oil started the week at the round level of $40, and proceeded to post sharp losses. The EIA Crude Oil Inventories report surprised with a decline last week of -3.6 million barrels, the first decline since late September. However, this release was overshadowed by the OPEC meeting last week, which failed to produce an agreement on any production cutbacks.

OPEC members, who produce some 40 percent of the world’s oil, met for a key meeting in Vienna last week. Despite oil prices falling almost daily, OPEC failed to reach any agreement on cutting production, and in a sign of complete discord, failed to even issue a statement of a production target for the cartel. OPEC reported that its actually exceeded its production ceiling of 30 million barrels a day for most of 2015, and production in November hit a 3-year high. To make matters even worse for oil exporters, Russia continues to produce at high levels, and Iran is chafing at the bit, ready to increase oil production as soon as it receives the green light from the West and sanctions on oil sales are removed. This is expected to happen in early 2016, so it unlikely that crude oil prices will recover anytime soon.

The markets have become somewhat spoiled with strong job numbers out of the US, so weak employment readings this week came as a rude surprise. On Thursday, Unemployment Claims shot up to 282 thousand, its highest level in two months. The markets had expected a reading of 266 thousand. Still, the four-week average of unemployment claims remains at low levels. Earlier this week, JOLT Job Openings The important employment indicator slipped to 5.38 million, sharply lower than the previous month’s reading of 5.53 million. This soft figure was way off the estimate of 5.59 million. Will this weak numbers deter the Federal Reserve from proceeding with an expected rate hike at the policy meeting on December 16? There are no guarantees as to what the Fed has in mind for the markets, but the likelihood remains very high that a rate hike will occur, to the point that we’re likely to see strong volatility in the markets if the Fed doesn’t press the rate trigger next week.

WTI/USD Fundamentals

Friday (Dec. 11)

- 13:30 US Core Retail Sales. Estimate 0.3%

- 13:30 US PPI. Estimate 0.0%

- 13:30 US Retail Sales Estimate 0.2%

- 13:30 US Core PPI. Estimate 0.2%

- 15:00 US Preliminary UoM Consumer Sentiment. Estimate 92.3 points

- 15:00 US Business Inventories. Estimate 0.1%

- 15:00 US Preliminary UoM Inflation Expectations

*Key releases are highlighted in bold

*All release times are GMT

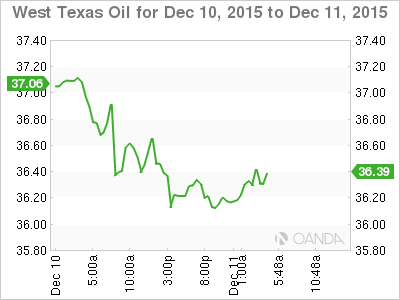

WTI/USD for Friday, December 11, 2015

WTI/USD December 11 at 9:00 GMT

WTI/USD 36.65 H: 36.76 L: 36.43

WTI/USD Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 30.00 | 32.22 | 35.09 | 37.75 | 39.87 | 42.59 |

- Crude has been flat in the Asian and European sessions

- 37.75 has switched to resistance role

- 35.09 is providing resistance

Further levels in both directions:

- Below: 35.09, 33.22 and 30.00

- Above: 37.75, 39.87, 42.59, and 44.30