The US market has fallen out of favor for the last 3 days. If you are a long term holder then keep an eye on it to make sure things don’t get out of hand, but rather than looking at each tick all day long and sweating what you will tell you clients or worse, your wife, about why their account went down today, why not look to China?

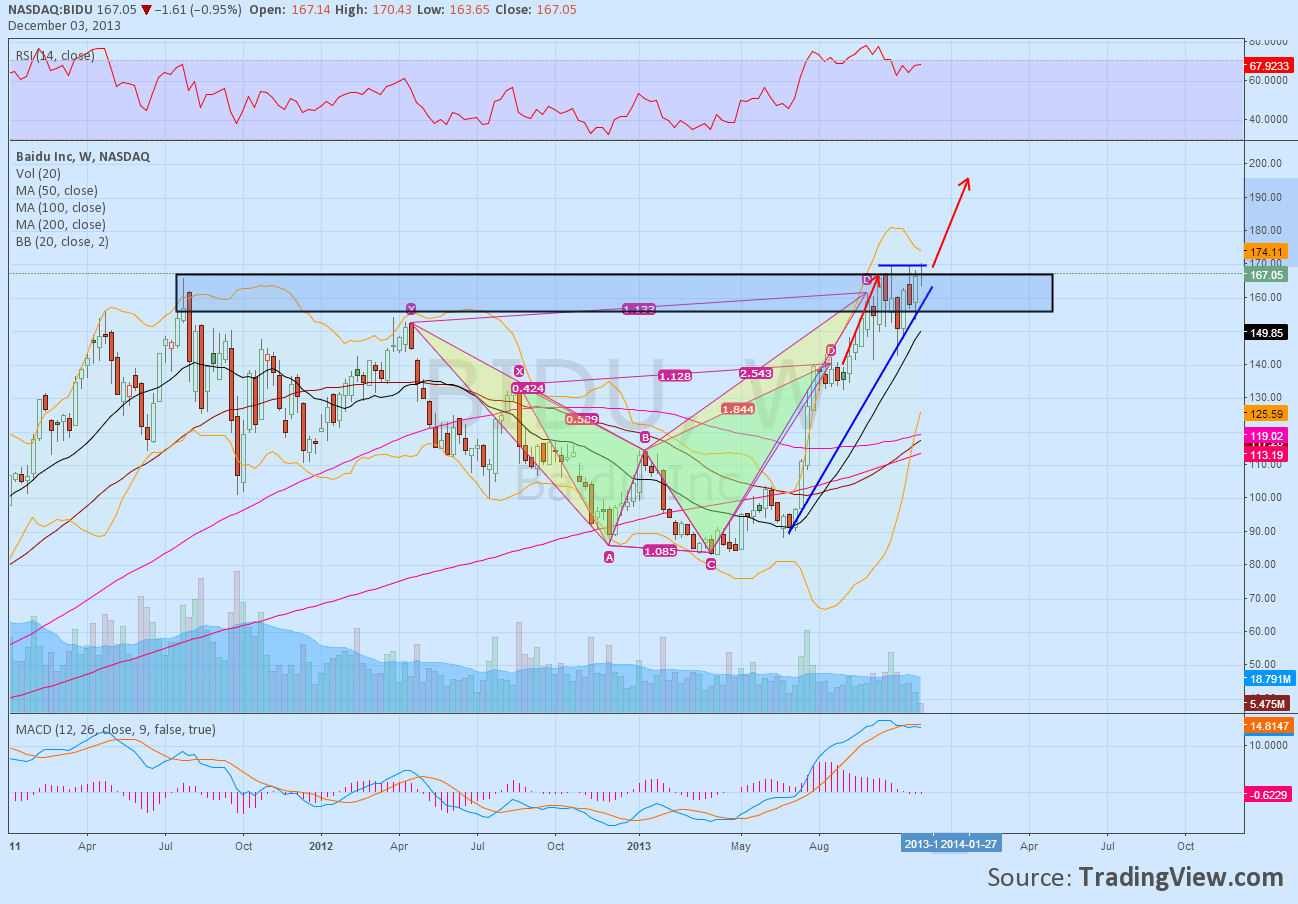

The Chinese market has looked better over the last few weeks, and some names traded in the US are set up to break out. Baidu, (BIDU), is one of them. The short term action shows the price at resistance at 170.50 for the third time. A quick push of the toe above and then

retreating. It also has two sets of support tightening the range on that resistance. The Relative Strength Index (RSI) is bullish but pulled back Tuesday, while the MACD is rising. A step back to look at the weekly chart gives some insight as to why it has stalled in this range for so long. Not only is it the Potential Reversal Zone (PRZ) of the yellow Shark but the retest of the previous highs from July and August 2011. It was also technically overbought on this timeframe but has now worked that off through time. A move over 170.50 would carry a Measured Move higher to 195, a stone’s through away from 200. Symmetry would suggest that this could happen by the end of January. That can keep you busy for a little while.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Original post