Have you refinanced your house recently?

Me neither. Somehow, for our house, it’s already four years ago, though I can remember the transaction like it was yesterday.

Full credit for the smart financial move to my wife, who asked about refi timing over (and over) and fortunately got it through my thick head before interest rates really started to rise. Fed Chair Jay Powell was running the printing presses like crazy and long rates (mortgage included) would eventually lift from basement levels.

When refi activity slows, it is bullish for elite 8.5%-yielding Rithm Capital (NYSE:RITM) (RITM). RITM, our old Contrarian Income Report friend, smartly purchased a stockpile of mortgage service rights (MSRs), which gain in value as rates grind sideways or up.

We bought RITM for CIR in July 2021, shortly after my refi. At the time the stock was paying 7.6% and the company was sitting on a pile of MSRs smartly purchased for cheap by company founder Michael Nierenberger.

Mortgage service rights (MSRs) are contracts that give the holder the right to collect payments from a borrower. These aren’t the loans themselves; they are the rights to service these loans. A subtle but important difference.

When we originally bought our house back in 2012, our bank flipped the servicing of our loan to Caliber Home Loans. Caliber collected our monthly payment and settled up with the lender. We made our payments on time (thank you autopay!) Caliber collected 0.25% of our monthly payment for, well, simply processing our payments. Our MSR was easy money.

Our 2021 refi disrupted Caliber’s gravy train. But with rates rising again in 2021, Caliber was due to see fewer loans “called away” via refinancing. Nierenberger saw this ahead of Wall Street. He announced plans to buy Caliber for cheap in April 2021, making RITM the largest owner of MSRs in the world.

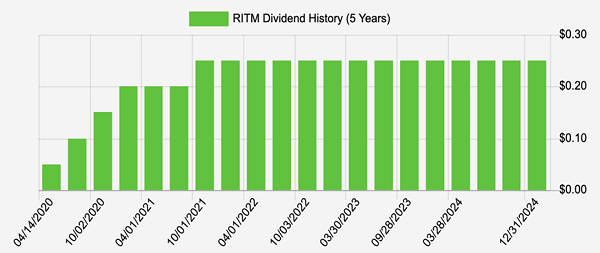

We bought the stock for CIR just in time for a 25% dividend raise, boosting our yield-on-cost from 7.6% to 9.5%. The current yield trended lower over the 3.5 years we owned it because buyers swarmed in, boosting the price and dropping the dividend on new money. We contrarians enjoyed 48% total returns, mostly as cash dividends—a whopping $3.25 on a modest $10.46 purchase price!

RITM Raises Its Dividend as Income Increases

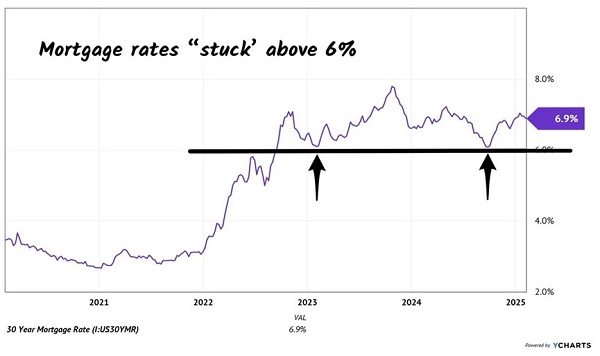

I said “sell RITM” in October as mortgage rates came down from 8% to nearly 6%. Lower rates were a potential problem for RITM if they led to increased refis. Fortunately for RITM, the dip did not last and the mortgage market remains moribund.

Today, mortgage rates remain stubbornly high above 6% by post-financial-crisis standards. This means a comatose housing market and mortgage activity:

Why the Housing Market is Comatose

Mortgage rates “stuck” high is great for RITM’s stock. The company earned $0.60 in its most recent quarter, plenty to fund its generous $0.25 payout. Wall Street analysts expected only $0.44 in profits—they are behind the curve.

Those same blinders-on analysts don’t get RITM’s recent acquisition of Sculptor Asset Management, either. The sculptor brought in $34 billion in assets under management, providing another river of fees to complement the MSR stream.

Hedge funds are starting to catch on to the dividend deal that is RITM. They added 2 million shares in the most recent quarter. These institutional players are “stronger hands” than vanilla individual investors and are likely to set a floor under the stock price.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."