In mid-July, the Australian dollar (FXA) surged higher after a hawkish interpretation of the RBA minutes. Guy Debelle, Deputy Governor of the Reserve Bank of Australia (RBA), tried to walk the market off its enthusiasm. The pause was temporary. By the early September RBA meeting, AUD/USD hit a 2+ year high, albeit partially because of weakness in the U.S. dollar.

Since then, the RBA produced two nearly identical statements on Monetary Policy which helped to cool off interest in the currency. In October, the RBA suggested it had no intention of hiking rates anytime soon by pointing to the undesirable strength in the Australian dollar:

“The Australian dollar has appreciated since mid year, partly reflecting a lower US dollar. The higher exchange rate is expected to contribute to continued subdued price pressures in the economy. It is also weighing on the outlook for output and employment. An appreciating exchange rate would be expected to result in a slower pick-up in economic activity and inflation than currently forecast.”

The RBA also described inflation as “low.” In November (Tuesday the 7th), the RBA reiterated the same observations on the Australian dollar and then confirmed definitively that rates are not going up anytime soon by providing the following observations on inflation:

“Inflation remains low, with both CPI and underlying inflation running a little below 2 per cent. In underlying terms, inflation is likely to remain low for some time, reflecting the slow growth in labour costs and increased competitive pressures, especially in retailing. CPI inflation is being boosted by higher prices for tobacco and electricity. The Bank’s central forecast remains for inflation to pick up gradually as the economy strengthens.”

The rhetoric has helped to push AUD/USD below its flattening 200-day moving average (DMA).

The Australian dollar versus the U.S. dollar (AUD/USD), has steadily weakened off its peak two months ago. The pair now faces a critical test at its 200DMA line of support.

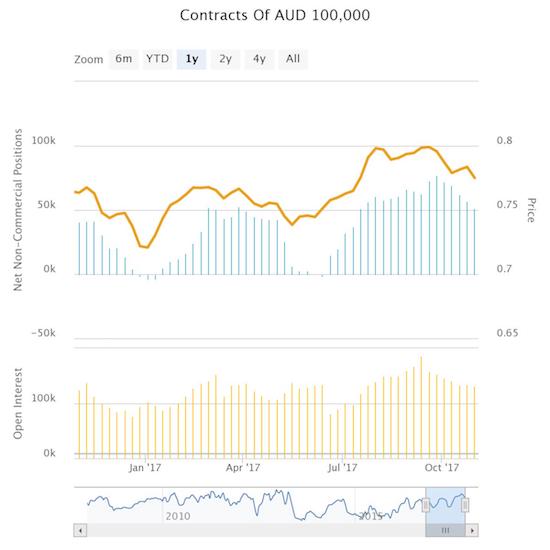

I am inclined to short the Australian dollar here against the U.S. dollar, but I am waiting for more clarity like trading below the low of the current consolidation range. Speculators have followed the Australian dollar downward by reducing net long positions ever so slowly. This trend seems to confirm a bias of weakness. If net positioning is trending down to zero as in June, then there should be substantially more weakness ahead for AUD/USD and perhaps other Aussie pairs…just waiting for some technical confirmation…

Speculators are slowly but surely winding down net longs on the Australian dollar in what looks like the completion of the latest bull cycle.

Be careful out there!

Full disclosure: short EUR/AUD