Bitcoin climbed by 5% in the last 24 hours and is trading at around $6,650. Yesterday, the benchmark coin was clinging to $6,200, but it started to grow sharply late at night. As for technical analysis, this price jump closed the gap formed at the opening of the trading week. After that, the interest of buyers decreased.

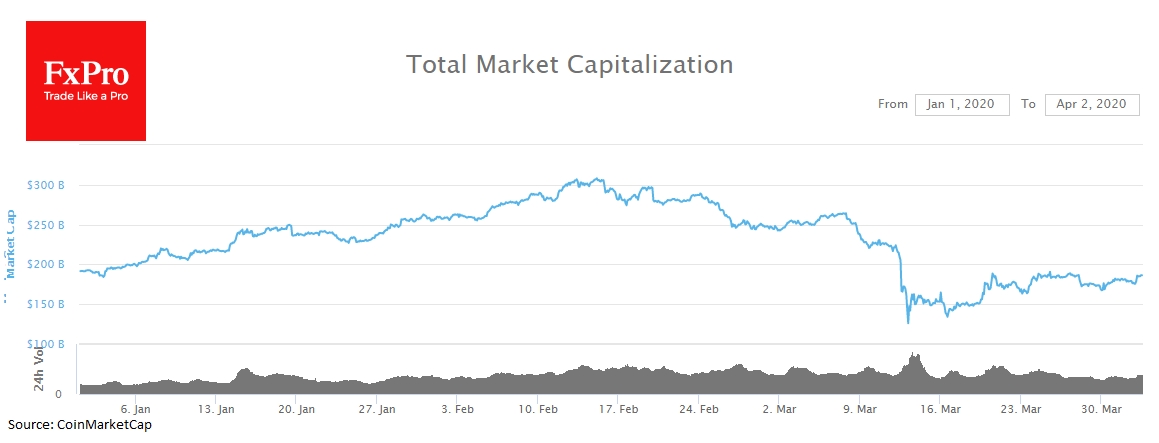

Altcoins are showing full compliance with the bitcoin price dynamics. The top 10 altcoins are growing by 3-4%. Another argument in favour of the reversal may be the pressure on the Tether (USDT) stablecoin, which often sags slightly at moments of growth of other cryptocurrencies. According to CoinMarketCap, the daily trading volume of the crypto market has grown by 23% to $130bn. The total capitalization increased by almost 4% to $186bn in 24 hours. The Crypto Fear & Greed Index has grown by several points per day, being in the area of “extreme fear”. RSI is in a neutral zone waiting for new triggers.

According to WhaleAlert, an unknown whale moved 101,857 BTC (USD 633,535,530) yesterday. These bitcoins were transferred between two anonymous wallets. The wallet with a single deposit immediately took third place in the TOP 100. It is challenging to link this transaction to the growth of the bitcoin explicitly, but such large transfers are rare and can definitely “shake up” the crypto community.

Recently, digital currencies have demonstrated a correlation with traditional risk assets, so if the market trend reverses, an improvement can be expected in the crypto sector as well.

Traders at Coinbase have prepared for the market rebound in advance. Coinbase data showed a significant increase in trading activity and demand for the purchase of leading digital currencies immediately after the collapse of the crypto market on March 12. Traders bought the dips, which allowed the market to bounce back quickly, but a full-scale reversal required much larger volumes.

If we take a longer-term perspective, the options market shows a negligible 4% probability of Bitcoin price growth to $20K. The market’s pricing only 16% likelihood for the move above $10K, although it was there as recently as six weeks ago. Monetary easing announced by central banks are not able to revive demand for cryptocurrencies, but institutional investors’ optimism may well push the digital coins up.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

With Increased Volumes, Is Crypto Ready For Growth?

Published 04/02/2020, 09:41 AM

Updated 03/21/2024, 07:45 AM

With Increased Volumes, Is Crypto Ready For Growth?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.