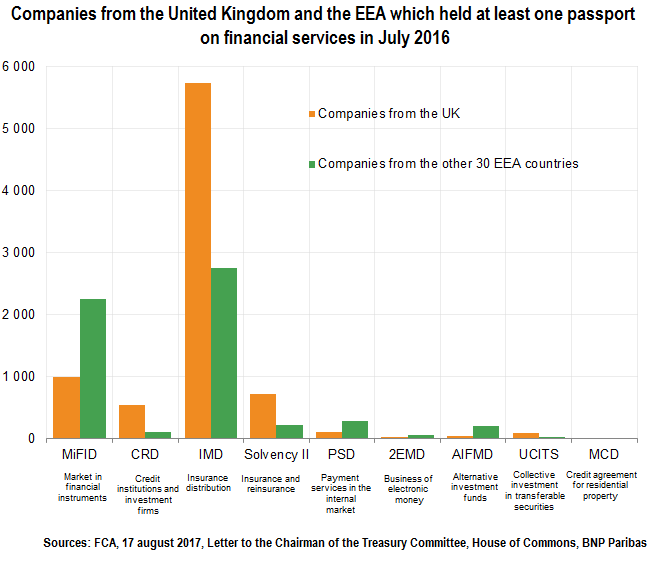

The European financial services passport can be divided into nine passports differentiated by type of financial activity. Each passport grants specific rights to the holders, who generally accumulate several passports to cover their customers’ needs. These passports allow the freedom to provide financial services within the European Economic Area (EEA) and to set up branches (and not necessarily locally-licensed subsidiaries).

In 2016, 13,500 companies in the EEA benefited from at least one passport. Although the number of passports per activity provides an indication of the potentially numerous legal obstacles to pursuing cross-border activities, it does not say much about the scope or type of financial flows, nor the number of jobs affected by the loss of the European passport. With Brexit, the UK will become a third country. It will have to comply with equivalence regimes, which are granted (or not) by the authorities of each host country for a definite or indefinite period of time.

by Laure Baquero