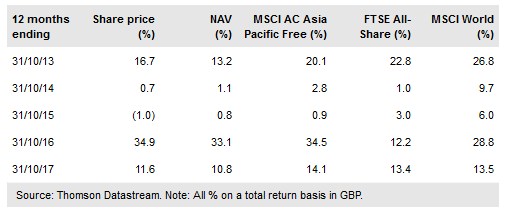

Witan Pacific Investment Trust (LON:WIPA) employs an active multi-manager strategy, aiming to generate long-term growth in capital and income from a diversified portfolio of Asia Pacific equities, which includes Japan, Australia and India. Since adopting the multi-manager approach in 2005, WPC has outperformed its benchmark, the MSCI AC Asia Pacific Free index, in eight out of 12 financial years, but has lagged since mid-2016. The board changed the manager line-up from end-September 2017, dropping Gavekal and appointing Dalton Investments and Robeco Institutional Investment Management. WPC has a progressive dividend policy, aiming to grow the annual distribution in real terms. The regular dividend has increased in each of the last 12 years.

Investment strategy: Multi-manager approach

WPC’s board actively manages the line-up and allocations of its external managers, aiming to outperform the benchmark and diversify risk. At end-September 2017, the allocations to the revised line-up of four external managers were set as: Aberdeen (25%), Dalton (10%), Matthews (40%) and Robeco (25%). The managers have complementary investment styles, while the multi-manager approach tends to smooth WPC’s investment performance compared to that of the individual managers. The board is excited about the appointment of the two new managers and believes that they will be accretive to WPC’s relative investment performance.

To read the entire report Please click on the pdf File Below: