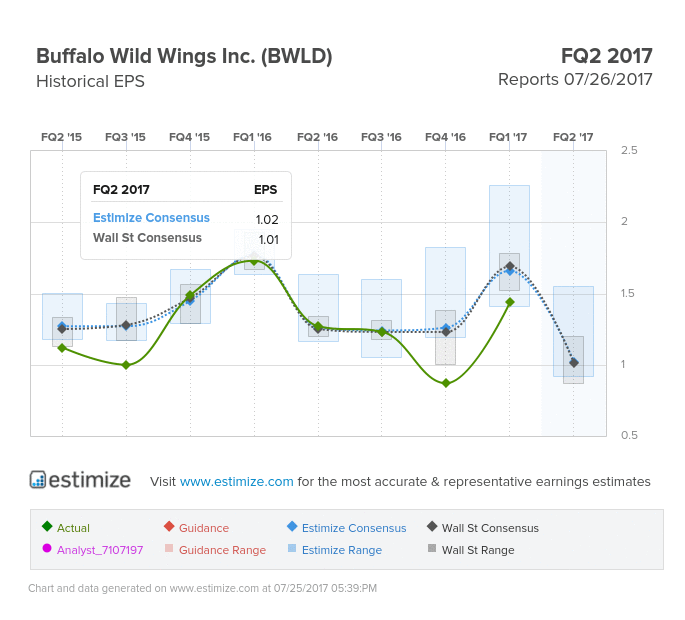

When the American-classic Buffalo Wild Wings Inc (NASDAQ:BWLD) chain reports after the market closes tomorrow, they are poised to announce a third straight quarter of declining year-over-year EPS.

The street is looking for profits of $1.01, while the Estimize consensus checks in at $1.03. Meanwhile the revenue numbers are similar. What is most worrisome about the popular chain is a medium to long term decline in same store sales. Revenue is increasing only as a result of new locations, and not increasing profitability in existing stores. Furthermore, our Estimize consensus percent change points to severe negative revisions which reflects a negative sentiment about the stock. In the 22 quarters we’ve covered this name, BWLD has only beaten our estimates 41% of the time. These indicators together paint a dangerous picture, and it would be wise to decrease exposure to this name around its earnings.

Now, although our technical indicators point towards a disappointing quarter, there are some reasons to believe in a turnaround. The company is opening a series of small-format restaurants called B-Dubs Express which focuses on quick service and take-out as fast food trends towards this model. The new stores will seat less people and have a less expansive menu, but will reduce service time and collaborate with food delivery services. A C-Suite management shakeup has investors nervous, but if new leadership can put the company on a new path, then investors may have reason to believe.