Williams-Sonoma Inc. (NYSE:WSM) just released its second quarter fiscal 2017 financial results, posting earnings of 61 cents per share and revenues of $1.2 billion. Currently, WSM is a #3 (Hold) on the Zacks Rank, and is up almost 5.4% to $45.76 per share in trading shortly after its earnings report was released.

Williams-Sonoma:

Beat earnings estimates. The retailer reported earnings of 61 cents per share, surpassing the Zacks Consensus Estimate of 59 cents per share.

Matched revenue estimates. The company saw revenues of $1.202 billion, meeting our consensus estimate of $1.2 billion and growing 3.7% year-over-year.

Total comparable sales increased 2.8% in the second quarter. Breaking it down by brand, Pottery Barn saw comps of 1.2%, Williams-Sonoma came in at 1.9%, while West Elm surged with 10.1% in same-store sales growth. Pottery Barn Kids and PBTeen saw a decrease of 3.9% and a slight 0.2% in comps, respectively.

Operating margin was 6.8%, while gross margin came in at 35.2% during the quarter.

Looking ahead, total net revenues in the range of $1.27 billion to $1.31 billion are expected for the third quarter of fiscal 2017, with diluted EPS in the range of 80 cents to 87 cents per share. WSM also expects comparable stores sales growth of 2% to 5% growth.

"These results reflect the strength of our brands and our competitive advantages, as well as our relentless focus on our initiatives to drive innovation and operational excellence. And, we are aggressively building upon these initiatives to further differentiate ourselves and to drive profitable growth,” said Laura Alber, President and Chief Executive Officer.

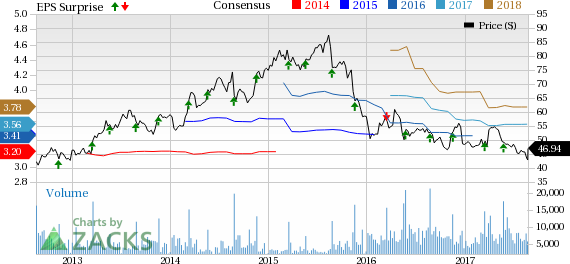

Here’s a graph that looks at Williams-Sonoma’s price, consensus, and EPS surprise:

Williams-Sonoma, Inc. is specialty retailer of products for the home. The retail segment sells its products through its three retail concepts: Williams-Sonoma, Pottery Barn and Hold Everything. The direct-to-customer segment sells similar products through its five direct-mail catalogs, Williams-Sonoma, Pottery Barn, Pottery Barn Kids, Hold Everything and Chambers, and the Internet.

4 Surprising Tech Stocks to Keep an Eye On

Tech stocks have been a major force behind the market’s record highs, but picking the best ones to buy can be tough. There’s a simple way to invest in the success of the entire sector. Zacks has just released a Special Report revealing one thing tech companies literally cannot function without.

More importantly, it reveals 4 top stocks set to skyrocket on increasing demand for these devices. I encourage you to get the report now – before the next wave of innovations really take off. See Stocks Now>>

Williams-Sonoma, Inc. (WSM): Free Stock Analysis Report

Original post

Zacks Investment Research