The Williams Companies, Inc.’s (NYSE:WMB) Constitution Pipeline project recently suffered a major setback when the Federal Energy Regulatory Commission (FERC) refused to rescind New York’s denial of a water permit to the project. The ruling has come as a blow to pipeline developers’ endeavors to transport additional natural gas to New England, which relies heavily on pipeline imports from Canada and overseas.

Williams Companies applied for the water permit in August 2013. However, the company withdrew and resubmitted the application twice, which led to the resetting of the one-year deadline by New York Department of Environmental Conservation (DEC). In 2016, the DEC announced its decision not to grant the water permit to Williams Companies.

Interestingly, the project had received FERC’s approval in early 2016. However, the DEC denied issuing a water quality permit to the pipeline claiming that the owners of the project and the FERC did not analyze the environmental impacts of the project adequately and the pipeline will possibly impact over 250 streams adversely.

The pipeline company filed a petition in October 2017 requesting the FERC to repeal DEC’s decision. The company claimed that New York DEC failed to act on the application within the stipulated time frame. The petition filed by the company stated, “The Clean Water Act specifies that if a state agency fails or refuses to act on a request for certification under Section 401 within a reasonable period of time, which shall not exceed one year, after receipt of such request, the certification requirements shall be waived.”

However, the FERC maintained that DEC acted within the necessary time frame, given the constant withdrawal of applications by the company which had deferred the decision.

Notably, FERC had revoked New York Department of Environmental Conservation’s (DEC) denial of water quality certification to Millennium Pipeline in September 2017. Williams Companies had been hoping for a similar outcome for Constitution Pipeline, however FERC’s latest verdict crushed the hopes of the company to make its pipeline come online by 2019. Nevertheless, the company is planning to seek a rehearing.

Notably, the project has also drawn severe censure from various activists and environmental groups as they are of the opinion that the project will have implications on public health and environment.

Constitution Pipeline project is jointly owned by William Companies, Cabot Oil & Gas Corporation (NYSE:COG) , WGL Holdings, Inc. (NYSE:WGL) and Piedmont Natural Gas Company which was acquired by Duke Energy Corporation (NYSE:DUK) last year. The $750-million project runs from Pennsylvania to Schoharie County and has the capacity to transport 650,000 dekatherms of gas each day.

Oklahoma-based Williams Companies presently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1(Strong Buy) Rank stocks here.

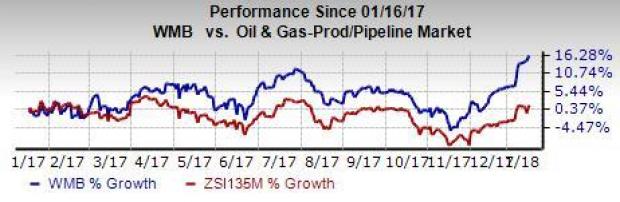

Over a year, Williams Companies’ stock has outperformed the industry it belongs to. During the aforesaid period, Williams Companies’ shares have rallied more than 16.2% against the 1.5% gain of the broader industry.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Duke Energy Corporation (DUK): Free Stock Analysis Report

WGL Holdings Inc (WGL): Free Stock Analysis Report

Williams Companies, Inc. (The) (WMB): Free Stock Analysis Report

Cabot Oil & Gas Corporation (COG): Free Stock Analysis Report

Original post

Zacks Investment Research