Shares of action camera company, GoPro Inc (NASDAQ:GPRO), tumbled down 5% in trading on Monday, March 2nd after Chinese smartphone company, Xiaomi, launched a similar product called the Yi Action Camera.

The Yi Action Camera has a 16-megapixel camera and can record high-definition videos at 60 frames per second, whereas the GoPro Hero only has a 5-megapixel camera and records high-definition videos at just 30 frames per second. In addition, the Yi Action Camera supposedly comes with more storage and weighs less than the GoPro Hero. While the low-tier GoPro Hero retails around $130, the Yi Action Camera costs about half the price at $64, or 399 yuan.

However, the Yi Action Camera is currently only sold in China and does not have any plans to expand sales internationally. Despite this, GoPro investors are more worried that this will hinder the company’s sales strategy in Asia.

Following the drop in GoPro’s shares, Northland Securities analyst Gus Richard reiterated an Outperform rating on the stock with a price target of $70 on March 2nd saying that Xiaomi's launch of the Yi Action Camera further "validates GoPro's business model" and the firm's opinion that "the company's opportunity is significantly larger." Overall, Richard believes GoPro’s estimates are rather “conservative," and validates his firm as "aggressive buyers" of shares at current levels. The analyst also points out that while the Yi Action Camera’s features are a “bit better” than the entry level GoPro Hero, it is still “far below” the higher-end GoPro products.

Overall, Gus Richard has a 76% success rate recommending stocks and a +13.4% average return per recommendation. However, the analyst has rated GoPro twice since February 2015 with no success and a -17.5% average loss per GoPro recommendation.

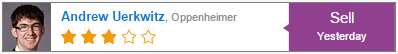

On the other hand, Oppenheimer analyst Andrew Uerkwitz maintained an Underperform rating on GoPro with a price target of $35 on March 2nd after the stock declined the same day. The analyst noted, “We reiterate our view that aggressive competitors such as Xiaomi will materially reduce GoPro's market opportunity in China and Asia.”

However, Uerkwitz believes the Yi Action Camera “does not pose a threat to GoPro's US and EU markets” because “in typical Xiaomi style… the camera will be in very short supply in the near term.” The analyst concluded, “We believe Yi Action Camera and its likes will prevent GoPro from getting material market share in general consumer market in China. Going forward, we believe GPRO's market will be confined to extreme sports enthusiasts in China.”

Andrew Uerkwitz currently has an overall success rate of 53% recommending stocks and a +2.4% average return per recommendation. He has rated GoPro 6 times since October 2014, earning a 100% success rate recommending the company and a +34.0% average return per GoPro recommendation.

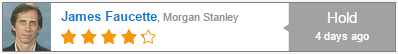

On February 27th, a few days before the launch of Xiaomi’s action camera, Morgan Stanley (NYSE:MS) analyst James Faucette initiated an Equal-Weight rating on GoPro with a $57 price target, citing that the company has to come out ahead of the big competitors in order to keep growing. He noted, "If GoPro is the one who successfully brings that to market, then you have a lot of upside."

James Faucette has an overall success rate of 73% recommending stocks and a +15.5% average return per recommendation. He has only given GoPro 6 Neutral ratings since December 2014, earning no success rate or average return on the stock.

On average, the top analyst consensus for GoPro on TipRanks is Hold.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Will Xiaomi's New Action Camera Threaten GoPro? Analysts' Weigh In

Published 03/03/2015, 08:23 AM

Updated 05/14/2017, 06:45 AM

Will Xiaomi's New Action Camera Threaten GoPro? Analysts' Weigh In

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.