In a remarkable development, Ventas Inc. (NYSE:VTR) signed a deal to acquire significantly all of the life science and medical real estate assets of Wexford Science & Technology, LLC. from Blackstone Group LP (NYSE:BX) for $1.5 billion in cash. The transaction is expected to close in fourth-quarter 2016, subject to closing norms.

The move marks the company’s foray into the thriving university-affiliated life science real estate business and is expected to be accretive to Ventas’s normalized funds from operations (“FFO”) in 2017 by 7–9 cents per share on a leverage-neutral basis.

Notably, Wexford, a leading university focused developer, had been a part of BioMed Realty Trust Inc. – a company that Blackstone had purchased in January this year.

The Deal

The portfolio involves 23 operating properties with 4.1 million square feet and two development assets comprising around 400,000 square feet of space. The company is also buying nine development sites mainly adjacent to existing assets.

Tenants of these assets comprise leading universities, academic medical centers and research companies, including Yale University, the University of Pennsylvania Health System, Washington University in St. Louis, Wake Forest University and Alexion Pharmaceuticals (NASDAQ:ALXN), Inc.

As part of the buyout, Ventas will enter into an agreement that would allow the company exclusive rights to jointly develop future projects with Wexford. On the other hand, Wexford will continue to manage the portfolio and be independently owned and operated.

Moreover, total consideration for the deal is $1.5 billion, together with the assumption of $33 million of liabilities. Notably, Ventas would sell up to 10.35 million shares and use the proceeds to finance the transaction.

The Benefit

The deal is a strategic fit given the scope to capitalize on the increasing health-care-driven research and development driven by top-tier research universities. Increasing longevity of the aging U.S. population coupled with biopharma drug development growth opportunities are fueling the institutional life science and medical-market fundamentals. Moreover, long lease terms and top rated, institutional quality tenants assure steady growth in cash flows for Ventas.

Further, addition of 100% private pay assets would increase Ventas’s net operating income (NOI) contribution from private pay assets to 84%, which is encouraging. In fact, pro forma for the Wexford transaction, the assets acquired would reap around 5% of Ventas’s total NOI.

In Conclusion

Ventas’ large and diversified healthcare portfolio will help it benefit from an increasing healthcare spending, aging population and a rise in insured individuals. Further, the above-mentioned acquisition deal is consistent with the company’s strategy of adding high-quality properties generating improving cash flows. Yet, stiff competition keeps us concerned.

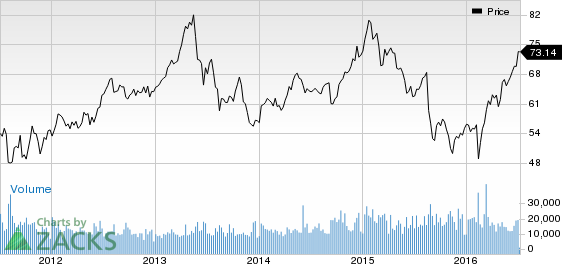

Ventas currently has a Zacks Rank #3 (Hold). Investors interested in the REIT industry can also consider stocks like other better-ranked stocks like HCP Inc. (NYSE:HCP) and Omega Healthcare Investors Inc. (NYSE:OHI) . Both the stocks has a Zacks Rank #2 (Buy)..

Note: FFO, a widely used metric to gauge the performance of REITs, is obtained after adding depreciation and amortization and other non-cash expenses to net income.

BLACKSTONE GRP (BX): Free Stock Analysis Report

HCP INC (HCP): Free Stock Analysis Report

VENTAS INC (VTR): Free Stock Analysis Report

OMEGA HLTHCARE (OHI): Free Stock Analysis Report

Original post

Zacks Investment Research