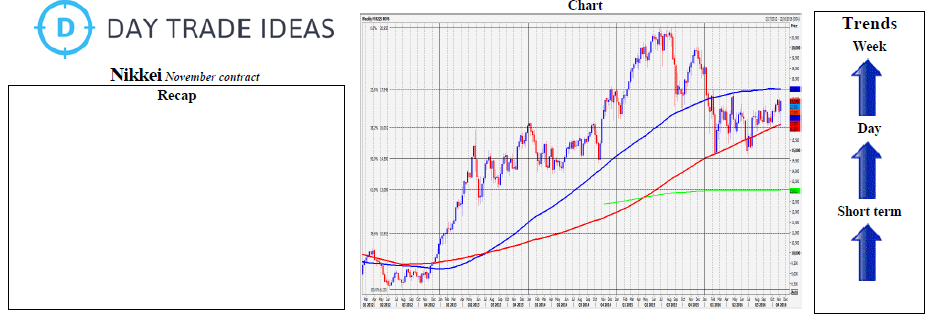

Mini Nikkei 225 futures topped at 17620 yesterday. Holding below 17490 is less positive now and targets 17355, then 17310, before strong support at 17250/240. We look for a bounce from here, but longs need stops below 17190. Further losses target 17155 then 17060/050.

Bulls need prices above 17500 to be back in the driving seat and target 17560 then yesterday's high at 17620. A break higher targets the April high at 17745, perhaps as far as 17860. On further gains look for the January high at 17910 before important longer term Fibonacci and 100 week moving average resistance at 17950/980.