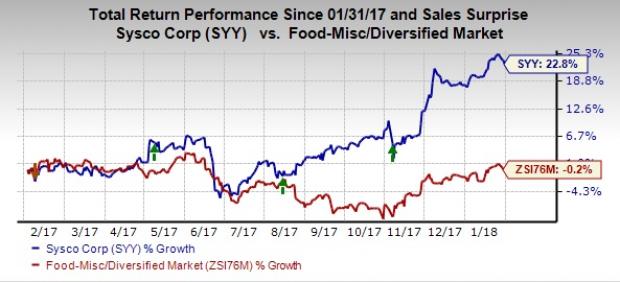

Sysco Corp. (NYSE:SYY) is slated to release second-quarter fiscal 2018 results on Feb 5. The food products giant delivered positive earnings surprise in seven out of the past eight quarters, while sales topped the Zacks Consensus Estimate for three consecutive quarters. Sysco’s strong record has also helped it to jump 22.8% in a year against the industry that dipped 0.2%.

So, let’s see if this Texas-based company can keep its spectacular surprise streak alive this time too.

Factors at Play

We expect Sysco to continue gaining from its cost-saving and revenue-management efforts, which have been driving its performance for a while now. Incidentally, the company has been impressively managing expenses for the past few years, and is making progress in both SG&A and supply chain areas. In the supply chain area, the company is witnessing positive momentum from its productivity initiatives and ongoing process improvements.

Driven by these endeavors, the company remains on track to achieve the high end of the three-year adjusted operating income growth target of approximately $600-$650 million through the end of FY18. This growth is expected to come from lower administrative costs and improving gross margin, which gives out positive signals for the quarter under review.

Further, the company’s focus on acquisitions, new product developments, value-added services and improved e-commerce capabilities remains a growth driver. In this regard, the company’s recent acquisition of HFM Foodservice is likely to augment its top line, by boosting revenues of the U.S. Foodservice segment. Notably, Sysco expects to achieve 0.5-1% sales growth through acquisitions in the long term. Other than aiding sales growth, these acquisitions also enhance Sysco’s presence in international markets.

Backed by these factors, Sysco has been witnessing year-over-year growth in top and bottom lines for quite some time now, and we expect this trend to continue in the quarter to be reported.

How Are Sysco’s Segments Placed?

Taking a segment-wise look, we remain optimistic about the company’s U.S. Foodservice Operations, which delivered a strong performance in the last reported quarter despite bearing the brunt of hurricanes. Notably, sales in this segment advanced 4% to $9,849.9 million, with local case volume within U.S. Broadline operations up 2.8%. Also, gross profit increased 3.8%, backed by the company’s focus on product management, efficient pricing and revenue management initiatives.

Going forward, management expects its domestic business to be buoyed by increased consumer demand and traffic. The Zacks Consensus Estimate for sales at this segment is pegged at $9,561 million, which reflects 5.2% growth from the year-ago period.

Moving to the International Foodservice Operations, this unit delivered improved sales too in the last reported quarter. However, results were partly hurt by softness in Europe, which is battling slow traffic. Moreover, weak UK currency resulted in food cost inflation, thereby leading to pricing pressure. These headwinds are likely to persist throughout the fiscal, though management remains focused on reducing the impact of such obstacles. Additionally, the company remains encouraged about the growth prospects in Latin America. Markedly, the consensus mark for International sales stands at $2,784 million compared with $2,626 million in the same year-ago period.

The company also remains hopeful of growth in its SYGMA segment, for which the consensus estimate for sales is $1,613 million, up 6.1% from the year-ago reported sales figure.

Q2 Expectations as a Whole

Given these factors and Sysco’s focus on its recently announced strategies for 2020, we believe that the company will continue with its top and bottom-line growth in the second quarter.

Encouragingly, the Zacks Consensus Estimate for second-quarter earnings is pegged at 65 cents, which represents more than 12% growth from the year-ago period. Moreover, analysts polled by Zacks expect revenues of $14,186 million, up 5.4% from the year-ago reported figure.

What the Zacks Model Unveils?

To top it, our proven model shows that Sysco is likely to beat bottom-line estimates this quarter. For this to happen, a stock needs to have both a positive Earnings ESPand a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold). You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Well, Sysco possesses the right combination, as the Zacks Rank #1 company has an Earnings ESP of +0.78%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Other Stocks With Favorable Combination

Here are some other companies that possess the right combination of elements to post an earnings beat:

Philip Morris International Inc. (NYSE:PM) has an Earnings ESP of +0.74% and a Zacks Rank #3.

Coty Inc. (NYSE:COTY) has an Earnings ESP of +1.99% and carries a Zacks Rank of 3.

Church & Dwight Co., Inc. (NYSE:CHD) has an Earnings ESP of +0.17% and carries a Zacks Rank #3.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Coty Inc. (COTY): Free Stock Analysis Report

Sysco Corporation (SYY): Free Stock Analysis Report

Church & Dwight Company, Inc. (CHD): Free Stock Analysis Report

Philip Morris International Inc (PM): Free Stock Analysis Report

Original post

Zacks Investment Research