Gold is certainly one of those crises currencies per se, and its impact is being felt in the markets due to the current Ukranian crisis. How effective is trading commodities in crisis situations? Are there any pitfalls for traders? These are certainly questions I hear from time to time.

While it’s clear that commodities certainly are the place to run to, the next question is for how long and how far can they climb? The current tension in Ukraine is nothing to take lightly. An invasion of a nation's sovereign territory is an act of war, especially to a large country like the Ukraine, who has over a million army reserves on call up if required. So far, Russia seems to be trying to annex the Crimea peninsula from Ukraine to keep its vested interests with the Navy port in Sevestapol. This is an act of war, though no actual war has begun or come close yet to even starting. To be honest, an all out war is the least possible thing at this current stage, as neither the West nor Ukraine actually want to start one over a small peninsula.

Despite the war threats, it’s likely that nothing will come of it. No one wants war, and it's likely that both sides will up the rhetoric in an effort to stem off one from the other, but Russia won't give up the Crimea anytime soon. This will likely have flow on effects on the global markets, as economic sanctions can and will be be imposed on Russia. It is likely that the Russians may indeed lead the charge for safety nets in commodities such as Gold, as the rubble crumbles from capital flight during the economic sanctions.

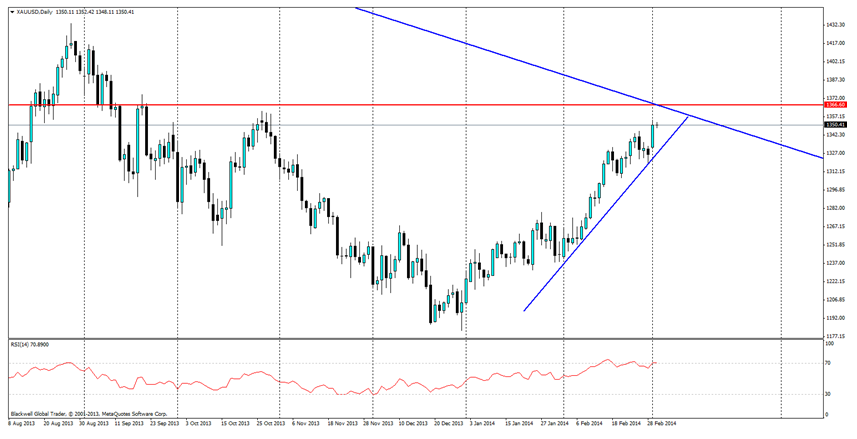

Coming back to my main focus is the fact that the Gold market is a good punt/bet for a large portion of traders during crisis and nothing says crisis like the threat of war, especially one that has the power to engulf Europe if it all falls apart. Currently, Gold has been looking very resurgent as markets are a little anxious over the US economy; and I don’t blame them as so far it has given mixed results – despite what the FED and Yellen have said. Now if Gold is set to rise and it most likely will, the question is: will it be able to break through the very long term trend line that has been in place for some time?

If anything, this crisis is a good catalyst for it and we may see pushes higher for the 1400 mark.

XAU/USD Daily 2" title="XAU/USD Daily 2" height="242" width="474">

XAU/USD Daily 2" title="XAU/USD Daily 2" height="242" width="474">

If we see more pressure during the Europe trading period today, expect to watch the long term trend line coupled with resistance at 1366.00. This will be the key point for further bullish movements - if we can see a breakthrough at this point, we could potentially see price movements all the way up to the 1400 level. This price action movement is supported by the heavy buying in Gold markets, as can be seen in the RSI which has been pushing overbought territory over the last few days.

Certainly over the next few weeks, we will see further pressure on Gold, but in the short term, it looks likely that Gold will be the commodity of choice if market movements are anything to go off. However, one should not discount other safe havens like the Yen and the USD which investors will also look into. The real action though, will most certainly be in the Gold market in the coming days.