U.S. Steel (NYSE:X) is set to release its second-quarter 2016 results after the bell on Jul 26.

The steel giant posted a bigger loss in the first quarter of 2016, hurt by lower selling prices. Adjusted loss was wider than the Zacks Consensus Estimate. Revenues tumbled year over year on lower shipments and pricing, and missed expectations.

High levels of imports and lower drilling activities by energy companies continued to put pressure on pricing and shipments in the quarter. These headwinds were partly offset by the company’s cost management actions.

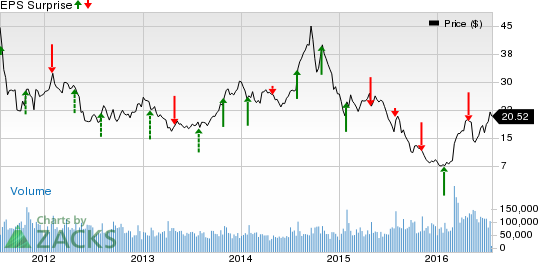

U.S. Steel has missed the Zacks Consensus Estimate in 3 of the trailing 4 quarters with an average negative surprise of 39.56%. Let’s see how things are shaping up for this announcement.

Factors to Consider

U.S. Steel, in its first-quarter 2016 call, said that it envisions improving market conditions for its Flat-Rolled and European divisions. Recent favorable trade rulings (leading to levy of tariffs on imports) on steel trade cases have been a catalyst for improved domestic market conditions. The company also noted that the impact of recent rise in prices for flat-rolled products will start to reflect in its results in the second quarter.

CEO Mario Longhi said that the company will remain focused on improving its cost structure and is making progress on its Carnegie Way program. U.S. Steel expects roughly $500 million of cash benefits from working capital improvements in 2016, mainly associated with better inventory management.

If the prevailing market conditions (including spot prices and import volumes) remain at their current levels, the company expects adjusted earnings before interest, income taxes, depreciation and amortization (EBITDA) for 2016 to be near $400 million. If market conditions change, U.S. Steel sees adjusted EBITDA to change consistent with the pace and magnitude of changes in market conditions.

Steel market conditions in the U.S. have improved lately, driven by favorable rulings on steel trade cases in the recent past. The U.S. Department of Commerce (“DOC”), in May 2016, slapped final anti-dumping duties on imports of corrosion-resistant steel from China, India, Italy, South Korea and Taiwan including a staggering anti-dumping duty rate of 209.97% on imports of these products from China. The regulator also levied a hefty final anti-dumping duty rate of 265.79% on imports of cold-rolled steel from China in May.

According to the American Iron and Steel Institute ("AISI"), total steel imports for the first five months of 2016 dropped 31% from the same period a year ago. U.S. Steel is expected to benefit from the favorable impact of reduced steel imports as a result of these punitive actions taken by the U.S. trade regulators.

U.S. Steel is seeing strong demand in the automotive space. It is also aggressively pursuing actions to improve its cost structure through its Carnegie Way program, which should lend support to its June quarter results.

Earnings Whispers

Our proven model does not conclusively show that U.S. Steel is likely to beat the Zacks Consensus Estimate in the second quarter. That is because a stock needs to have both a positive Earnings ESP (Expected Surprise Prediction) and a Zacks Rank of #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. That is not the case here, as you will see below.

Zacks ESP: The Earnings ESP for U.S. Steel is 0.00% as both the Most Accurate Estimate and the Zacks Consensus Estimate stand at a loss of 55 cents.

Zacks Rank: U.S. Steel’s Zacks Rank #2, when combined with a 0.00% ESP, makes surprise prediction difficult. We caution against stocks with a Zacks Rank #4 or 5 (Sell-rated stocks) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Stocks That Warrant a Look

Here are some companies in the steel space that you may want to consider as our model shows that these have the right combination of elements to post an earnings beat this quarter:

AK Steel Holding Corp. (NYSE:AKS) has an Earnings ESP of +100% and a Zacks Rank #2.

Ryerson Holding Corp. (NYSE:RYI) has an Earnings ESP of +16.67% and a Zacks Rank #2.

Steel Dynamics Inc. (NASDAQ:STLD) has an Earnings ESP of +5.97% and a Zacks Rank #2.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report >>

AK STEEL HLDG (AKS): Free Stock Analysis Report

STEEL DYNAMICS (STLD): Free Stock Analysis Report

UTD STATES STL (X): Free Stock Analysis Report

RYERSON HOLDING (RYI): Free Stock Analysis Report

Original post