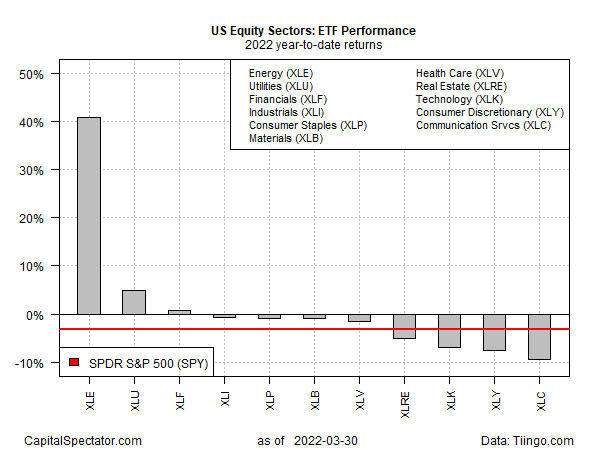

Energy stocks are enjoying the mother of all upside outlier performances for US equity sectors this year, based on a set of ETFs through Mar. 30. Only two other sectors are posting year-to-date gains, but at levels that barely register relative to energy’s run.

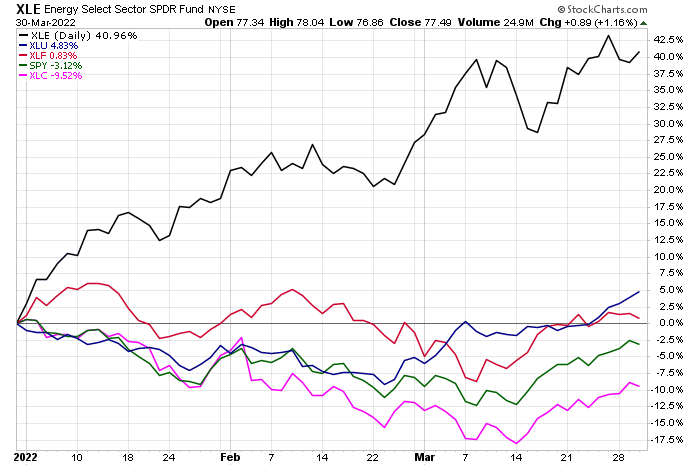

Energy Select Sector SPDR® Fund (NYSE:XLE) is up nearly 41% so far this year. This astonishing rally leaves the rest of the sector field in the dust. Two other sectors have managed to deliver gains in 2022: utilities (XLU) are up a modest 4.8% and financials have increased by a slight (0.8%). Otherwise, it’s red ink for the rest of the field.

The biggest year-to-date loser: communication services (XLC), which holds a mix of telecom and media stocks. The ETF is clearly having a bad year via a 9.5% loss – well below the broad market’s 3.1% year-to-date decline, based on SPDR S&P 500 (NYSE:SPY).

Energy’s front-runner status is impressive, but leaders posting extreme gains are vulnerable when shares are priced for perfection, which in this case is assuming that the surge in energy prices is a constant as far as the eye can see. The Biden administration, however, may be set to challenge that narrative, if only on the margins.

The White House is reportedly considering a release of roughly one million barrels a day from the Strategic Petroleum Reserve in the months ahead. Oil prices are down this morning, which isn’t surprising, given the news. The bigger question is whether there will be a longer-term effect?

Ed Bell, senior director of market economics at Emirates NBD, a bank, has doubts.

“Markets are still going to be very much squarely focused on supply going forward and the lack of it that we’re going to be seeing from Russia, the incremental additions we’re going to be seeing from OPEC+ and so far the real lack of price response from U.S. producers to high prices. For the longer term though, I do think this is a bit of a risky strategy for the U.S. to draw down on its SPR so heavily if you think that we’re going to be going into the more heavy use summer months in the United States, we’re going to be drawing down inventories just as we’re going to be needing them in a time of uncertain supply conditions.”

But another analyst says the potential release could have a substantial impact on the market. Current reports suggest this would be the largest release in the 45-year history of the US strategic reserve and it would come on the heels of the second-largest drawdown. The net effect will narrow the gap that currently indicates global supply outstripping demand.

Kevin Book, managing director of ClearView Energy Partners, advises in a research note:

“It is hard to overstate the scale of this intervention, if it bears out.”