Thursday’s a busy day for economic updates on both sides of the Atlantic. Another clue on how the Eurozone is faring at the start to 2016 arrives via today’s economic sentiment numbers for January from the European Commission. Later, the US labour market is in focus, with the weekly update on jobless claims, followed by the monthly report on pending home sales in the US for December.

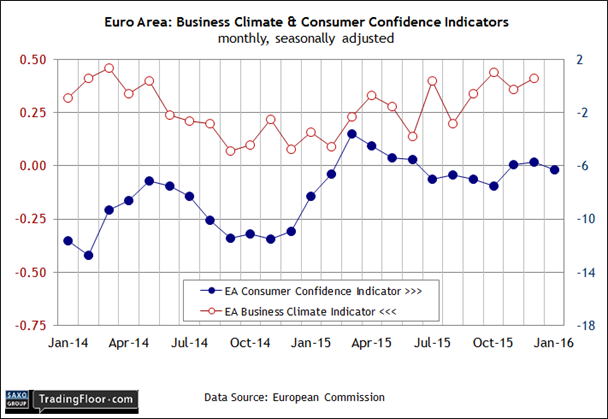

Eurozone: Consumer Confidence and Business Climate Indicators (1000 GMT): Next month’s flash estimate of Eurozone GDP for the fourth quarter of 2015 (scheduled for February 12) is on track to reveal relatively upbeat news, based on estimates from a variety of sources.

Now-casting.com’s recent Q4 projection, for instance, calls for a roughly 0.4% quarter-over-quarter increase in output, which is to say a slightly faster rise vs. Q3’s 0.3% gain. Slightly stronger growth was also picked up by EY’s December forecast, which noted that “the Eurozone recovery is becoming broader-based and more self-sustaining.”

Is optimism still warranted as the first month of 2016 comes to a close? Yes, but within limits, as suggested in last week’s softer flash data for the Eurozone Composite Output Index in January. Although the benchmark remained in growth territory, this month’s initial estimate slipped to an 11-month low. But there’s still enough positive momentum to keep the recovery alive. The January survey data implied GDP advancing at quarterly rate of 0.3% to 0.4%, according to the chief economist at Markit Economics.

Today’s sentiment update across the countries that share the euro offers another spin on how the trend is evolving in the new year. The previously released flash data for the Consumer Confidence Indicator in January ticked lower, the European Commission reported earlier this month. But that’s only slightly below the levels posted in late 2015. A hefty downgrade in today’s revision, however, would point to the potential for a run of weaker numbers in the weeks ahead, but for the moment a setback is unlikely.

We’ll also see the first look at the EC’s Business Climate Indicator for January. Recent data has been printing near the highest levels in two years. If today’s update leaves BCI close to December’s 0.41, the news will add another data point on the side of the optimists.

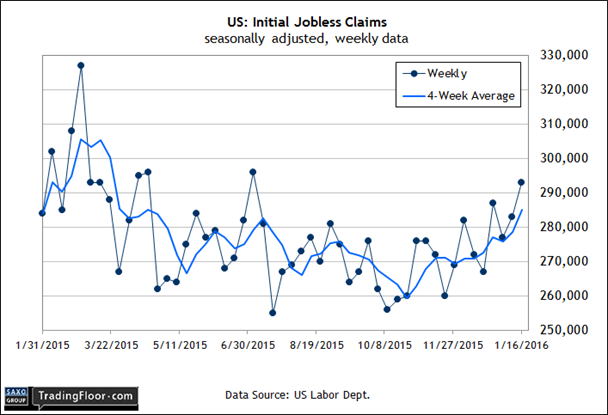

US: Initial Jobless Claims (1330 GMT): Is this leading indicator for the labour market and the economy dispensing a warning sign for the business cycle? Recent data hints at the possibility, which means that today’s update could be critical for deciding if the macro worries of late are warranted.

Last week’s update revealed that new filings for unemployment benefits unexpectedly jumped to a six-month high. Economists were looking for a modest decline but the data popped by 10,000 to a seasonally adjusted 293,000. As you can see in the chart below, the long-running trend in claims has reversed course, or so the figures in recent weeks suggest.

Another increase—especially one that pushes claims above the 300,000 mark—would add to the worry that the labour market is stumbling. But economists expect that today’s update will bring a bit of good news for a change. Claims are on track to fall by 8,000 to 285,000, based on Econoday.com’s consensus forecast. If the prediction turns out to be accurate, the crowd will breathe a sigh of relief.

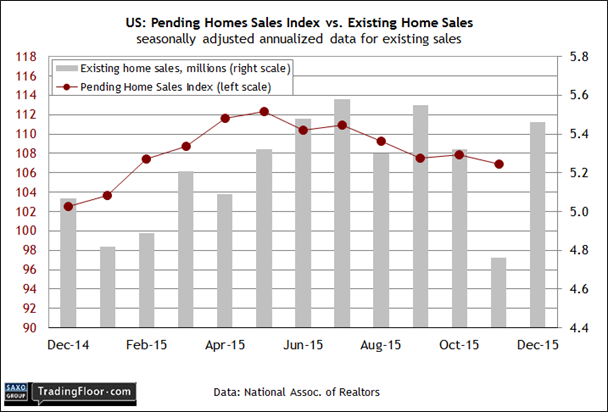

US: Pending Home Sales Index (1500 GMT): Housing data continues to impress lately, including yesterday’s surprisingly big gain in new home sales in December. The news followed upbeat reports in recent days from other corners of the residential real estate market. Will today’s pending sales data—a widely followed leading indicator for housing—add another bullish data point to the mix?

Yes, according to the crowd. Briefing.com’s consensus view anticipates a solid 0.8% rise for the Pending Home Sales Index in December. The news would certainly be welcome in the wake of a six-month downtrend for this leading indicator of housing activity and wobbly data from elsewhere in the economy. In fact, existing home sales surged in December after falling sharply in the previous month. Given the hefty U-turn, it would be surprising if today’s release doesn’t fall in line with the sales numbers to a degree.

Among the US housing sector optimists at the moment is David Mericle, a senior economist at (N:Goldman Sachs). He recently commented that “there are lots of upsides in housing, more so than any other sector of the economy.” His vote of confidence will resonate a bit deeper with the crowd if we see some of that upside in today’s figures for pending sales.

Disclosure: Originally published at Saxo Bank TradingFloor.com