Key Points:

- USD/JPY likely to retain its bullish predisposition.

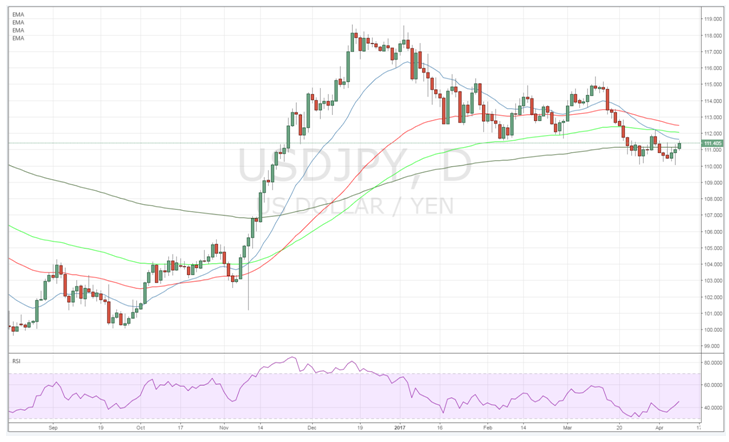

- RSI Oscillator bounces from oversold levels.

- Watch for a retracement back towards the 100-day MA in the coming week.

The USD/JPY initially started last week in a deep slide following a disappointing Flash Manufacturing PMI result which slipped to 53.3. However, the pair’s fortunes quickly turned around following the release of the U.S. Trade Balance data and the surprise fall in the unemployment rate. Subsequently, the pair largely turned bullish but it remains to be seen if it will retain this bias in the coming week. Therefore, let’s review what occurred last week and what is potentially on the horizon for the venerable pair.

Last week started with a whimper as the pair slumped following a disappointing U.S. Flash Manufacturing PMI result of 53.3 which refocused the market on moving capital into the yen as a safe haven. However, this negative sentiment quickly turned around following a surprise improvement in the U.S. Trade Balance to -43.6B which saw traders flooding back into long positions. In addition, the U.S. labour market also impressed with the unemployment rate falling to 4.5% which sent the pair roaring to finish the week around the 111.11 mark.

The week ahead is likely to bring about further gains for the pair with a score of U.S. centric economic data due for release. In particular, the U.S. inflation data, as well as the PPI results are likely to set the pair’s near term trend. The CPI result is expected to come in right on 0.2% m/m but we could see a slight uptick given the recent strength of the labour market.

In contrast, the Japanese event to watch is the Core Machinery Orders data which is forecast around the 3.7% m/m mark. However, much of the other Japanese economic data is likely to prove relatively disappointing in comparison to the United States. Subsequently, expect the market to focus sharply on the U.S. inflation data and PPI and for these results to determine the pair’s near term trend.

From a technical perspective, the pair’s rally late in the trading week has taken price action back above the 12EMA which has also seen the RSI Oscillator rising away from oversold territory. Although the pair remains within the bounds of a falling channel, a short term rally throughout the coming week is likely and, subsequently, our initial bias is cautiously bullish. Support is currently in place for the pair at 111.22, 110.61, and 110.10. Resistance exists on the upside at 112.96, 113.74, and 114.94.

Ultimately, a return to USD/JPY bullishness was always going to occur given the wide economic divide between both nations. However, the U.S. Unemployment Rate result surprised the market and subsequently the pair is likely to enter the new trading week in a relatively strong manner. The most likely scenario is a continued rally back towards the declining 100-day MA around the 112.20 mark in the coming week. However, keep a close watch on volatility around the release of the U.S. CPI figures.