Key Points:

- USD/JPY slides below 100.00 handle as FOMC split becomes apparent.

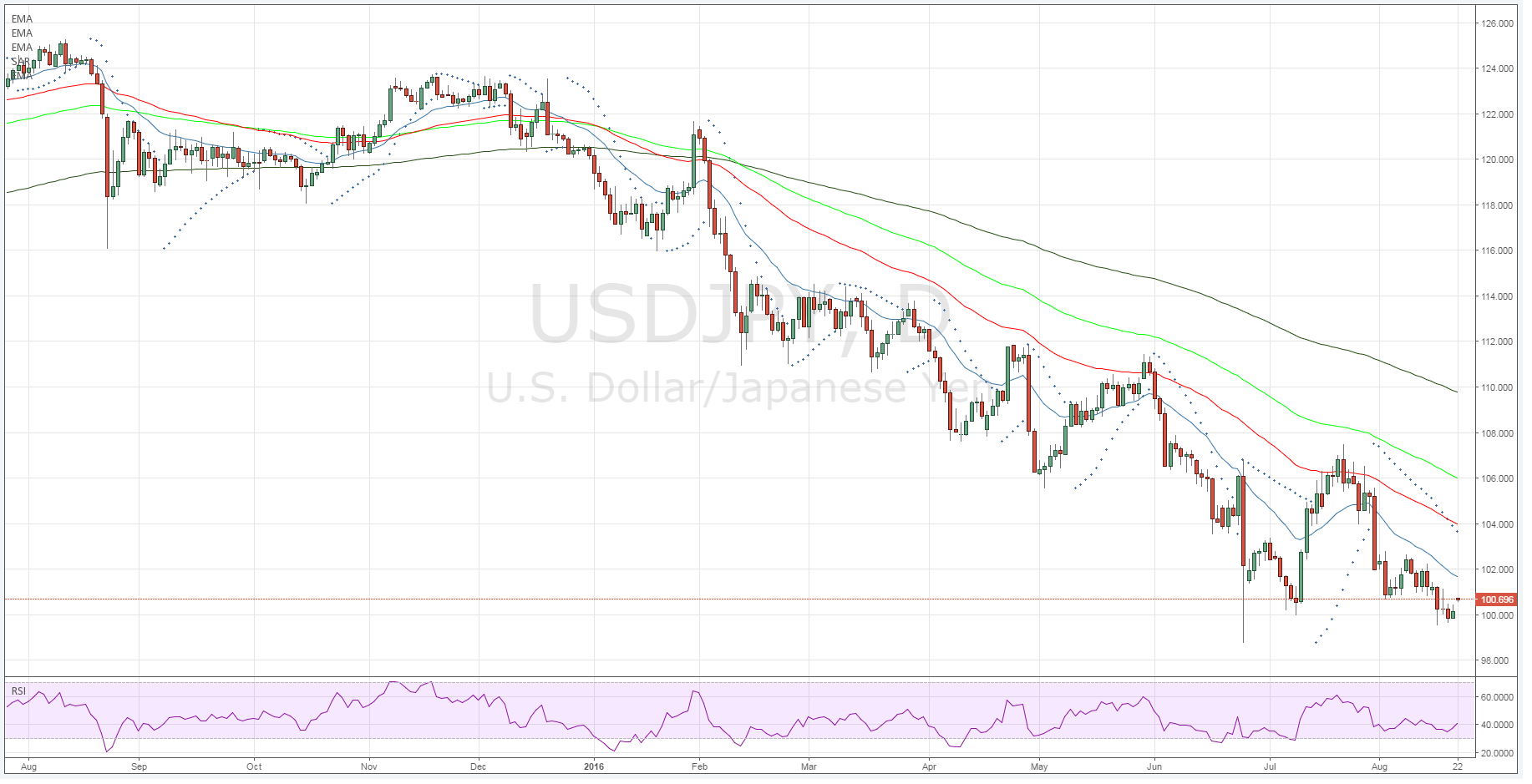

- Persistence of 102.64 resistance point leaves downside move in play.

- Outlook remains cautiously bearish in the week ahead.

Last week was sharply negative for the USD/JPY as a broadly weaker US dollar saw the venerable pair slide below the key 100.00 handle.

Even a poor Japanese Preliminary GDP result of 0.0% q/q was unable to arrest the move as the market focused entirely on the lack of action from the US Federal Reserve.

Subsequently, the pair finished the week right on the key 100.00 handle and could potentially continue to slide in the week ahead.

The chief culprit of the sharp USD depreciation was the Fed’s FOMC minutes which caused a broadly negative sentiment swing and some sharp dollar selling.

The move followed the release of the US Fed’s FOMC minutes which showed a highly split vote and little expectation of a rate hike in the near term from the central bank.

Subsequently, the US dollar depreciated sharply against the yen which took it back below the key 100.00 handle. Even Sunday’s poor JPY GDP result of 0.0% was unable to push the yen back down.

The week ahead has the potential for some sharp volatility for the pair as a bevy of US economic data is due out with all eyes likely to be upon the preliminary GDP result. Given the variability of US data of late, the forecast of 0.6% q/q may not hold.

Subsequently, a weak return could see additional dollar selling and further depress the pair below the 100.00 level. In addition, the Japanese CPI figures are due out on Thursday and should be monitored given their forecast of a contraction of 0.4% y/y.

From a technical perspective, the USD/JPY initially remains cautiously bearish in the week ahead with resistance at 102.64 having held during the latest swing. Subsequently, the downside is looking enticing with a potential break of 98.98 likely to signal further bearish moves.

However, the RSI Oscillator is currently flirting with oversold territory and a period of moderation may therefore be required. Support is currently in place for the pair at 99.54 and 98.98. Resistance exists on the upside at 102.66, 107.47, and 110.16.

Ultimately, the pair is technically predisposed to remain under pressure and continue its move lower in the week ahead. However, the great unknown is the Bank of Japan and at what level they may intervene to depreciate the overvalued yen.

Any such intervention is likely to be swift and potentially ads a level of risk to any further moves below the key 100.00 handle. Subsequently, keep abreast of any developments that could potentially involve the central bank ringing around dealers to obtain prices as a sharp reversal would then be likely.