Recently, John Hussman’s weekly market comment implied a USA recession was likely to be triggered by the Eurozone recession.

……the argument from Wall Street is that despite clear evidence of recession across Europe, and significant slowdown or recession elsewhere in the world, the United States will somehow “decouple” and avoid recession.” ……. The correlation with U.S. GDP – particularly in Euro-zone countries – is generally in the range of 70-90%.

John Hussman’s “coupling” argument aligns with my beliefs – the global economies are coupled. Consider that the 2007 Great Recession was fully synchronized across the global economies – and by synchronized I mean the growth trend lines of the economies pivoted almost at the same time. China and India (among others) did not recess, and merely slowed.

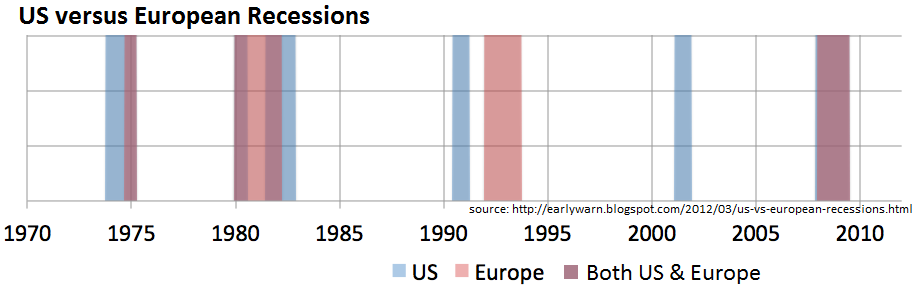

The coupling belief has limitations – all global economies have different dynamics. For example, Europe has not dragged the USA into a recession in recent times. Note that:

- The global oil crisis beginning in the mid 70′s showed Europe out of phase and behind the USA.

- The early 80′s recession was really one big recession which was technically separated in the USA into two recessions.

- Where was Europe’s 2001 recession?

At times both Europe and the USA have faced the same set of economic realities and slid into recessions with Europe’s recession start date coincident or lagging. Other recessions (say the 2001 USA recession) was caused by USA specific reasons, and did not spill over to Europe. In all cases, the amplitude of the recessions varied because each economy is geared differently.

Getting down to the crux of the issue – is a recession coming coming to the USA because of Europe? Europe’s current recession is mainly driven from Europe’s weak, and to date inflexible, monetary union. This particular set of European recession headwinds are not part of the USA economic dynamics.

That does not mean the USA is immune from a European recession. There is a potential contagion into the USA economy via the financial markets. The cause of this European recession is unusual with no clear understanding how it will play out.

Even the Federal Reserve cannot qualify or quantify the euro crisis. In a very detailed Federal Reserve Policy Speech, Federal Reserve Vice Chair Janet Yellen stated:

Strains in global financial markets have resurfaced in recent months, reflecting renewed uncertainty about the resolution of the European situation. Risk premiums on sovereign debt and other securities have risen again in many European countries, while European banks continue to face pressure to shrink their balance sheets. Even without a further intensification of stresses, the slowdown in economic activity in Europe will likely hold back U.S. export growth. Moreover, the perceived risks surrounding the European situation are already having a meaningful effect on financial conditions here in the United States, further weighing on the prospects for U.S. growth.

Global trade is synchronized – a recession in Europe would effect USA exports to all countries, not just Europe. And it is unclear what economic multipliers exports add to the domestic economy. But I would think a 4% decline in the European economies could contract USA exports enough to drag a already struggling USA economy into a recession. A 4% decline in the European economy is not likely based on what we know today.

I would not bet whether a recession is coming or not to the USA. Even without Europe’s problems, the USA is facing its own specific negative economic dynamics which will emanate from a slowdown of public sector fiscal spending (or tax increases).

And the U.S. is also in the same global economy with Asia. Earlier this week we learned that India just had a weaker quarter than any in The Great Recession and then that China started cutting interest rates in an attempt to soften a downturn. If everybody else has contractionary economic patterns at the same time, ask not for whom the bell tolls . . .

Other Economic News this Week:

The Econintersect economic forecast for June 2012 shows continues to show moderate growth – although marginally weaker. There was degradation both in our government pulse point,and in some of our transport related pulse points. There are no recession flags showing in any of the indicators Econintersect follows.

ECRI has called a recession. Their data looks ahead at least 6 months and the bottom line for them is that a recession is a certainty. The size and depth is unknown but the recession start has been revised to hit around mid-year 2012.

The ECRI’s WLI index value has been jumping around due to backward revision – and this week has dropped below zero. The index is indicating the economy six month from today will be slightly worse than it is today.

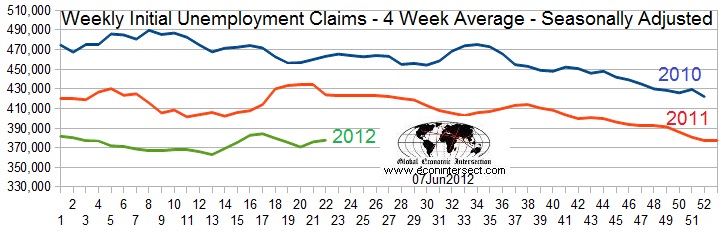

Initial unemployment claims decreased from 383,000 (reported last week) to 377,000 this week. Historically, claims exceeding 400,000 per week usually occur when employment gains are less than the workforce growth, resulting in an increasing unemployment rate (background here and here). The real gauge – the 4 week moving average – rose from 374,500 (reported last week) to 377,750. Because of the noise (week-to-week movements from abnormal events AND the backward revisions to previous weeks releases), the 4-week average remains the reliable gauge.

Data released this week which contained economically intuitive components (forward looking) were rail movements (which is still indicating a moderate expansion if one ignores coal), ISM Services business activities sub-index (which showed higher growth), and the import portion of Trade Balance (which was essentially unchanged). Econintersect does not see any other data release this week as particularly intuitive in understanding future economic conditions.

Weekly Economic Release Scorecard:

Click here to view the scorecard table below with active hyperlinks.

Bankruptcies this Week: Franklin Credit, Delta Petroleum