The U.S. dollar rebounded on Friday while short traders in the EUR/USD and GBP/USD were able to book a good profit with both major currency pairs declining towards crucial support levels. We will have a look at the technical picture further below.

This week, all eyes turn to the Federal Reserve meeting with the Fed’s policy decision and press conference due on Wednesday. The market is unanimous: The Fed will reaffirm that its ultra-loose policy remains appropriate, and that it is too soon to start the taper talk. While this might be the case at the Fed’s press conference on Wednesday, chances are slightly in favor of a modestly stronger U.S. dollar.

Economists predict that policy makers won’t signal scaling back monetary stimulus until the Jackson Hole Economic Symposium in late August, but the quarterly rate-forecast “dot-plot” could show at least one rate increase in 2023. By way of reminder, the Fed’s forecast in March showed no liftoff until 2024. Such change would be slightly more hawkish.

In a nutshell, it will be hard for the Fed to be more dovish than the market currently expects. But if there is a hawkish surprise, the greenback will soar with market participants rushing pricing in the shift.

Is the shift in monetary policy starting? To be sure, the shift is still conditional.

Fed policy makers continue to insist that higher inflation is unlikely to persist as it reflects bottlenecks as the economy rebounds from the pandemic. As for the labor market, recent weaker-than-expected job data strengthen the Fed’s wait-and-see approach.

Economists are therefore split on when the tapering announcement is most likely. One-third predict August, another third September and the last third December.

EUR/USD

The euro posted an almost linear decline until the 1.21-support last Friday. If we now see a break below 1.2080, the focus shifts to the lower support at 1.20. For the euro to resume its primary uptrend, it would need a sustained break above 1.2250.

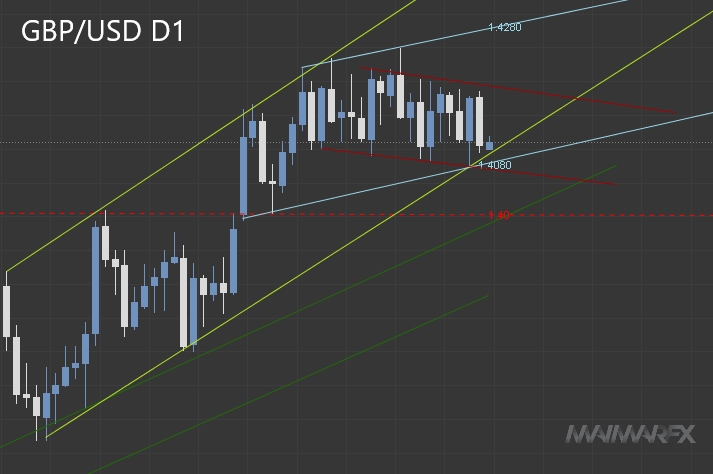

GBP/USD

We see a mesh of support and resistance lines in the cable’s chart. Given the recent downward movement we see a next support zone between 1.4080 and 1.4060. Below 1.4070 we could see the pair drifting towards the crucial 1.40-support. On the topside, the 1.42-resistance needs to be broken before shifting the focus towards a higher target at 1.4280.

Trading could be muted at the beginning of this week with a number of holidays including Australia and China. Have a good start to the new week everyone.

Disclaimer: All trading ideas and expressions of opinion made in the articles are the personal opinion and assumption of MaiMarFX traders. They are not meant to be a solicitation or recommendation to buy or sell a specific financial instrument.