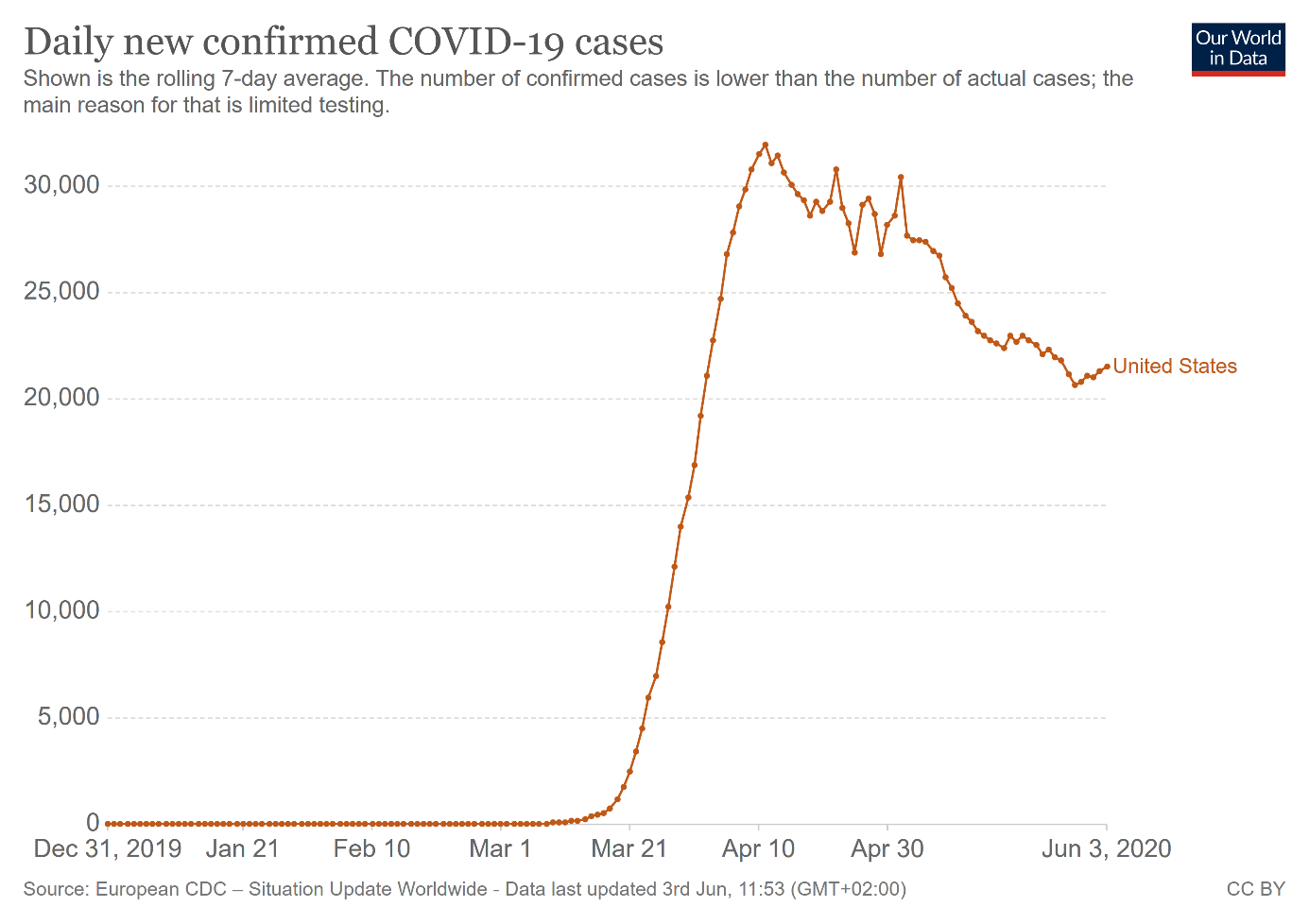

The initial health crisis seems to be under control in many countries, including the US. The situation is stabilizing and the governments are easing quarantine restrictions. And, importantly, the number of daily confirmed deaths in the US peaked in April and has been declining since then, as the chart below shows.

Chart 1: The number of daily confirmed cases in the United States (as a rolling 7-day average) from December 2019 to June 2020.

However, this is not the end of the epidemic. Many epidemiologists are warning about a second wave of infections, especially if people stop distancing socially too quickly. For example, Dr. Zhong Nashan, a leading Chinese epidemiologist, has recently said that a lack of immunity among Chinese residents could be a cause for concern in spurring another wave of infections. Are these warnings sensible and what do they imply for the gold market?

Nobody knows for sure. On one hand, as people put themselves into quarantine long before the governments mandated them to do, they are likely to socially distance even after the "Great Unlocking". Thus, the feared second wave may never arrive. Instead, we will have one prolonged wave with a lower, but steady rate of new infections.

On the other hand, for the pandemic to disappear, we need herd immunity, so more than half of the population (at least half, as we might need up to 70 percent) would have to be immune, either from a prior infection of from a vaccine. And we have bad news here. The vaccine will not arrive in the very near future, and we are still a long way from developing the herd immunity. According to the recent Spanish study, only five per cent of Spain's population has been infected, so far. In the US, even in the hardest-hit communities like New York, only 14 percent of residents have been infected at some point by coronavirus. These results are really frightening, as they show that the disastrous outcomes in Spain or New York are not even close to the worst-case scenarios.

It means that either societies will distance socially until the vaccine arrives, which could be difficult due to the economical and psychological constraints, or a second wave is inevitable.

History also suggests that the second wave is possible. After all, historians have counted eighteen waves of bubonic plague, although over more than two hundred years, stretching from 541 to 750. More recently, in the early 20th century, Spanish flu hit in three waves (in some areas even in four waves), partially because authorities eased restrictions too early. And the second wave of the 1918 pandemic was much more deadly than the first.

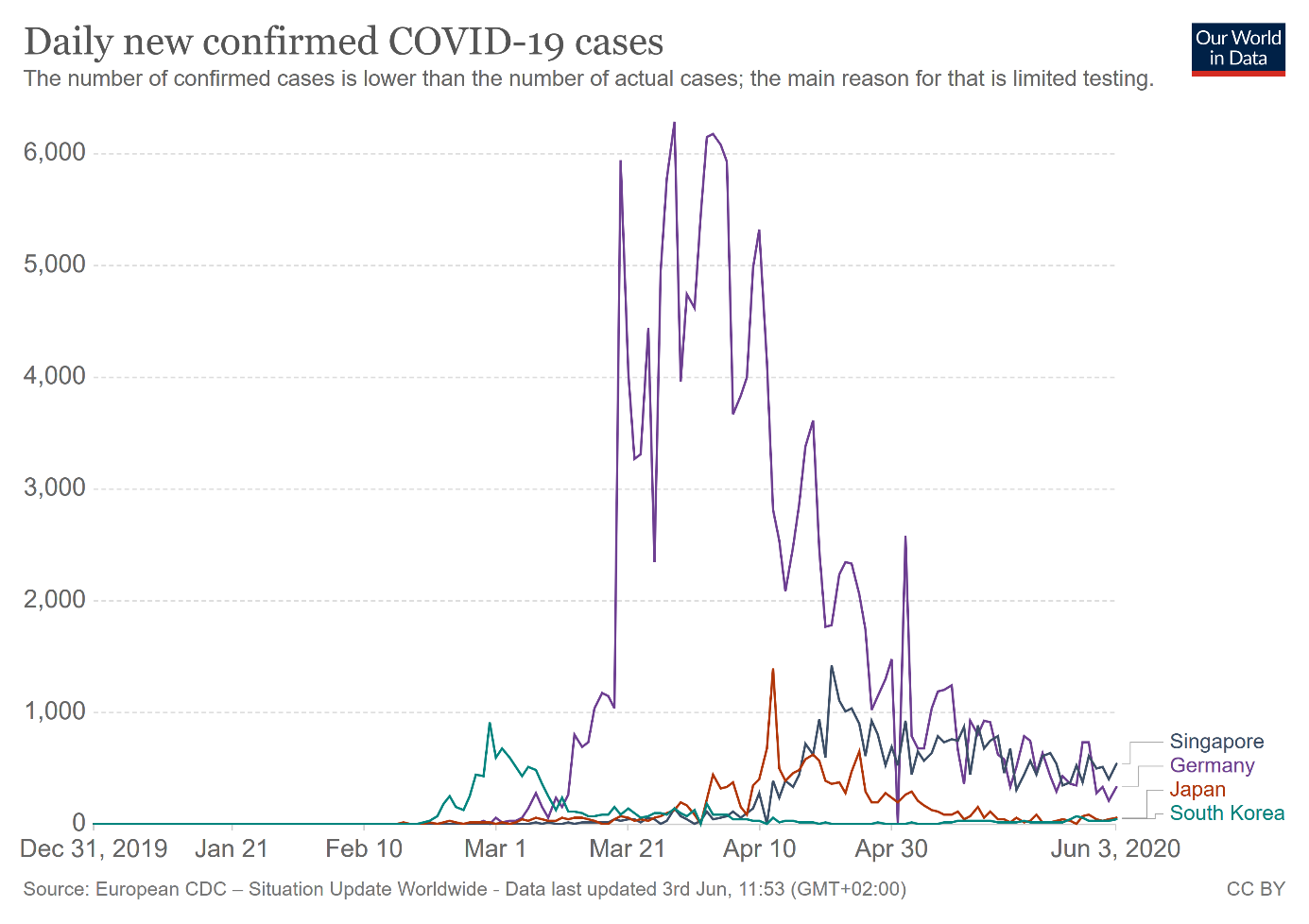

And, when it comes to the coronavirus, all countries that seemingly contained the virus - Germany, Japan, Singapore, and South Korea - were hit by the second wave, although this was relatively modest, as the chart below shows. But these countries were adequately prepared to combat COVID-19 from the very beginning.

Chart 2: Daily confirmed Covid-19 cases in Germany (purple line), Japan (blue line), Singapore (grey line) and South Korea (red line).

What About Gold?

Assuming a second wave had a similar impact to the first, the price of gold should go up, but not without plunging first. Given that the price has appreciated by around 8 percent since the stock market crash on February 20, gold could ultimately (after a potential decline) reach almost $1,900, assuming another 8-percent upward move.

However, the second wave might not have the same effects as the first. As people have become accustomed to the epidemic, its impact may be weaker. A second wave might also be partially already priced into gold. And just as the simple SIR models of the epidemic turned out to be too gloomy, a second wave might be less deadly than many epidemiologists fear. Such a scenario would be less favorable for gold and we could see some correction then, although the fundamental outlook should remain bullish.

On the other hand, given the level of complacency in the US stock market and a widely held hope for a V-shaped economic recovery, a second wave of infections might be like a bucket of cold water for investors. Such a scenario would be more positive for the gold market, although, initially, the price of gold might drop together with stocks.

Which scenario is more probable? I wish I knew! But generally people react the most to new, unknown threats, so they should react less vividly in the future to coronavirus-related risks, especially given that governments should be better prepared. Remember quantitative easing? The first round was very supportive for gold, while the later ones proved to be less effective. Similarly, the subsequent rounds of infections could have a diminishing impact on financial markets. However, some people are already fed up with the epidemic and hope for a return to normality. A second wave would dash these hopes, especially if it is worse than the first, as was the case with Spanish flu.

Anyway, one thing is certain, life is not likely to be completely "normal" for a significant period of time, perhaps until a vaccine is widely available. And gold prefers such abnormal, exceptional times more than boring business-as-usual.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.