Trump Set to Deliver Tax Reform Before Christmas

US equity markets are poised to open a little higher on Friday, as we await the passage of tax reform through the House of Representatives giving Donald Trump his first major legislative victory since coming to office.

While it’s debatable who the real beneficiaries of the bill will be, stock markets have clearly benefited in anticipation of it, with major corporations being among the big winners of the bill. With equity markets having risen more than 25% since Trump’s election victory, at least in part due to his tax reform plans, it’s likely that this is almost entirely priced in at this point so it will be interesting to see whether the rally can now be maintained until the end of the year, or whether the Santa rally will instead grind to a premature halt as investors lock in some profits.

It may be a while until we find out for certain who stands to really benefit from tax reform but it’s interesting to see that the moves in the US dollar don’t really reflect what we’ve seen in equities. I wonder whether this is a reflection of the perceived economic benefit of the bill and the impact, or lack of, it will have on inflation. If investors truly thought that there’ll be a strong economic benefit – which has been strongly debated – I would expect the dollar to be reflecting this more.

Sterling Higher as IMF Lowers UK Growth Forecasts

The pound continues to trade a little higher on the day this morning, despite the fact that the IMF downgraded the country’s growth forecast for this year and predicted slower growth again next. The downward revision comes as little surprise to anyone that’s seen the data this year and the ongoing impact that a combination of slow wage growth and high inflation will have on the consumer.

It’s no surprise that the IMF cited Brexit as being behind the UK’s disappointing growth, claiming the data has justified its “gloomy” forecasts prior to the vote, with the body having been among those lambasted for their dire predictions. While forecasts of recessions now appear to have been over the top, it seems clear that over the next couple of years, low levels of growth are to be expected until more clarity on the future relationship is known and the inflationary impact of the pound’s depreciation passes.

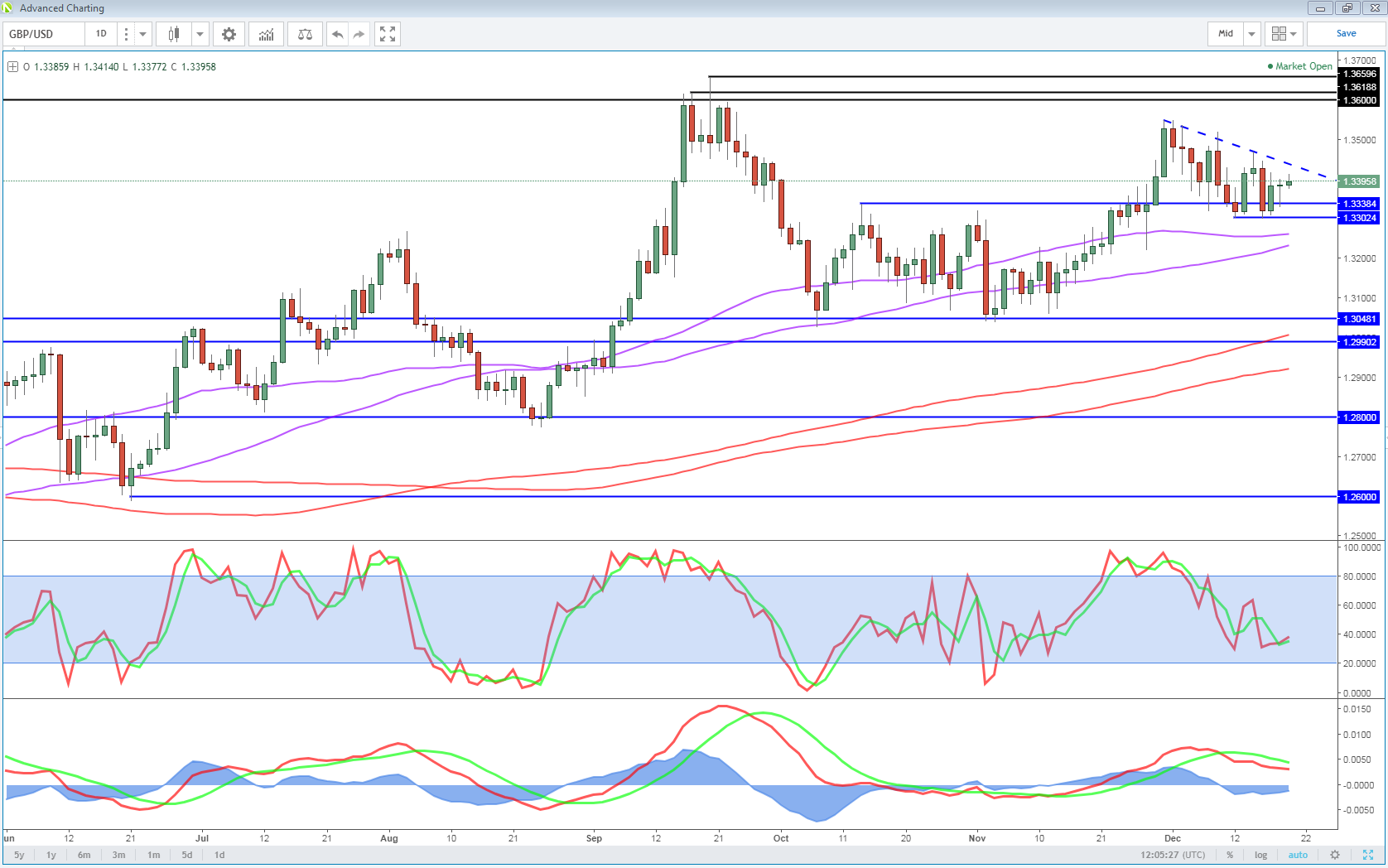

GBP/USD Daily

Bitcoin Dips Bought Again as Traders Eye $20,000

Bitcoin has rebounded from its earlier losses, with the crypto crowd seemingly undeterred by the 20% drop seen over the last few days. Once again traders are jumping at the opportunity to buy dips and Bitcoin on both the CME and CBOE is now trading in the green on the day, having been 5-10% lower earlier in the session. Traders clearly have their eye on $20,000, having stumbled at this level at the first time of asking and coming only a few weeks after $10,000 was surpassed for the first time.