I have been suggesting for several years that the US Dollar would confound those anticipating its demise by starting a long secular uptrend.

In early September I made the case for a rising U.S. dollar, based on the basic supply and demand for dollars stemming from four dynamics:

- Demand for dollars as reserves

- Other nations devaluing their own currencies to increase exports

- “Flight to safety” from periphery currencies to the reserve currencies

- Reduced issuance of dollars due to declining U.S. fiscal deficits and the end of QE (quantitative easing)

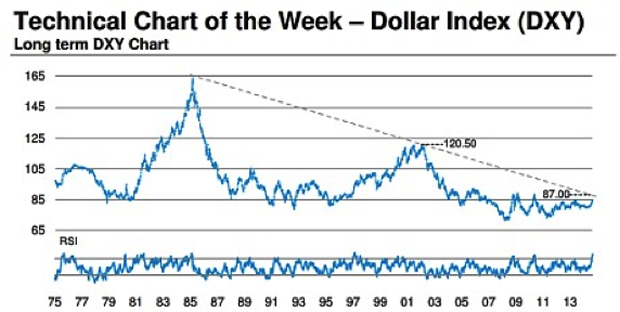

Since then the dollar has continued its advance, and is now breaking out of a downtrend stretching back to 2005—and by some accounts, to 1985:

Technically, the Dollar Index has broken out of a multi-year wedge:

So what does this mean for the global economy?

Since currencies are intertwined with virtually every aspect of the global economy—trade, credit, inflation/deflation, commodities and capital flows, even political and soft power—there is no one consequence, but a multitude of interactive consequences.

For U.S. households, the rising dollar will have gradual, generally marginal effects: our dollars will buy more euros and yen when we visit Europe and Japan as tourists, imports from countries with weakening currencies will be slightly cheaper (if the importers don’t palm the difference as extra profit) and we may be competing with more foreigners for dollar-based assets such as American homes, oil wells and Treasury bonds.

In sum, a rising dollar will only affect households on the margins. Since roughly 85% of the U.S. economy is domestic, imports and exports have relatively limited influence on the entire economy.

In other words, the direct consequences of a stronger dollar on U.S. households are generally positive, with the exception of those working in price-sensitive export industries, where the rising dollar will make goods sold in countries with weakening currencies more costly.

But the secondary effects could end up being far more consequential for Americans and everyone else on the planet, for this reason: the centrality of the dollar in the global economy means that the effects of a stronger dollar can create potentially destabilizing dynamics.

Simply put, the dollar's rise could destabilize the entire global financial system. To understand why this is so, we have to start with the source of the risk: the world's central banks.

Central Banks Are Responsible for the Heightened Risk

One primary reason for this expansion of risk is the unprecedented actions of the world’s central banks since the 2008 Global Financial Meltdown. In effect, the central banks doubled down on debt and leverage as the politically expedient “solution” to the implosion of credit and leverage (what we call de-leveraging) as the collateral underlying highly leveraged loans (think subprime mortgages on overpriced McMansions) evaporated like mist in Death Valley.

Any solution that forced the write-down or write-off of the mountain of bad debt would have collapsed the over-leveraged banks which had become linchpins in the global financial system.

So the only way to maintain the status quo and avoid handing massive losses of wealth to financial elites was to issue trillions of dollars in new credit-money, lower interest rates to near zero and start buying assets from private-sector owners, turning their assets into cash that could then be used to invest overseas or in domestic stocks and bonds.

Each major central bank injected unprecedented sums of new money into their economies to ease the refinancing of debt at lower interest rates and enable expansion of credit for new loans.

If each economy (or in the case of the European Union, currency region) was moated by strict capital-control regulations, this massive goosing of credit might have been contained within each economy.

But in today’s world of digital finance, capital, credit, risk and interest rates all flow wherever the risk is perceived to be controllable and the return is greatest.

Let’s pause for a moment to recall that risk in 2008 was perceived to be controllable right up until the day that Lehman Brothers declared bankruptcy and the global financial system erupted in a fireball of panic and liquidation.

Why was risk considered controllable right up to the implosion? Derivatives and hedges were widely assumed to be solid protection against any spot of bother in global credit markets. But this confidence was misplaced, as it ultimately relied on multiple counterparties retaining their solvency.

If a position was hedged by a derivative that was to be paid by a counterparty if things went south, and the counterparty blew up before the hedge could be paid off, there was no hedge.

It turned out that liquidity—a market of buyers and sellers that allows any security to be sold more or less whenever the seller decides to sell—dried up, and markets for risky securities went bidless, i.e. there were no buyers at any price.

If there are no buyers, the value of the security drops to zero, and everybody down the line who counted on that security fetching the anticipated price so their hedge could be paid off also implodes.

Central banks countered this implosion by buying bonds and mortgages and lowering interest rates so old debt could be refinanced at much lower costs.

But in doing so, they created a vast market for global carry trades—the borrowing and buying of assets in various currencies to take advantage of yield and interest-rate differences. In the old pre-digital days, it was difficult to arbitrage these variations in national currencies and interest rates. But in today’s world, it’s easy for financiers and financial institutions to borrow money in dollars or yen at low interest rates and re-invest the money in higher-yield securities issued in other countries.

The Problem with Carry Trades and Cross-National Debt

The central bank’s massive issuance of new money put trillions of dollars in the carry trade, and this vast expansion of global currency/interest-rate arbitrage has put currency values front and center.

The carry trade simply means cheap-to-borrow money in the US and Japan flows to emerging markets where rates are higher. If you can borrow $1 billion at a 0.25% rate in the U.S. or Japan and then buy emerging-market bonds that pay much higher yields, why not? The profit is free money.

The sums of money being gambled in carry trades are enormous. It is estimated that $7 trillion of emerging market debt is denominated in another currency. According to the Telegraph newspaper (U.K.), roughly two thirds of the $11 trillion in cross-national loans are denominated in U.S. dollars.

$11 trillion may not seem like much when compared to America’s $16 trillion gross domestic product (GDP), but the emerging markets which have been the happy recipients of this vast river of capital have much smaller economies and credit markets.

They also have fewer options to refinance debt, as they lack heavyweight central banks like the Bank of Japan, the European Central Bank and the Federal Reserve.

As a result, these capital flows are extremely consequential and thus potentially disruptive.

Here’s the risk in carry trades: if the currency you borrowed the money in strengthens and the currency you’re receiving the interest payments in weakens, the deal sours. The rise and fall in currencies can erase the profits of the carry trade.

If the currencies weaken/strengthen beyond break-even, a once-profitable trade turns into a losing trade.

And how do you extricate yourself from the carry trade? You sell the emerging-market assets and repatriate the money back into the currency you borrowed the money in: for example, the U.S. dollar.

This has immediate supply-demand effects on currencies. The emerging-market currency that’s being sold drops in value while the currency that’s in demand (U.S. dollars) strengthens.

We might imagine that the Federal Reserve ending its vast money-issuance program of quantitative easing would lessen the global risk posed by the carry trade, as it reduces the flood of dollars seeking higher-yield homes outside the U.S.

But this tightening has actually increased the risk of carry trades blowing up and bringing down emerging-market economies, for it reduces the flow of fresh capital into emerging markets. As the supply of dollars dries up, demand for dollars rises as carry trades are unwound. Emerging-market currencies then weaken significantly, causing profitable carry trades to reverse into losing trades, which then causes those holding debt in dollars and assets in other currencies to dump the assets and pay off the dollar-denominated debts before the trade goes even more against them.

There is a positive feedback in play: the more the dollar rises, the greater the losses in carry trades denominated in the dollar, and the greater the incentive for those still in the trade to sell emerging market assets and currencies.

In response to these massive outflows of capital, emerging nations must raise interest rates quickly to offer incentives for capital to stay put, which then causes the cost of new loans (and doing business in general) to quickly rise to painful levels.

As the currencies suffering outflows decline against the dollar, imports become more expensive and exports lose value when traded for dollars. It’s a triple-whammy for emerging nations: their borrowing costs are soaring, the capital leaving to pay off dollar-denominate debt leaves them starved for investment capital, and their imports rise in cost as their exports earn less.

So here is the net result of central banks pursuing quantitative easing and zero-interest rates: a massive increase in global risks resulting from the carry trades the money expansion and cheap rates fueled.

The central banks’ “solution” has blown another global bubble of risk that now threatens to destabilize not just the carry trades but the economies and credit systems that have become intertwined with the carry trade.

In effect, the failure to address the structural problems revealed in the Global Financial Meltdown of 2008-2009 have been transferred to the larger foreign-exchange (FX) market, which is connected to virtually everything in the global economy.

In Part 2: Why The Strengthening Dollar Is A Sign Of The Next Global Crisis, we examine these risks to the global economy. Not only is a rising dollar a sign of weakness elsewhere in the world, but the higher it rises, the more destabilizing global currency imbalances become. If it rises too high, it then becomes a cause of further destabilization -- one that could trigger the next global crisis.

This essay was first published on peakprosperity.com, where I am a contributing writer.