Key Points:

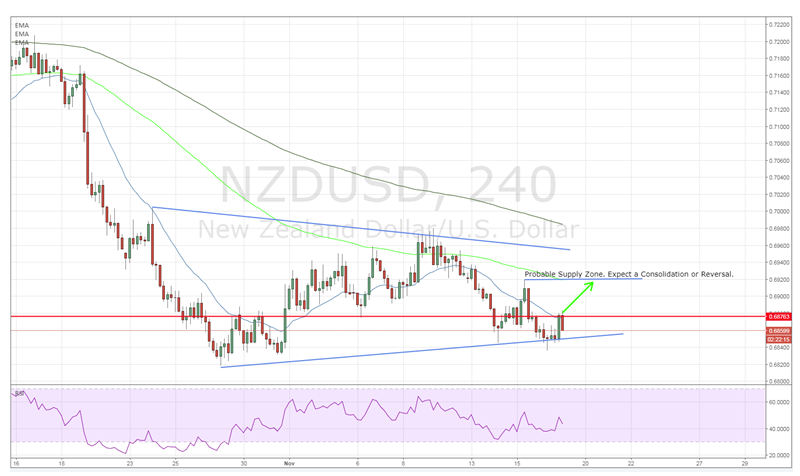

- Price action forming a wedge pattern.

- RSI Oscillator continuing to rise within neutral territory.

- Watch for a move towards the supply zone within the coming week.

The New Zealand dollar has been under siege of late as a range of political upsets have seen the pair facing a steady wave of depreciation. Subsequently, price action has tumbled from around the 70 cent handle, in late October, all the way to its present level at 0.6861. However, the question remains if the pair will continue to decline over the next few weeks as the New Zealand Labour Party continues to showcase their new social and economic policies.

Thankfully, the answer to the above question lays in the technical aspects of the pair’s chart with price action having formed some interesting patterns over the last few days. In fact, looking at the 4-hour timeframe shows a relatively clear low as having been formed on the 27th. Subsequently, the NZD/USD has been slowly creeping its way higher over this period and the lows are now starting to get higher.

Additionally, there is a relatively clear descending wedge formation on the 4-hour timeframe which would seem to suggest that we might have recently seen the full extent of the bearish push. In fact, the RSI Oscillator largely backs this view with the indicator steadily moving higher, within neutral territory, suggestive of further upside action to come.

Subsequently, the most likely scenario for the coming week is for price action to decline back towards the bottom of the wedge pattern, before commencing a sharp move towards the supply zone around the 0.6870 mark. At this level, a consolidation or reversal is equally likely and all will be off. However, any challenge to this level could see a solid bid form which would take the pair towards the top of the wedge.

Ultimately, the full extent of the shock of a labour party win appears to have run its course and the NZD’s valuation is expected to stabilise itself over the next few days. Subsequently, don’t expect too much negativity, at least in the short term, from the “left wing labour” factor.