Jerome Powell brought reality to the market. Powell told the Senate Banking Committee in prepared remarks,

"The latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated,"

"If the totality of the data were to indicate that faster tightening is warranted, we would be prepared to increase the pace of rate hikes."

Powell noted that economic data from January on inflation, job growth, consumer spending, and manufacturing production have partly reversed course from the slowdown seen back in December.

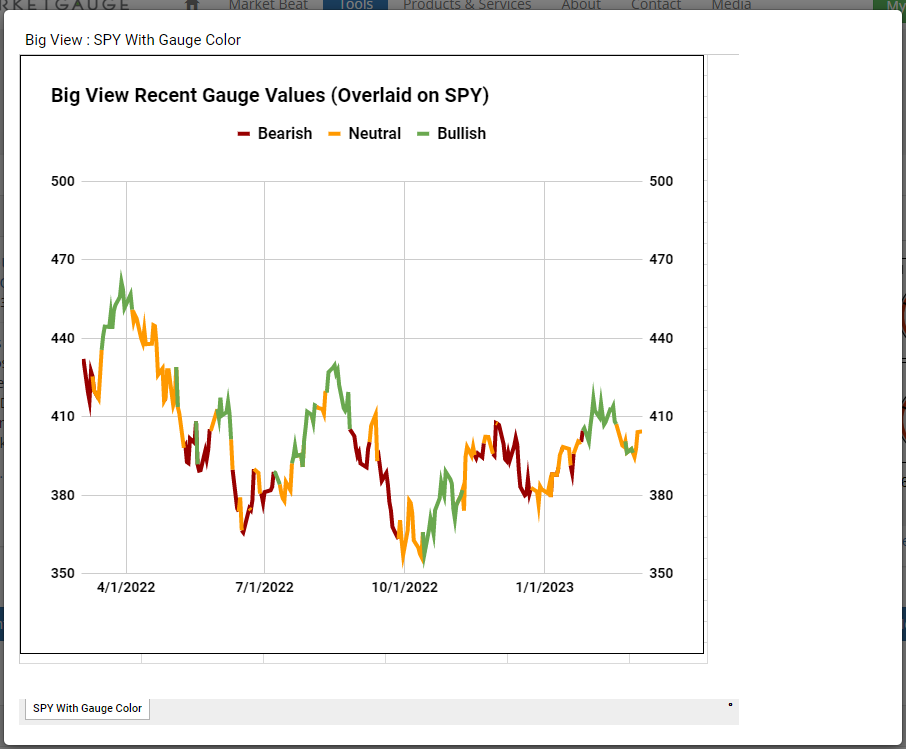

Interestingly, coming into today, the Sentiment Gauge flashed neutral.

Monday’s daily stated,

“Looking at Granny Retail, that business cycle not only leaves investors with the trading range resistance, it also shows how the Retail sector could be a harbinger of worse times this spring.”

We went on to say,

“Granny Retail and Prodigal Regional Banks are my key go-to’s for this week.”

So, will neutral sentiment go to bearish? And if so, what is next?

Powell says he has no intention of raising the inflation target from 2%-but that could change-especially since CPI is still above 6%, and that number comes out next week.

With an inverted yield curve, a potential bottom in the long bonds, a stronger dollar, a persistent trading range, and-certain commodities still strong regardless (sugar, grains, crude oil, steel), the environment keeps screaming stagflation.

The long bonds (iShares 20+ Year Treasury Bond ETF (NASDAQ:TLT)) chart has a constructive exhaustion gap bottom in play. Since then, we have seen consolidation between 101-102.50. TLT is now outperforming SPY (Leadership).

And, the Real Motion indicator shows a positive divergence as momentum is just under the 50-DMA while the price is considerably below its 50-DMA. Why would long bonds bottom?

The long bond is just one part of the yield curve. It could mean that while the short-term yields inverted, the market is expecting a recession, hence a flight to safety in long bonds.

We imagine that should 20+ year bonds continue to go north, that too can be inflationary. TLTs have to get above the 50-DMA to get interesting. Stagflation is the worst thing for the FED.

Pause inflation goes higher. Don’t pause-certain inflation beyond Fed’s control goes higher given geopolitical and natural disaster potentials. Raise rates higher and kill the economy.

ETF Summary

- S&P 500 (NYSE:SPY): 390 support with 405 pivotal 410 resistance

- iShares Russell 2000 ETF (NYSE:IWM): 190 failed so Grandpa hurts-185 support

- Dow Jones Industrial Average ETF Trust (NYSE:DIA): 326 support 335 resistance

- Invesco QQQ Trust (NASDAQ:QQQ): 284 big support 300 pivotal 305 resistance

- S&P Regional Banking ETF (NYSE:KRE): 57 big support 60 resistance

- VanEck Semiconductor ETF (NASDAQ:SMH): 240 pivotal 248 key resistance

- iShares Transportation Average ETF (NYSE:IYT): 240 resistance and 230 support

- iShares Biotechnology ETF (NASDAQ:IBB): 125-135 trading range

- S&P Retail ETF (NYSE:XRT): 66 pivotal with 64 key support