Our Market Risk Indicator signaled last Friday in the last hour of trading which caused us to add an aggressive hedge to the hedged portfolio. I have to say that I was surprised to see an acceleration of the selling without some consolidation near the 200 day moving average for the S&P 500 Index (SPX) first. The reason for my surprise is that the market had already fallen sharply before the signal came and that condition often causes whip saws in the indicator.

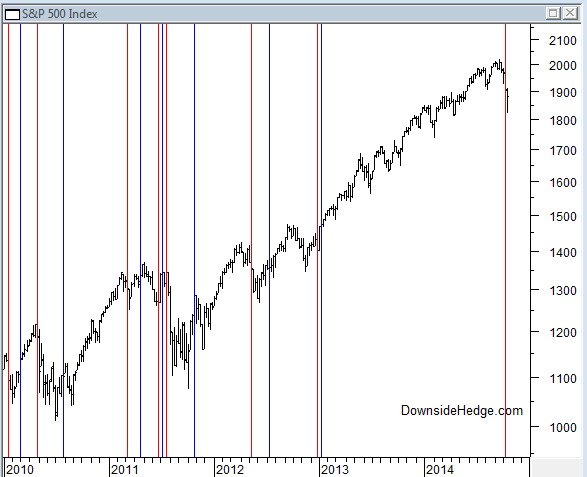

The market has since recovered much of the decline from earlier in the week. So what do we do next? If the market continues to rally I suspect that our risk indicator will clear its warning within a week or so (similar to the whip saws in March and June of 2011 on the chart below.

Note: red lines are risk signals, blue lines are cleared warnings). If this happens then we’ll change our hedge back to a simple short of the S&P 500 index (using SH or an equivalent).

On the other hand if the selling accelerates again we’ll be looking for good points to take some profit on the aggressive hedge and also soften the hedge. We’re using mid term volatility (like S&P 500 VIX Mid-Term Futures ETN (NYSE:VXZ), ProShares VIX Mid-Term Futures (NYSE:VIXM), or S&P 500 Dynamic VIX ETN (NYSE:XVZ)) for the aggressive hedge. As the market accelerates downward volatility rises, but it doesn’t stay high for long. As a result, we’ll want to take profit. As a general rule, I look for a 15% profit in the hedge and/or a 15% decline in the longs in the portfolio as a good time to soften the hedge. If that occurs I’ll sell a third of the aggressive hedge and replace it with an SPX short (like SH). In addition, I’ll re-balance the portfolio by buying longs with any profit the hedge generates. The net effect would be a portfolio that is 50% long, 33% aggressively hedged, and 17% short SPX. I’ll make an official post on the site if this happens. I want you to be aware that it could happen in the middle of a week (I don’t wait for a Friday close to take profit and re-balance). As always, watch your own portfolio and make decisions based on your comfort level.

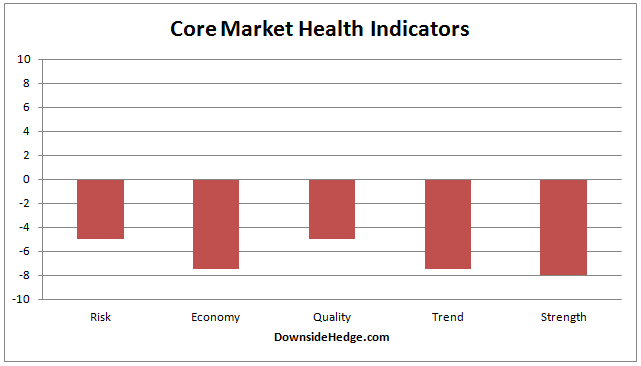

Our core health indicators all declined this week and are still below zero.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI