Key Points:

- Despite a rough week, the NZD may not be moving into a downtrend just yet

- Fears over falling dairy prices may be somewhat overblown

- The technical bias suggests that support should remain intact

The kiwi dollar declined rather sharply as last week opened and then remained rather depressed in the following sessions. As a result, questions over what is next for the pair are now circling as some fear that the NZD could be moving into a medium to long-term downtrend. However, if we take a closer look at what was fundamentally behind last week’s tumble and also the broader technical bias, the bulls may have some reason to remain optimistic.

The kiwi dollar was slammed straight out of the gate last week, coming under heavy selling pressure as the greenback roared higher. Of course, most of the blame for this move can be laid at the feet of the ISM Manufacturing PMI which saw an uptick from its prior print of 54.9 to 57.8. However, the rest of the week’s performance largely reflected deeper concerns over the pair’s recent rally given that we saw yet another slip in the GDT Price Index, this time, of around -0.4%. This broader pessimism prevented the NZD from making much use of the sudden shift in sentiment away from the USD on Thursday following a dismal ADP NFP result of 158K (185k exp).

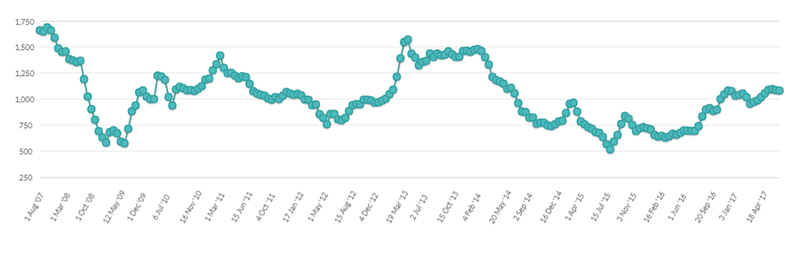

One thing worth pointing out here is the fact that this general pessimism may be somewhat of an overreaction. Whilst it is true we have now has two consecutive (albeit slight) contractions in the GDT Index, it pays to remember that dairy prices are still at the highest that they have been in over two years. As a result, fears that falling dairy prices are going to be sending the NZD into retreat in the medium-term are a little overblown and may subside moving forward. What’s more a quick look at the technical bias reveals that the pair may have more support than it at first appears.

Specifically, although the kiwi dollar is fairly neutral technically, it at least looks as though support could limit any further losses. This is primarily due to the presence of the old declining trendline which is now likely to be a source of support for the pair. This support could prevent the NZD from sinking too much lower and thereby avoid an inversion of the Parabolic SAR to bearish. Additionally, the EMA bias remains highly bullish and we have trended out of overbought territory which leaves the upside open to exploitation should impending economic news proves to be supportive.

Overall, even if the NZD/USD isn’t looking particularly bullish this week, at least its support seems to be relatively intact. Additionally, as the initial shock factor of the GDT data wears off, the kiwi dollar should regain its footing and remain buoyant – even if it doesn’t stage a recovery just yet.