They should and soon, but it’s unclear as to whether or not this will actually happen in looking at a variety of intraday and daily equity charts.

In looking at the 1-minute chart of the S&P above and the only time measure showing yesterday’s gap and one reason to think it may not close any time too soon, it is clear that yesterday morning’s opening gap was an aggressive confirmation of the index’s daily Bear Pennant marked in above that confirms safely at 1357 for a target of 1292 and similar to the large gap earlier this month, it just “looks” like this one may try to close but fail to meet its 1380 destination.

When the daily chart of the VIX is brought into the picture, it supports the S&P’s attempt to close that gap, but provides no proof that a full closing will happen.

Rather it seems likely that its downside gap closes at 18.05 and something that means the S&P rises but perhaps not to that 1380 level as its somewhat confirmed Bear Pennant tries to pull it down even though it may take another few days for safe confirmation and an S&P aspect supported by a large Inverse Head and Shoulders pattern in the VIX and a pattern that confirms roughly at 21 for a target of nearly 26.

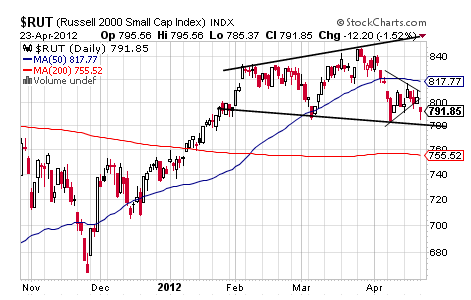

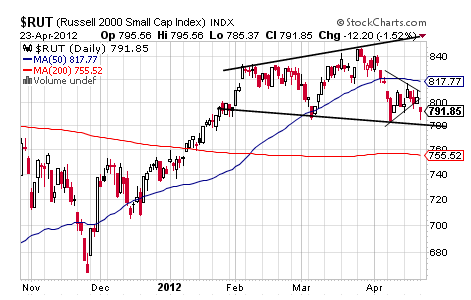

Plus in looking at the daily chart of the Russell 2000, yesterday’s downside gap does not appear as formidable as the one in the XLB, but it somehow looks set to go the way of the one from earlier this month and that is to say unclosed as this small cap index may just move lower to confirm its Bear Pennant safely at 784 for a target of 727.

All of this is somewhat subjective and reflects what these charts look like to me while objectively all of these gaps and others “should” close and something that would cause equities to bounce at least briefly.

It is not the bounce part that looks unlikely to me, but the degree of that bounce and it just seems as though an Apple (AAPL) falling from its tree potentially on Tuesday/Wednesday with a lack of clear timing on a potential QE3 later that day may be a part of why the gaps will not close.

In looking at the 1-minute chart of the S&P above and the only time measure showing yesterday’s gap and one reason to think it may not close any time too soon, it is clear that yesterday morning’s opening gap was an aggressive confirmation of the index’s daily Bear Pennant marked in above that confirms safely at 1357 for a target of 1292 and similar to the large gap earlier this month, it just “looks” like this one may try to close but fail to meet its 1380 destination.

When the daily chart of the VIX is brought into the picture, it supports the S&P’s attempt to close that gap, but provides no proof that a full closing will happen.

Rather it seems likely that its downside gap closes at 18.05 and something that means the S&P rises but perhaps not to that 1380 level as its somewhat confirmed Bear Pennant tries to pull it down even though it may take another few days for safe confirmation and an S&P aspect supported by a large Inverse Head and Shoulders pattern in the VIX and a pattern that confirms roughly at 21 for a target of nearly 26.

Plus in looking at the daily chart of the Russell 2000, yesterday’s downside gap does not appear as formidable as the one in the XLB, but it somehow looks set to go the way of the one from earlier this month and that is to say unclosed as this small cap index may just move lower to confirm its Bear Pennant safely at 784 for a target of 727.

All of this is somewhat subjective and reflects what these charts look like to me while objectively all of these gaps and others “should” close and something that would cause equities to bounce at least briefly.

It is not the bounce part that looks unlikely to me, but the degree of that bounce and it just seems as though an Apple (AAPL) falling from its tree potentially on Tuesday/Wednesday with a lack of clear timing on a potential QE3 later that day may be a part of why the gaps will not close.