Investors this week will be keenly watching how or if the Federal Reserve and the bond market cooperate with Donald Trump’s order for lower interest rates. Although the central bank is unlikely to make decisions based on directives from the White House, the Trump 2.0 policy agenda will surely be a factor, one way or another.

On Thursday last week, the president declared that he would “demand” a cut in interest rates. Even if the president isn’t calling the shots directly, his influence will still course through markets and affect decisions on monetary policy, albeit not necessarily in a way that Trump prefers.

“I’m going to ask Saudi Arabia and OPEC to bring down the cost of oil,” Trump said on Thursday at a virtual address to the World Economic Forum in Davos, Switzerland. “With oil prices going down, I’ll demand that interest rates drop immediately.”

Using Fed funds futures as a guide suggests that the central bank will leave its target rate unchanged at a 4.25%-to-4.50% range at Wednesday’s policy announcement (Jan. 29). The March 19 FOMC is a more promising possibility for a rate cut, but futures are currently estimating only a 58% probability that the central bank will keep rates steady, which at this point is close enough to a coin flip to reserve judgment about what’s probable.

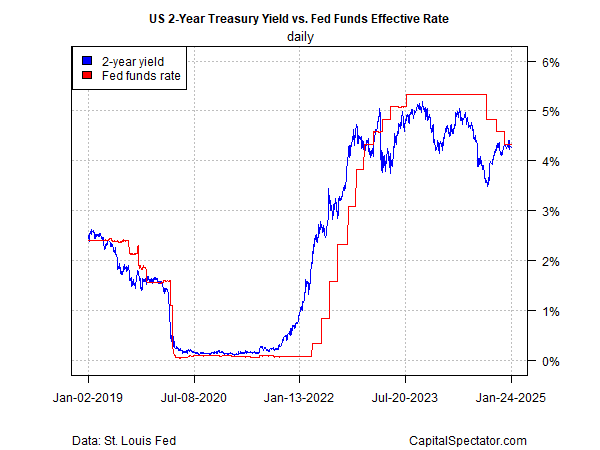

The Treasury market has recently been pricing in a relatively neutral outlook for Fed rate changes, based on the spread for the 2-year yield less the effective Fed funds rate (EFF). The current spread is close to zero, with the 2-year rate (4.27%) fractionally below EFF on Friday (Jan. 24). That compares with a long stretch of an implied forecast for rate cuts when the 2-year yield traded well below EFF.

Some analysts are looking for a rate cut in March and June, but Trump's policies are the complicating factor. After the president’s first week in office, there’s still a high degree of uncertainty about the details of Trump’s plans for raising tariffs, tax cuts, and immigration – variables that will influence economic activity and inflation, which in turn will play a role in Fed decisions.

A deepening federal government deficit is another factor. Add in the growing evidence that inflation has turned “sticky” and the Federal Reserve will likely remain cautious on additional rate cuts until there’s more clarity on how economic and fiscal policy will evolve.

Harvard economist Ken Rogoff says,

“I think the odds of a hike are the same as the odds of a cut.”

“We expect a stagflationary policy mix from the new Trump administration,” advises Bradley Saunders, North America economist for Capital Economics. In a research note, he estimates that risk is “tilted to fewer cuts depending on the exact timing of Trump’s policy implementation.”

The Fed may be unwilling to make policy decisions based on direct orders from the president, but for the moment monetary policy seems highly dependent on what Trump decides and when.