- Fed sees inflation on a path to remain low

- Investors expect three 25bps rate cuts by January

- Fed to keep rates untouched, focus on guidance

- The decision is published on Wednesday at 18:00 GMT

Data Bolster Fed’s Confidence

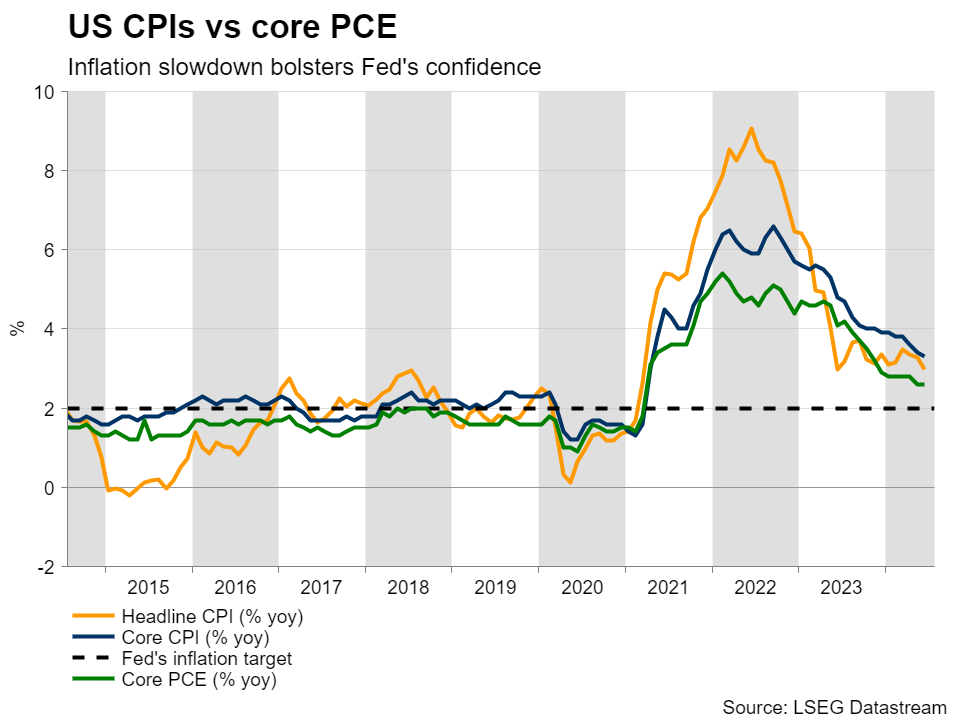

At its latest gathering in June, the FOMC appeared more hawkish than expected, revising its interest rate projections from three quarter-point reductions by the end of the year to just one. That said, the softer-than-expected CPI numbers for May a few hours ahead of the decision did not convince market participants about policymakers’ intentions.

Since then, the employment report for June revealed further softness in the labor market, while the CPI numbers for June also fell short of expectations, prompting several officials, including Chair Powell, to note that the data are bolstering their confidence that price pressures are on a sustainable path to remain low. Powell also said that they will not wait until inflation hits 2% to cut interest rates.

Are Investors Bets Overly Dovish?

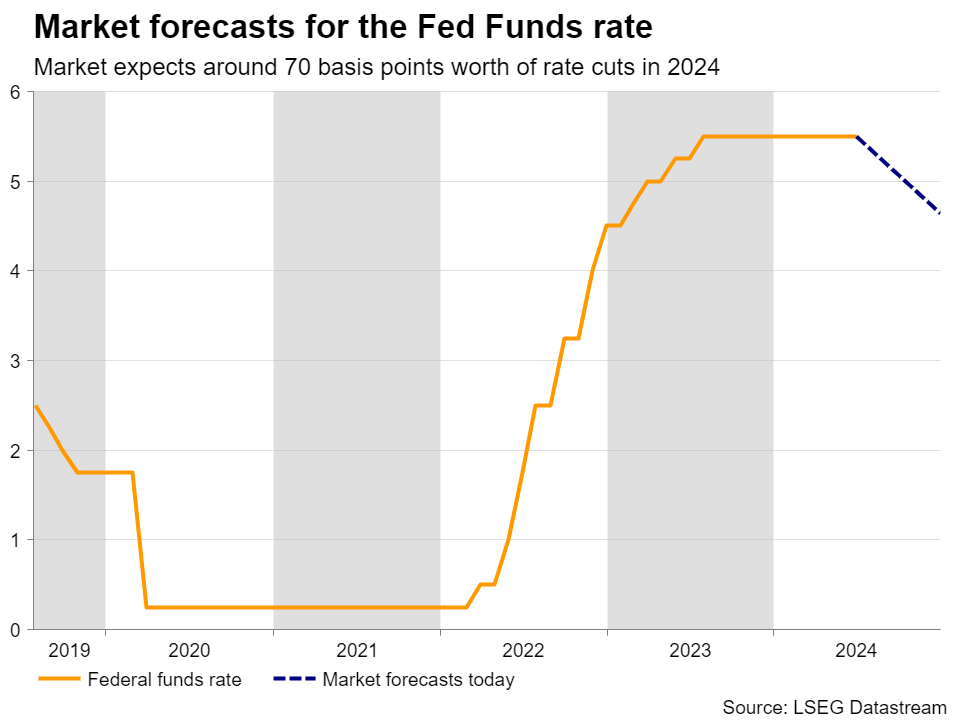

All these developments encouraged investors to fully price in a September quarter-point cut and more than two by the end of the year.

Fed funds futures are pointing to a strong 80% chance for a third reduction, which is fully priced in for January.

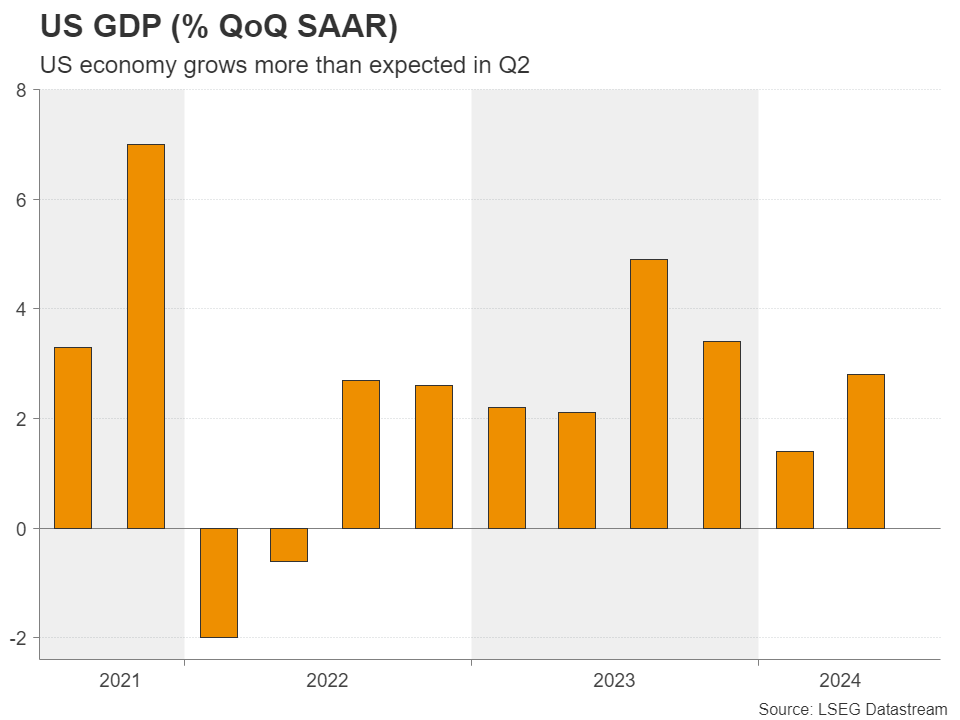

Nonetheless, with the flash PMIs for July pointing to further improvement in business activity, despite the manufacturing sector falling back into contraction, and the first estimate of GDP for Q2 suggesting that the economy fared much better than it did in Q1, investors’ rate cut bets may be overly dovish.

Fed Meeting Awaited for Fresh Clues

The next test for market participants’ views on the Fed’s future course of action may be next week’s Fed policy gathering. It will be one of the meetings that is not accompanied by updated economic projections and thus, bearing in mind that no policy action is expected at this meeting, the spotlight is likely to fall on the statement and Chair Powell’s conference on hints and clues about whether a September cut is indeed a done deal and what are their plans thereafter.

Former New York Fed President William Dudley, who was advocating for higher rates earlier this year, has had a change of heart, noting on Wednesday that the Fed should cut preferably at next week’s meeting. Although Dudley is not a Committee member anymore, his 180-degree turn may be some sort of indication that the July meeting may have a more dovish tilt than the one held in June.

Having said all that though, even if Powell and Co. appear more dovish, opening the door to a September reduction and perhaps hinting at another one in December, the dollar is unlikely to fall much as this scenario is already fully priced in. It could actually rebound if there is the slightest sign that a second rate cut this year is not a done deal and may depend on upcoming data.

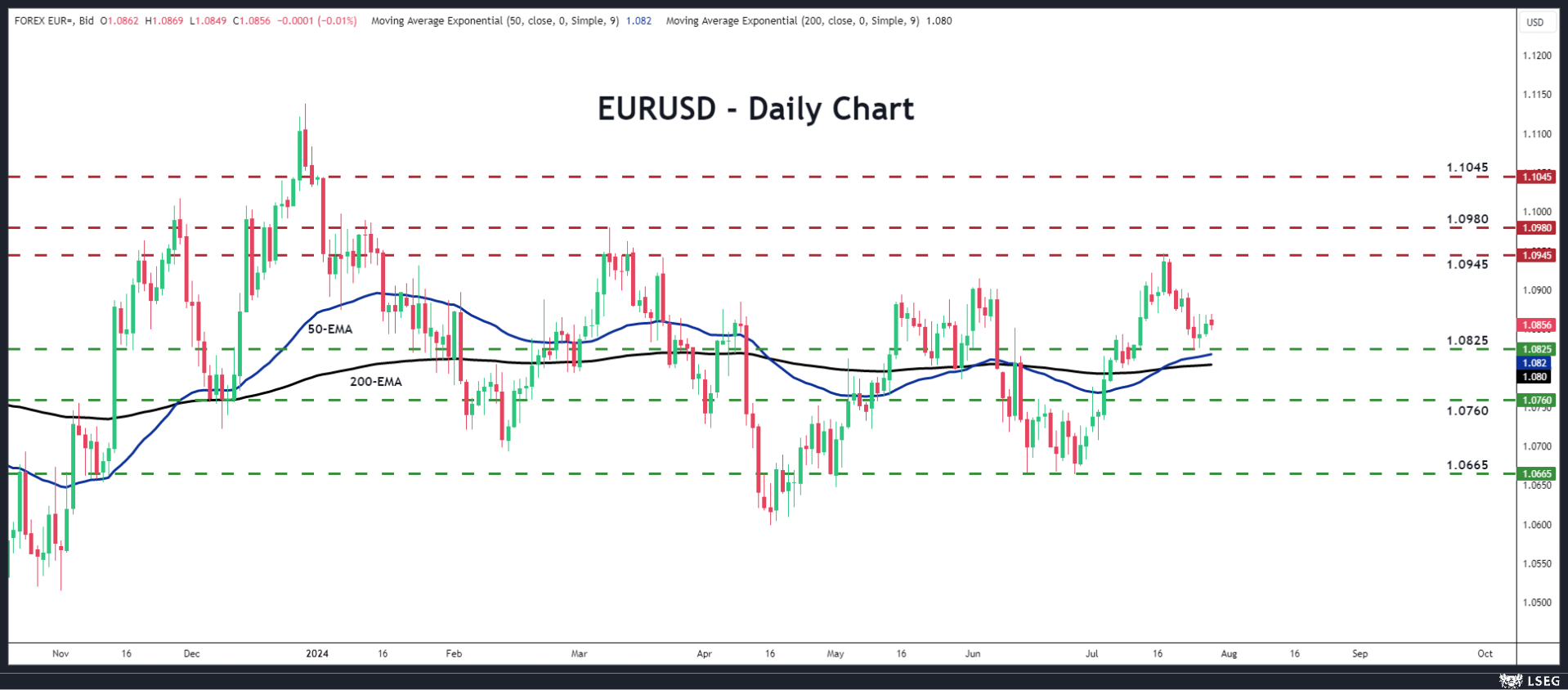

Euro/Dollar Could Resume Slide

Should the upside risks materialize, euro/dollar is likely to come under renewed pressure, with the bears perhaps aiming for the 1.0760 zone. If there are no buyers to be found there, a break lower could encourage extensions towards the 1.0665 zone, which acted as a key support barrier on June 14 and 26.

For the outlook of euro/dollar to start being considered bullish, a decisive close above 1.0945 may be needed. This could encourage buyers to challenge the 1.0980 barrier, marked by the high of March 8, the break of which could allow advances towards the high of January 2, at 1.1045.