The Federal Reserve is expected to leave interest rates unchanged in today’s monetary policy announcement, but firmer inflation in recent months lays the foundation for hikes in the months ahead.

This week’s news revealed that the core rate of the Fed’s preferred inflation index (personal consumption expenditures excluding food and energy) ticked up to a 1.9% year-over-year rate through March – just below the central bank’s 2.0% target. Headline PCE is a bit hotter at a 2.0% annual pace. The faster increase tells us that the Fed’s goals for lifting inflation have been met. As a result, it’s reasonable to assume that policymakers’ tolerance will fade on pricing-pressure data going forward.

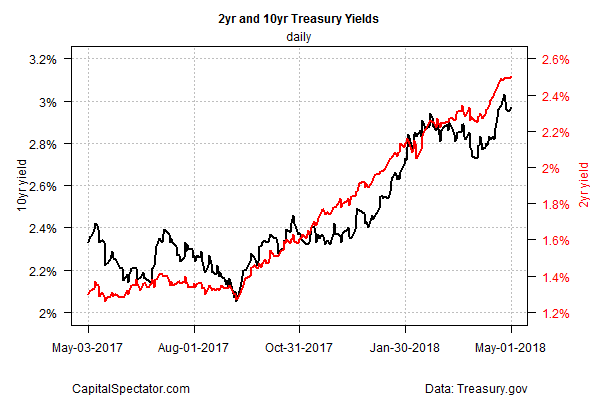

In turn, the Treasury market may become increasingly sensitive to hawkish statements from Fed governors and economic updates that support the narrative that inflation is trending higher. Hinting at this outlook, the policy sensitive 2-year yield continued to edge higher, rising to 2.50% on Tuesday (May 1), a new nine-year high.

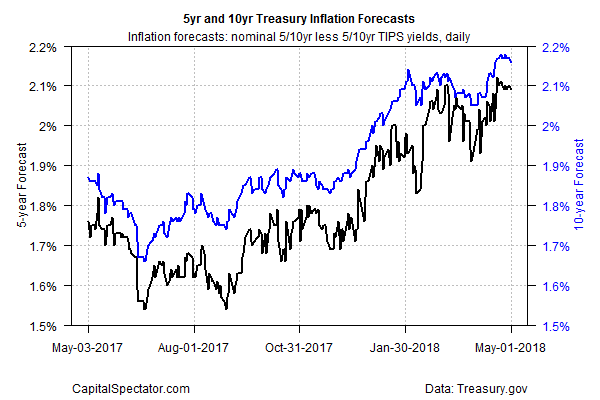

The Treasury market’s implied inflation forecasts have pulled back from recent highs, but the upside bias remains intact. The spread on the nominal less inflation-indexed rates for both the 5-year- and 10-year maturities remains above 2.0% — a sign that the crowd expects that hard data on inflation will hold at or above the Fed’s target in the near term.

The key question for policymakers and the Treasury market: Will pricing pressure continue to accelerate? The recent upturn in PCE inflation can be read as a sign that upside momentum is bubbling. The alternative explanation is that a brief round of disinflation from a year ago is fading and explains most of the recent increases. As The Wall Street Journal explains:

The 12-month inflation rate is rising because low readings a year ago are dropping out of the calculation. Recent data is subdued: core prices rose just 0.15% in March from February. Hospital services have contributed a lot to recent cost pressures but may be waning. True, the bond market’s implied inflation forecast has shot up since last year; but that’s almost entirely because of oil rather than economic fundamentals. Bond yields topped 3% last week but have slipped back since which doesn’t exactly scream that the 1970s are back. Yes, inflation could become a problem as fiscal stimulus overheats an already-tight labor market. Just not this year.

Last week’s news that economic growth slowed in the first quarter supports the tame-inflation narrative. But note that while the quarterly pace of GDP eased to 2.3% in Q1 – the slowest in a year – the annual change continued to perk up, advancing to 2.9% — the fastest increase in nearly three years.

Macro bulls point to Q2 nowcasts that call for a rebound in GDP growth. Now-casting.com’s latest estimate for the current quarter is a robust 3.2% increase; the Atlanta Fed’s GDPNow projection is even stronger at 4.1%, based on yesterday’s update. It’s still early in the quarter and so these numbers are little more than guesstimates. But if there’s a grain of truth in the nowcasts, there’s a reasonable possibility that inflation will remain at the Fed’s target or move higher in the months ahead.

That seems to be the reasoning in the Fed funds futures market, which is pricing in a near-certain rate hike for the June FOMC meeting, based on CME data this morning.

Meanwhile, all eyes are on today’s Fed announcement, which will provide fresh guidance on the central bank’s outlook. A key issue is whether the central bank is still inclined to view the economy at risk of overheating.

“The real headache is that it is easy to be the Fed when inflation is below target … a very important aspect as we go into this May meeting, is the tone of the debate changes completely as we get to 2 percent and beyond,” notes Torsten Slok, an economist at Deutsche Bank.

Nonetheless, today’s announcement will likely be a yawn, says Roberto Perli, a partner at Cornerstone Macro. “I just expect a ‘stay the course’ statement with just a few changes aimed mostly at marking to market the outlook. The June meeting should be more interesting. This week will probably just be about buying time.”