Given the looming G7 meetings, and the focus that is likely to exist upon the wider Eurozone economy, the EUR/USD could be in for a busy week. Subsequently, it is salient that a review is undertaken as to the risk events, both fundamental and technical, on the horizon in the week ahead.

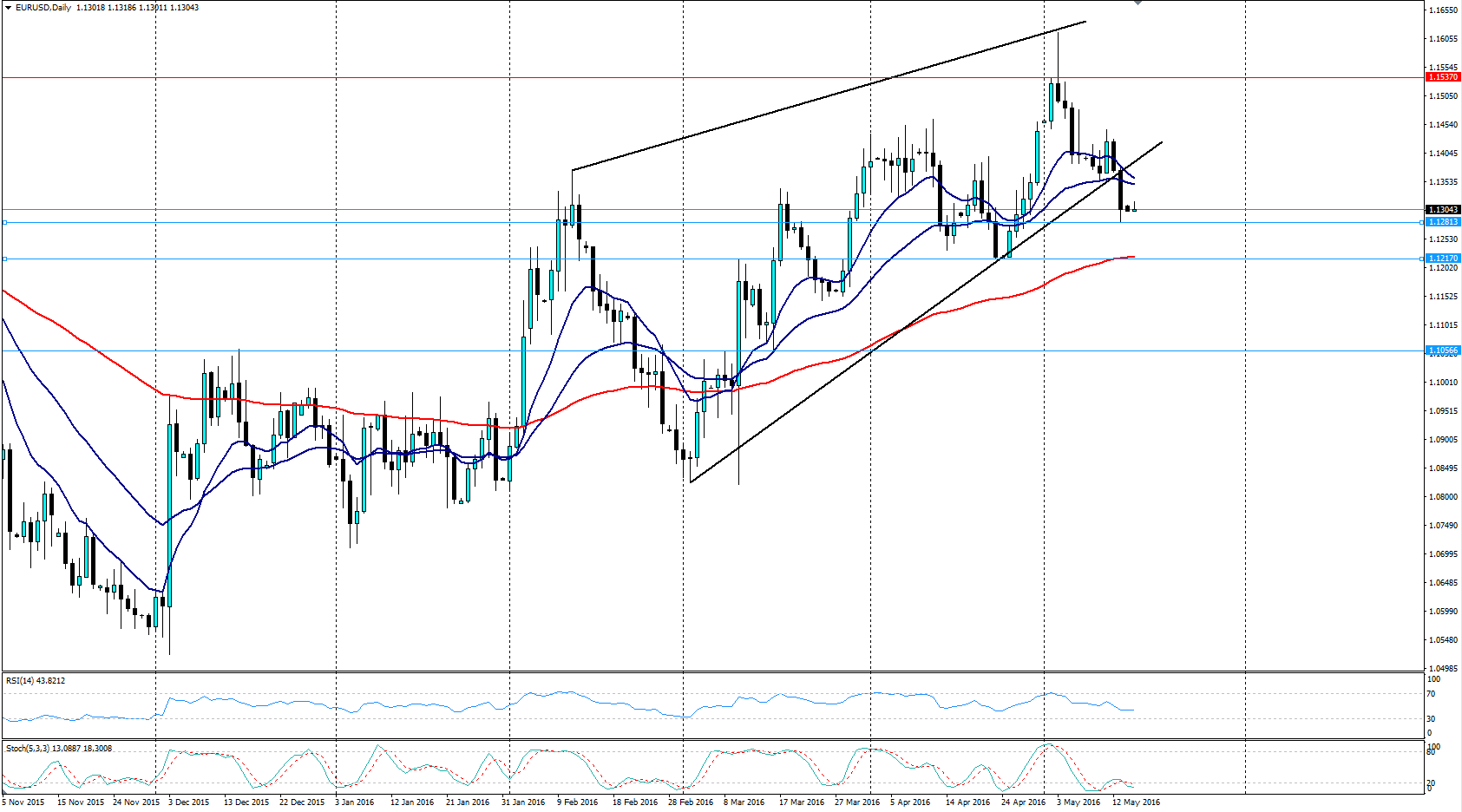

The euro continued to slide throughout most of the previous week as the pair faced a range of negative Eurozone indicators. In particular, the Industrial Production data proved disappointing at -0.8% m/m, with the Eurozone GDP also following suit providing a weak 1.5% y/y result. Subsequently, the pair was largely in selloff mode and closed below the bottom of the short term bullish channel at 1.1304.

Looking ahead, the EUR/USD is likely facing another tough week as a slew of important economic data falls due. The market’s primary focus is likely to be upon the US Core CPI figures, due Tuesday, and a strong result could see the euro depreciating strongly. In addition, the Eurozone CPI figures are also due out and any weakening from the forecast of -0.2% y/y could put the pair under pressure. As always the market will be scouring the US based economic and labour results for any sign of the Fed’s future direction. Subsequently, watch out for volatility around the US unemployment figures in the latter part of the week.

From a technical perspective, last week’s slide out of the bullish channel raises the prospect of a near term correction. There is currently a bearish conviction being demonstrated within the MACD indicator which is also mirrored in the 12 and 30 EMA’s. The RSI Oscillator is also trending lower within neutral territory indicating that there is plenty of room to move on the downside. Subsequently, our bias remains bearish for the week ahead back towards the key 1.1217 support level. However, watch out for some of the fundamental data due out in the next few days as it could cause a whipsaw. Support is currently in place for the pair at 1.1281, 1.1217, and 1.1056. Resistance exists on the upside at 1.1537, 1.1713, and 1.1810.

Ultimately, the pair is likely to face a variety of external fundamental pressures in the week ahead. In particular, given the risk that a negative Eurozone CPI figure poses, the downside is most certainly beckoning. Subsequently, given the confluence of both a range of negative fundamental indicators and a technical bearish currency pair, the case for further depreciation against the dollar appears relatively strong.