The euro has been on a rollercoaster the past few weeks as it has dealt with all manner of sentiment swings as the US Fed ramps up their rate hike rhetoric. Subsequently, it makes sense to take a look at what happened in in the markets last week and where the currency pair could be heading next.

The euro had a tumultuous week as the FOMC minutes surprisingly indicated that a rate hike in June was a real possibility. The meeting minutes highlighted the fact that most Fed members see June as an appropriate lift off point if the broader macroeconomic data continues to support it. In addition, the Eurozone CPI was on target, but lacklustre at -0.2% y/y, in contrast to the US Core CPI which rose to 0.2% m/m. Subsequently, the pair fell sharply back towards the key 1.12 handle to finish the week well down amid the volatility. On the fundamentals front, watch for the US Core Durable Goods Orders result.

Looking ahead, markets will likely now pivot to focus upon the Eurozone PMI’s as well as the US Durable Goods Orders data. The latter is forecasted to rise strongly from -0.2% to 0.3% m/m but a positive surprise could be likely given the recent strength within the US economic data. In contrast, the Eurozone Manufacturing PMI is likely to remain relatively flat around its current 51.7 level. However, keep a close watch on the Fed’s Janet Yellen, and Friday’s pending speech, as she may very well impact the pair with any rhetoric change.

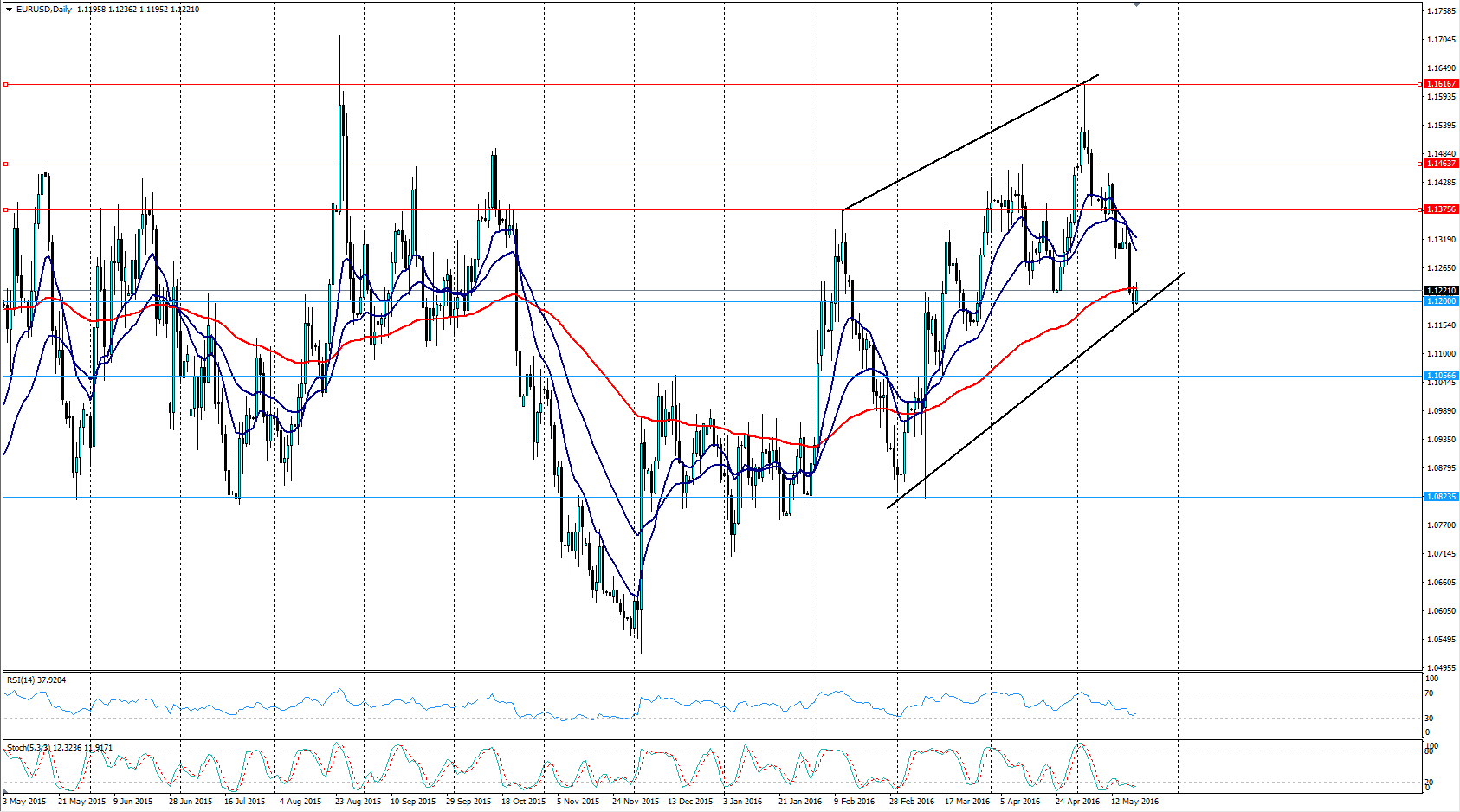

From a technical perspective, last week’s slide took the price action to the bottom of the bullish channel and the 100-day moving average. However, there are some signs that the rout may have finally stopped at the long term 1.1200 support level. The RSI oscillator is currently close to oversold and stochastics are also within the reversal zone. Subsequently, our bias remains tentatively bullish given the confluence of strong support and the 100-day MA. Support is currently in place for the pair at 1.1200, 1.1056, and 1.0823. Resistance exists on the upside at 1.1375, 1.1463, and 1.1616.

Ultimately, the short term trend is likely to be dictated by both the data and rhetoric emanating from the US. All the technical signs are in place for a recovery back above the 100-day MA but given the level of jawboning emanating from the Fed I would counsel awaiting a strong break, either long or short, before jumping into the middle of the trend.