Key Points:

- Euro rallies following weak U.S. CPI result

- The EU GDP release is likely to be the key fundamental event for the coming week

- Euro dollar outlook remains neutral in the week ahead

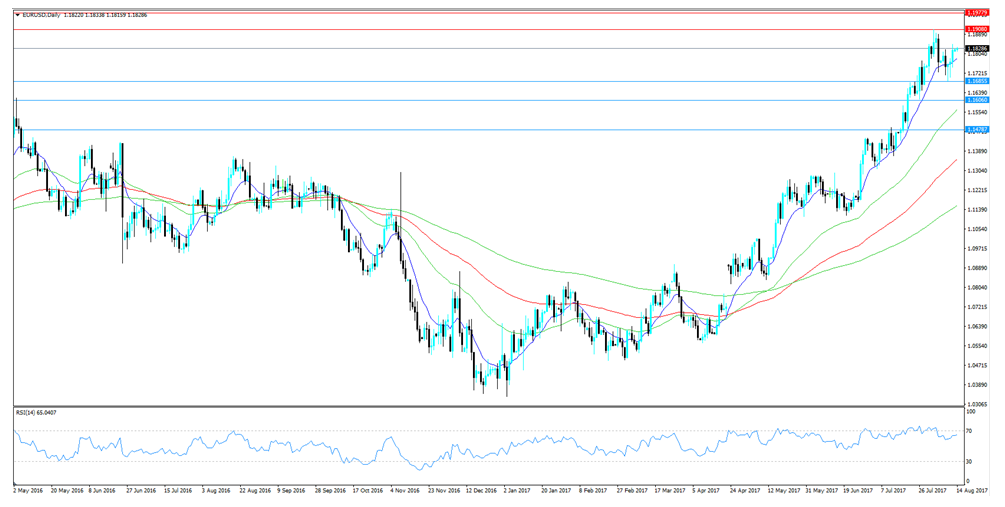

The euro dollar initially started the week under pressure as the U.S. JOLTS Job Openings came in above expectations but this sentiment quickly turned around in the face of increased risk from the North Korean crisis. Subsequently, the pair managed to find some support, as capital sought a safe haven away from the greenback, and rose to close the week higher at 1.1820 but it remains to be seen if the pair can remain buoyant in the week ahead.

The euro dollar initially started the week negatively following a relatively buoyant U.S. JOLTS Job Openings result of 6.16M as well as a slip in the German Industrial Production figures to -1.1%. However, the pair’s prospects turned around rapidly in the face of increased geopolitical pressure from North Korea as the rhetoric ratcheted higher between Trump and Kym Jong Un.

Subsequently, the markets largely took a risk-off approach and sentiment swung away from the greenback and into perceived safe havens. In addition, the broad bid was exacerbated by a range of disappointing U.S. economic data, including the Core CPI and PPI figures which fell to 0.1%, and -0.1%, respectively. Subsequently, the euro benefitted from the change in sentiment and this saw the pair lift to close the week higher at 1.1820.

Looking ahead, the coming week is likely to contain some key fundamental events with the EU GDP and U.S. Philly Fed results due for release. In particular, the Annual EU GDP figures will be relatively illuminating given that the Eurozone economy has continued to firm of late and speculation is rampant over near term monetary policy changes. The GDP result is forecast at 2.1% y/y, but as always, this number could vary significantly.

Additionally, the U.S. Philly Fed figures are due for release late in the week and, given the recent trend of poor economic data, could bring about some significant volatility for the pair if a miss is evident. Subsequently, keep a close watch over both events because they are likely to form the basis for the fundamental trend in the week ahead.

From a technical perspective, the pair’s pullback from 1.1908 appears to have now largely ceased. However, with the key near term resistance point intact, our initial bias now turns to neutral until the 1.1908 high is broken. Any downside moves are likely to be contained by the 38.2% retracement level at 1.1606 and, subsequently, bring about a rebound but watch for sideways action in the week ahead. Support is currently in place for the pair at 1.1685, 1.1606, and 1.1478. Resistance exists on the upside at 1.1908, 1.1977, and 1.2179.

Ultimately, the euro is likely to take its near term fundamental trend from the pending EU GDP figures and this will be a relatively critical event for the week. However, there is still plenty of geopolitical risk floating around with the ongoing North Korean crisis which could tip the scales at any stage.