Investing.com’s stocks of the week

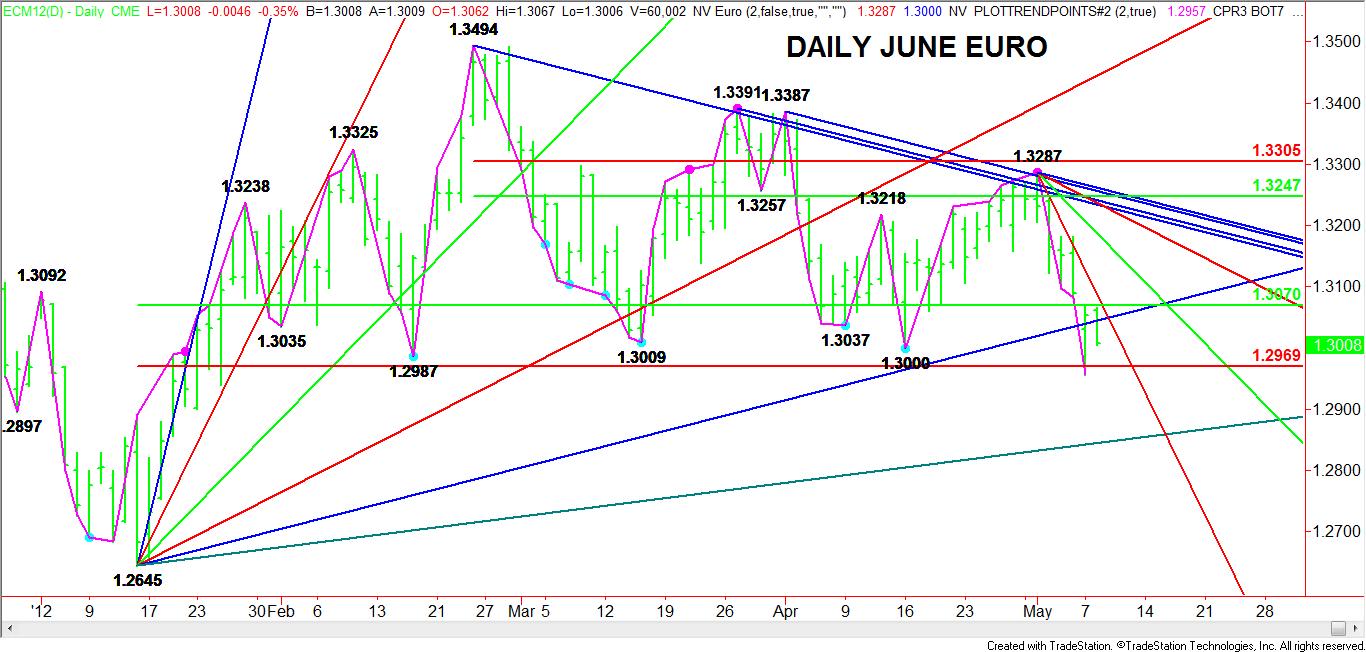

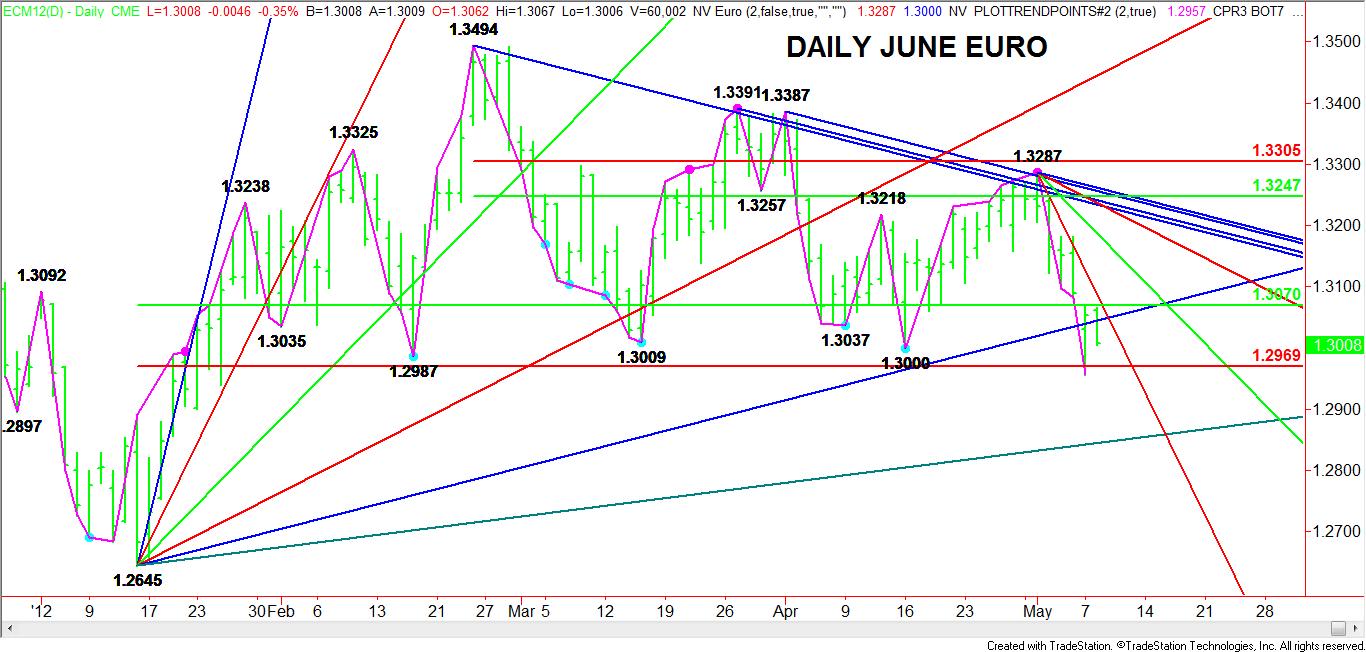

After briefly exploring the bearish side of 1.3000 on Monday, the June Euro turned around to close near the high of the day. Although this move had the appearance of a daily closing price reversal, it actually didn’t indicate anything other than short-term oversold conditions and a successful defense of the psychological 1.3000 price level.

Monday’s rally was impressive but when it came to following-through to the upside, this morning’s weakness is strong evidence that the euro is still in the hands of the short-sellers. The short-term picture shows that the market isn’t even strong enough to fill the Friday to Monday gap at 1.3082 to 1.3068. The bigger picture shows a market that is testing the bottom end of a major retracement zone at 1.2969 and a top at 1.3070. The longer the euro spends inside of this zone the greater the likelihood of a volatile breakout.

Besides the 50% level at 1.3070, the downtrending angle from the 1.3287 top is providing resistance at 1.3087. While not actually being touched to confirm it as a resistance angle, its presence is likely to act as a guide to the downside. Additionally, crossing to the weakside of a slow-moving uptrending Gann angle at 1.3045 is also an indication of dominant selling pressure.

Once again short-traders appear to have the power behind them to drive through the key 1.3000 level. Perhaps this time because of last night’s failed follow-through rally, buyers will be willing to give up their defense of this level, allowing the euro to seek a new value area.

Fundamentally, with negative news from Europe beginning to pile up, it is hard to be anything but bearish. Two key issues pressuring the Euro are worries that a new government in Greece will speed up its move to withdraw from the euro zone and the possibility of a strained relationship between France and Germany. On a positive note, rumors that Spain may be engaging in talks to create a domestic bank-recapitalization program could underpin the euro or at least slowdown the rate of its decline.

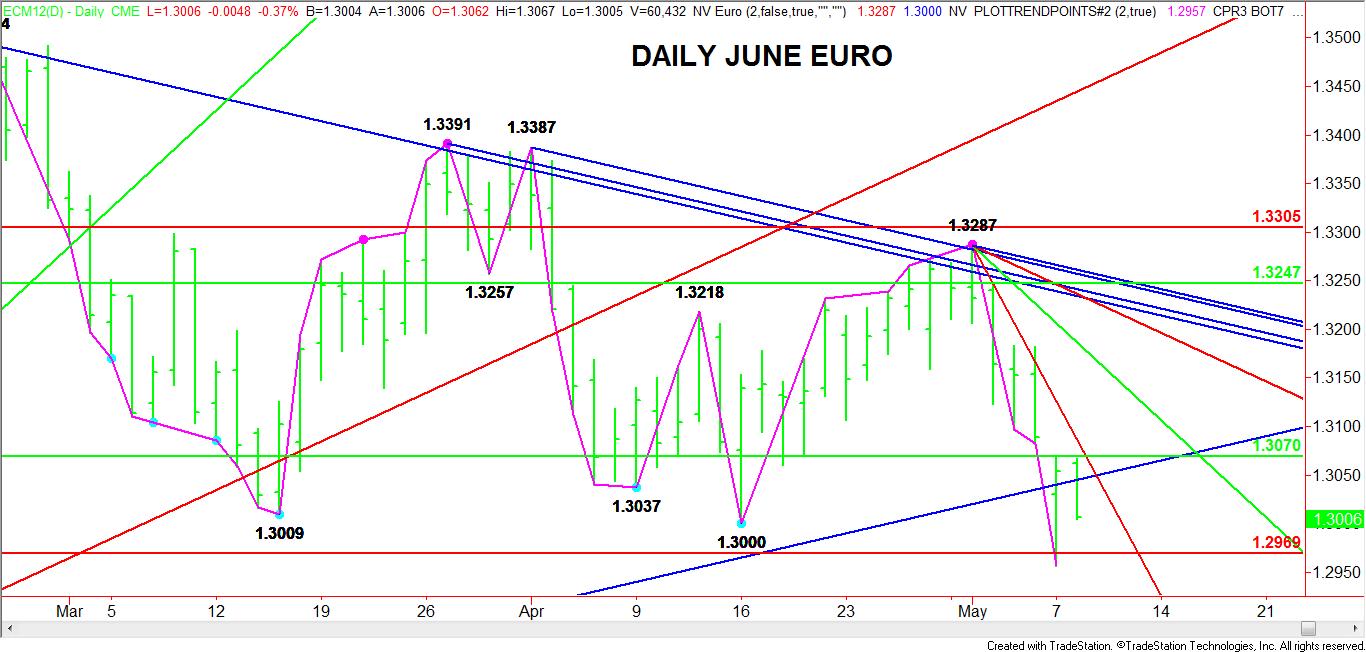

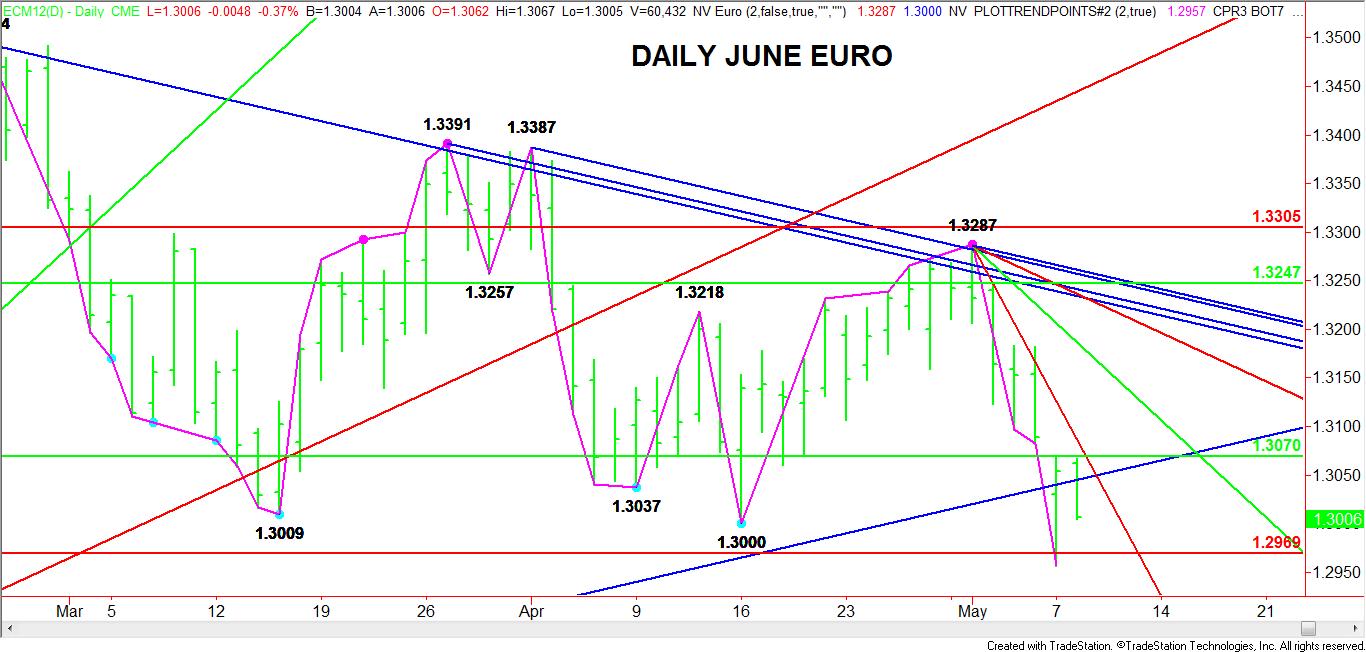

Monday’s rally was impressive but when it came to following-through to the upside, this morning’s weakness is strong evidence that the euro is still in the hands of the short-sellers. The short-term picture shows that the market isn’t even strong enough to fill the Friday to Monday gap at 1.3082 to 1.3068. The bigger picture shows a market that is testing the bottom end of a major retracement zone at 1.2969 and a top at 1.3070. The longer the euro spends inside of this zone the greater the likelihood of a volatile breakout.

Besides the 50% level at 1.3070, the downtrending angle from the 1.3287 top is providing resistance at 1.3087. While not actually being touched to confirm it as a resistance angle, its presence is likely to act as a guide to the downside. Additionally, crossing to the weakside of a slow-moving uptrending Gann angle at 1.3045 is also an indication of dominant selling pressure.

Once again short-traders appear to have the power behind them to drive through the key 1.3000 level. Perhaps this time because of last night’s failed follow-through rally, buyers will be willing to give up their defense of this level, allowing the euro to seek a new value area.

Fundamentally, with negative news from Europe beginning to pile up, it is hard to be anything but bearish. Two key issues pressuring the Euro are worries that a new government in Greece will speed up its move to withdraw from the euro zone and the possibility of a strained relationship between France and Germany. On a positive note, rumors that Spain may be engaging in talks to create a domestic bank-recapitalization program could underpin the euro or at least slowdown the rate of its decline.