The electric vehicles (EVs) market could increase by 3,400% by 2030 compared to 2015 EVs sales, according to the U.S. Department of Energy.

More powerful, reliable and cost-competitive batteries have driven EV growth. Lithium-ion batteries have effectively replaced lead batteries.

MetalMiner analyzed the usage of base metals in EVs and their price performance this year. The EV boom has driven investor sentiment for these base metals.

Base Metals’ Role in EVs

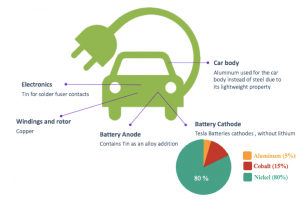

The infographic below breaks down car parts by type of base metal. Aluminum, nickel, copper and tin serve as the four main base metal “winners” in which the market could expect demand to grow.

Source: MetalMiner analysis of Business Insider data

Of the exchange-traded metals, all three of these base metals commonly have high trading volumes. Copper, in particular, tends to have high trading volume as the market considers it an economic indicator (often referred to by the nickname “Dr. Copper”).

Both aluminum and copper appear in an uptrend, especially since the summer when prices started to rally.

Nickel prices have also seen high volatility due to electric battery demand. This makes sense — if investors consider a metal “hot,” then volume and transactions may increase. Prices may change based on this, as they did for nickel.

Source: MetalMiner analysis of FastMarkets

And What About Tin?

Contrary to the other three base metals, tin prices do not look bullish.

Tin plays an important role in EVs, as it is used for electronic solder and batteries. However, tin prices appear both stagnant and weak.

Source: MetalMiner analysis of FastMarkets

Tin’s price momentum has diverged from EV supply/demand fundamentals and the LME price.

EV batteries have evolved toward technologies that include more tin alloys. According to the International Tin Research Institute (ITRI), tin used for batteries increased by 95% in 2016 compared to 2010 data (14,400 tons). Tin mine output has increased in 2017 compared to last year’s data (18% in China, 26% in Indonesia and 7% in Myanmar).

However, the ITRI forecasts a 7,300-ton deficit in 2017. Tin stocks remain low, with only a slight increase in SHFE stocks.

Current macro indicators support the bullish rally. However, tin prices still seem reluctant to react.

Have investors forgotten about tin?

Judging by the reception for aluminum, copper and nickel, perhaps 2018 will bring tin into the bull party.