There are multiple reasons we could face a very tough holiday season.

A second surge in COVID could tighten restrictions on brick and mortar businesses.

Delayed financial aid can cause more business shutdowns as many businesses were expecting support through these slow months.

The delayed stimulus for individuals and decreased unemployment checks mean less money for holiday shopping, again affecting expectations of holiday income to support businesses.

Restaurants could be at greater risk since many have used outdoor seating as a primary way to keep guests socially distanced.

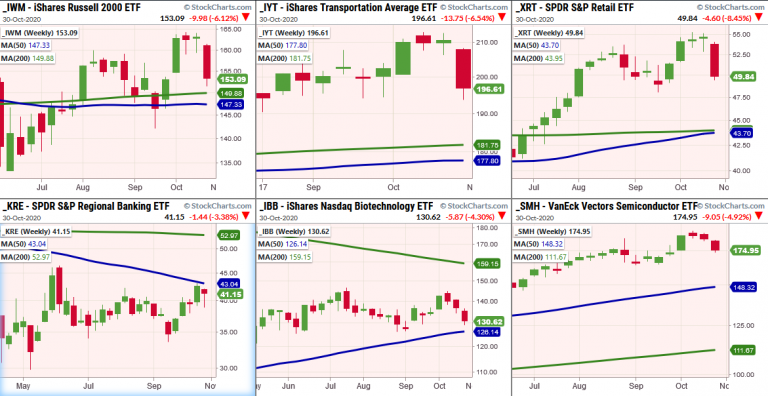

This Friday, the Modern Family all closed red for the week.

The Family consists of the Russell 2000 (NYSE:IWM), Transportation (NYSE:IYT), Retail (NYSE:XRT), Regional Banking (NYSE:KRE), Biotechnology IBB), and Semiconductors (NYSE:SMH).

Together they create a big view of what the economy is doing.

Like many real families, they worry about their jobs, flow of income, health, and the ability to afford goods for themselves and each other.

Right now the world is in a very insecure state. People's lives have been changed and it can be tough to envision the path back to normalcy.

Paired with social unrest and an election, there are many good reasons to worry.

But, on a more hopeful note, let's look at the Families weekly charts.

Given the negative situation, most of the family still sits well above support.

KRE is below but did have a green day on Friday looking poised to clear the 50-WMA.

Money is finally flowing into the banking sector as we could be seeing a possible rotation.

IWM sits by the 200 weekly moving average as potential support.

IYT holds support from the low of 194 across multiple weeks.

IBB looks to have made a double top, but still has support coming in from the 50 week moving average and the prior middle range.

We also can’t discount the possibility of this sector flying back to its highs when news of a vaccine is almost ready.

If the tech (SMH) sector continues lower, the first level of support comes in around 163-164.

Considering the numbers on Friday showing improved consumer confidence, spending and rising personal incomes, the selloff in the market like the weekly charts in the Economic Modern Family, could mean support levels have been established for this week.

S&P 500 (SPY) Held 320 support. Rallied at the end of day but still closed red.

Russell 2000 (IWM) End of the day buyers came in, yet still in a bad shape.

Dow (DIA) Tested the 200-DMA. Needs to hold these levels.

Nasdaq (QQQ) Could not hold and closed under the past 2 days low. 260 support.

KRE (Regional Banks) Looks very interesting. Closed back over 200-DMA

SMH (Semiconductors) Tested the 50-DMA but could not hold over.

IYT (Transportation) Roughly unchanged on the close. Looking to hold 193.

IBB (Biotechnology) Possible 200-DMA test next. .

XRT (Retail) Next support 48.02